The Government on 31 May announced that it has identified Blocks 81 to 83 MacPherson Lane for the Selective En bloc Redevelopment Scheme (SERS). Blocks 81 to 83 MacPherson Lane comprise 313 sold flats, which are about 50 years old. Under SERS, the residents of these blocks will move to new replacement flats, sited in a nearby location and will also receive compensation for their flats based on market value at the time of the SERS announcement.

HDB said that besides receiving payment of reasonable expenses (comprising removal allowance of $10,000 per flat and payment of stamp and legal fees) to help in the relocation, affected residents would also be assured allocation of a new flat at the designated replacement site.

HDB said that purchase of a replacement flat at a subsidised price was frozen at the time of the SERS announcement.

Singles who are eligible will received SERS grant of $15,000, while eligible joint singles and families will receive $30,000 for the purchase of a replacement flat. Residents will also receive exemption from the payment of resale levy if the SERS flat is a subsidised flat, and concessions for the payment of resale levy or sales premium for the

previous sale of a subsidised flat.

HDB will further provide exemption from the payment of $10,000 premium on top of the purchase price

of a replacement flat for couples who are first-timers and comprise one Singapore citizen and one Singapore permanent resident. Singles who own the SERS flat at the time of the SERS will get exemption from payment of $15,000 premium on top of the purchase price of a replacement flat.

HDB will provide concessionary housing loan for replacement flat for eligible SERS flat owners, subject to credit assessment and prevailing housing loan policies. It will also give a comprehensive financial package to resident to help them ease the cash flow for purchase of replacement flat.

Residents will also have the option to apply for a flat elsewhere under Build-To-Order (BTO) or Sale of Balance Flats (SBF) exercise with rehousing benefits and a 10% priority allocation. They will also be eligible for re-offer of Balance Flats (ROF) exercise with rehousing benefits. Eligible SERS flat owners may take also up an ex-gratia payment (up to $60,000) on top of their compensation instead of the SERS rehousing benefits.

HDB will build new flats, ranging from 2-room Flexi flats to 5-room flats at Circuit Road, as replacement flats for the residents. These new flats are estimated to be completed in 2nd Quarter 2023.

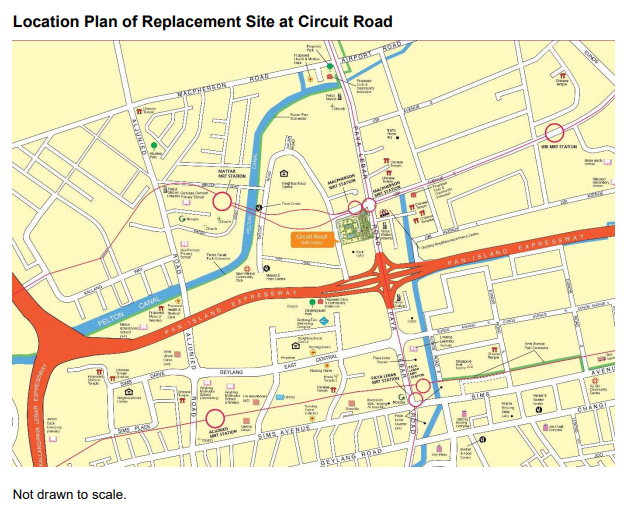

The replacement flats are located near the MacPherson MRT Station (interchange station for Circle Line and Downtown Line) and Pan Island Expressway. There are shops and eateries nearby, such as the Circuit Road Food Centre and the MacPherson Market and Food Centre. Paya Lebar Square is a few minutes’ drive away. In addition, residents can enjoy recreational activities at the nearby MacPherson Community Club.

The SERS plan will also involve 27 sold shops and 2 eating houses at Blocks 81 to 83 MacPherson Lane. The owners of these commercial properties will be given compensation based on the market value of their units at the time of the SERS announcement. They may opt to buy a new unit on a 30-year lease based on selling prices fixed at market value as at the time of the SERS announcement, rent a new unit based on the prevailing market rent at the time of letting, or choose not to take up a new unit and receive an ex-gratia payment pegged at 10 percent of the market

HDB said that it will inform all SERS flat owners and commercial property owners individually of these plans. They will also be invited to a SERS exhibition which will be held from 2 to 4 June 2018.

The SERS announcement of the flats in McPherson is one of the first since the National Development Minister Lawrence Wong said that HDB flat owners should not assume that all old HDB flats will become eligible for SERS.

Writing a blog in March last year, the Minister said that “only 4% of HDB flats have been identified for SERS since it was launched in 1995”, and that “it is only offered to HDB blocks located in sites with high redevelopment potential”.

The Wong’s announcement on SERS spooked a considerable segment of the HDB flat owners as about 70,000 flats (of the 1-million HDB flats) are more than 40 years old, and almost 10 percent of flats will face lease expiry in 50 years. The Minister’s announcement essentially means that such flats will have zero value once it reaches 99 years and owners will have to vacate their homes. Most owners will see the land their flat was on being returned to the State at the end of the 99-year-leasehold.

The public’s alarm caused the Minister to clarify that HDB flats are still a “good store of asset value”, so long as one plans ahead and makes prudent housing decisions.

The assurance by the Minister failed to ease the concerns of some who asked ‘how in one fell sweep, HDB flats had gone from being “asset enhancement” to “good store of asset value”’.

—

If you are home-hunting, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and with best home loans. The services of our mortgage loan experts are free. Our analysis will give best home loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at [email protected] for a free assessment.