Earlier this year SME director Choy Peiyi was sentenced to 10 years in jail for creating fake invoices that allowed her business, Vanguard Project Management, to raise more than S$25 via the Singapore-based crowdfunding site Capital Springboard. Users of the Capital Springboard platform that invested in Peiyi’s company lost nearly S$7 million in total.

Choose the Right Crowdfunding Platform

If this example worries you about investing in crowdfunding campaigns, you may be reassured to know that not all crowdfunding platforms pose this much risk. In fact, some platforms have incredibly low default rates, which highlights the need to conduct thorough research of the best platforms before signing up for an account. For example, Funding Societies has the lowest default rate of any platform in Singapore at 1.12%.

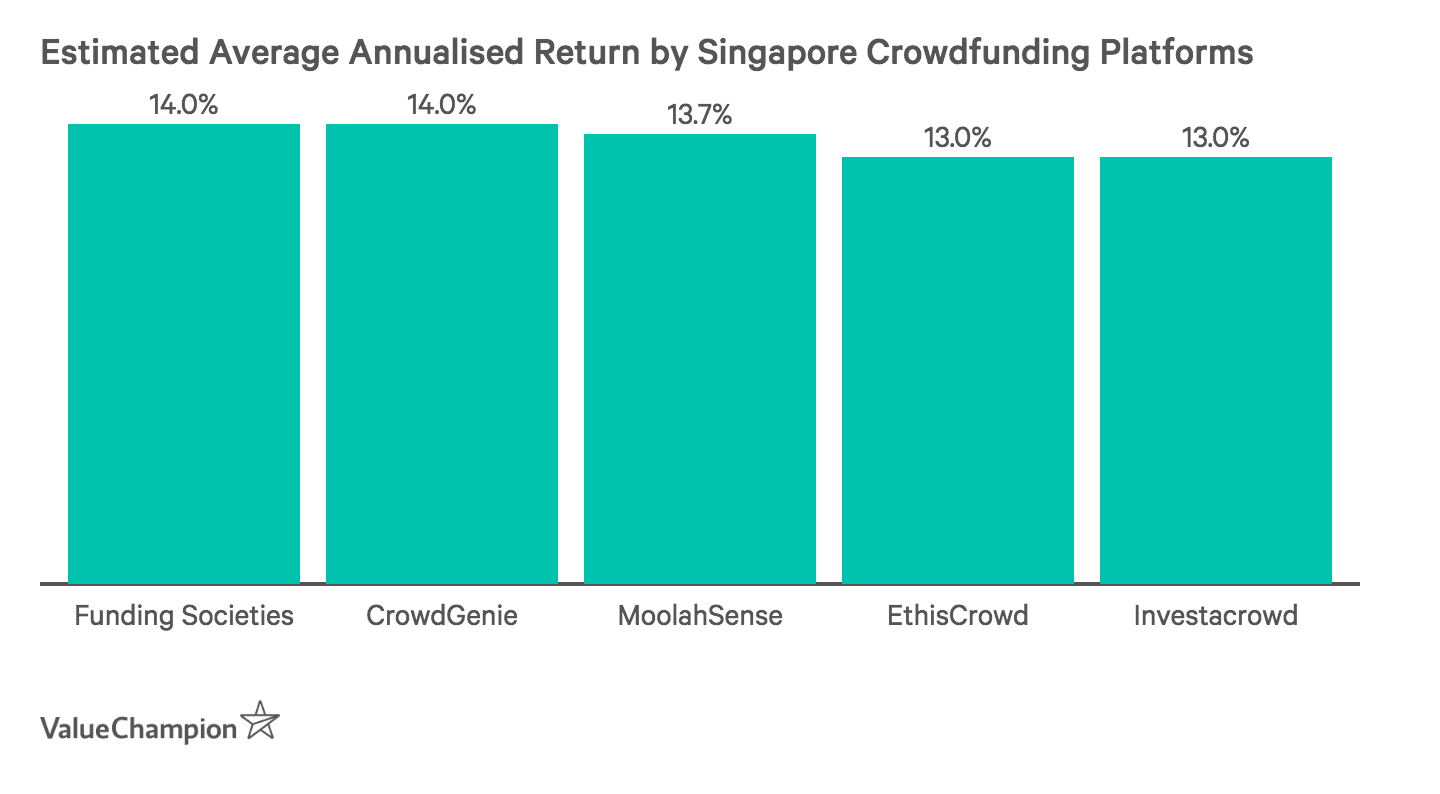

In addition to comparing default rate statistics, it is important to compare each platform’s advertised expected returns. This is important for prospective investors because platforms that claim to generate returns that are significantly higher than competitors that offer comparable investment products may be misleading, more risky or even less reputable. For example, crowdfunding platforms that offer small business loans and small business invoice financing tend to advertise average annualised returns of about 13% to 14%. Therefore, if you saw a platform advertising much higher returns for these types of investments, you would want to examine how the platform could offer such competitive rates before signing up.

