SINGAPORE/MONGOLIA: Singapore-based Bastion Mining has declared its off-market takeover bid for Xanadu Mines unconditional, having crossed the 50.1% threshold of the ASX-listed, Mongolia-focused copper and gold explorer.

The move solidifies Bastion’s grip on Xanadu’s flagship Kharmagtai project, a copper-gold asset in Mongolia’s South Gobi region that has drawn international attention for its vast reserves and strategic value in the global energy transition.

Bastion, controlled by Singapore-headquartered Boroo Pte Ltd (75%) and Xanadu director Ganbayar Lkhagvasuren (25%), launched its 8 cents-per-share offer in mid-May. The bid accelerated after a previous exclusivity agreement between Xanadu and China’s Zijin Mining lapsed without a finalised deal.

Xanadu’s independent board committee has since reaffirmed its recommendation for shareholders to accept Bastion’s offer in the absence of any competing bids.

The location

At the heart of Bastion’s takeover is Kharmagtai, a copper-gold project with a resource estimate of 730 million tonnes, containing 1.6 million tonnes of copper and 4 million ounces of gold. A recent feasibility study values the project at a net present value of US$930 million (A$1.43 billion), with development costs estimated at US$890 million.

If developed as planned, Kharmagtai could yield 80,000 tonnes of copper and 170,000 ounces of gold annually at an impressive cost of 70 US cents per pound of copper, positioning it as one of the lowest-cost producers globally.

The 29-year mine life — projected from 2024 — adds long-term stability, with operations based on conventional open-pit mining and sulphide flotation.

“Kharmagtai is well-positioned to help fill the looming global copper supply gap driven by growing demand for an increasingly electrified economy,” Xanadu said in a statement, noting its proximity to major transport infrastructure, including rail and roads for rapid development.

Geological upside

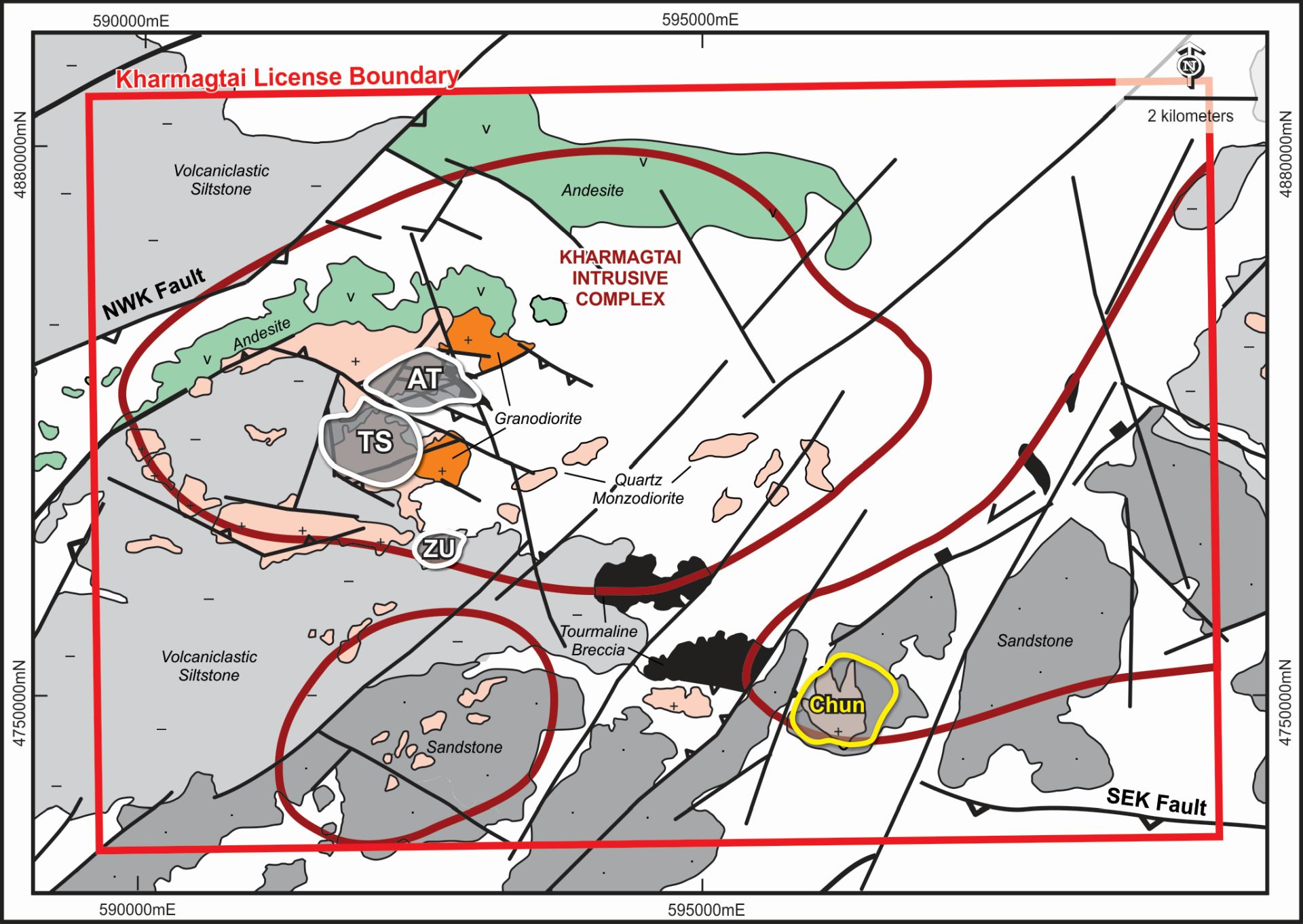

Geologically, the site comprises multiple co-genetic gold-rich porphyry copper centres and tourmaline breccia pipes within the Carboniferous Kharmagtai Igneous Complex. This complex is believed to have formed from a large, deep-seated fractionating magma chamber, the scope of which has been supported by recent gravity surveys.

The mineralisation and scale echo other world-class formations, enhancing its appeal in an era where copper is increasingly dubbed “the metal of electrification”.

What does the mine mean for Singapore?

Copper has long been an unsung hero of industrial progress. As one of the most conductive and cost-effective metals, it’s been powering homes and industries for over two centuries. But in the 21st century, copper is taking on an even more critical role — as the backbone of the energy transition.

From electric vehicles and grid-scale batteries to wind turbines and EV charging stations, copper is everywhere. As nations pivot toward decarbonisation, the world is discovering that electrification depends not just on innovation or policy, but on metals, and copper is at the top of the list.

S&P Global forecasts that demand for copper could double to 50 million metric tons by 2035, driven by the US, China, Europe, and India.

For Singapore, Bastion Mining’s control of the Kharmagtai project represents more than just a corporate acquisition — it’s a rare geopolitical and economic foothold in the global race for strategic minerals.

In a world where access to critical resources increasingly defines energy security and industrial competitiveness, owning a stake in one of Asia’s largest undeveloped copper-gold deposits gives Singapore leverage it has rarely had in the resource game. The Republic is typically seen as a financial and tech hub, not a mining power. But through entities like Boroo Pte Ltd and Bastion, Singapore is moving upstream in the energy transition supply chain.