Carefully Analyse Each Crowdfunding Campaign

While it is possible to avoid crowdfunding scams by choosing from the best available platforms, it is also essential to find legitimate campaigns on the platform that you select. After all, Capital Springboard does have many legitimate deals despite being tied to the Vanguard Project Management fraud. For this reason, it is important to consider several factors about the SME seeking funds in order to understand the risk associated with each campaign.

Ability to Repay

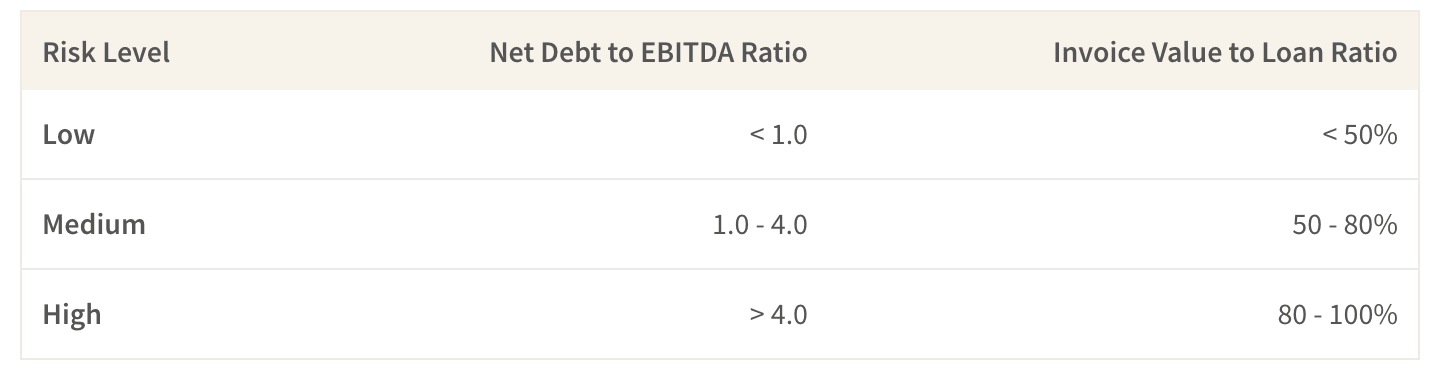

The first criteria to consider in order to assess the risk of a business defaulting on its loan is the business’s financial capability of repaying the loan. To the extent that it is possible, prospective investors should always review the SME’s financials. In particular, it is important to examine the amount of debt that the company owes to other lenders, whether its revenue exceeds its costs and if it has a positive net cash flow. To assess the company’s financial strength, investors can calculate the company’s leverage ratios to understand how much debt it holds and the comparative risk of non-repayment, such as the net debt to EBITDA ratio. This ratio can be calculated by subtracting the company’s cash from its total debt and dividing the result by its earnings before interest, taxes, depreciation and amortization (EBITDA). In general, investors should be wary of SMEs with net debt to EBITDA ratios above 4.0. Similarly, investors can assess the risk of an invoice financing loan by comparing the loan amount to the invoice amount. Typically, the smaller the loan is compared to the invoice, the less risk the investment poses. Additionally, some crowdfunding platforms provide their own analysis that estimates each borrower’s likelihood of repayment, which can be very helpful for less savvy investors.

Financing Needs

Another important way to understand the relative risk of each crowdfunding campaign is to examine why each SME seeks to borrow funds. Generally, specific-use loans are less risky from a lender’s perspective. That is because these loans are going to be used for a specific purpose, which is typically more transparent to the lender. Some examples of specific borrowing purposes for small business loans include working capital, asset purchase and expansion.

Borrowing History

Yet another indicator of the likelihood that a business will repay a loan is to look at the business’s borrowing record. This will help you decide if the business has traditionally repaid its lenders on-time. This factor is very important, even to the crowdfunding platforms. For example, some crowdfunding websites, such as Validus Capital even charge lower interest rates to SMEs that have a strong record of repayment through their platform.

Diversify Your Crowdfunding Investment Portfolio

Another way to minimise risk is to diversify your portfolio of investments. For example, by diversifying your invested funds among a few crowdfunding campaigns, you will be less likely to incur losses associated with a crowdfunding scam. Of course, diversification alone will not prevent you from investing in a scam or in an SME that is likely to default on its loan; however, it helps you limit your exposure to risk.

Alternatives to Crowdfunding

If you are still nervous about crowdfunding scams and would feel more comfortable investing elsewhere, you may be interested in opening an online brokerage account. There are many online brokerages, and a variety of advantages and disadvantages to each type. We strongly suggest that individuals that are new to investing are careful to choose a platform that fits their preferences for characteristics such as international market access, fees, and minimum investment amounts. Additionally, novice investors should conduct a significant amount of research into investment strategies before investing any significant amount of money.

The article 3 Ways to Avoid Becoming a Victim of a Crowdfunding Scam originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Source: VP