The majority owners at Margate Point, a 15-unit apartment development at Margate Road, have collectively put their property up for sale by tender in their maiden collective sale attempt. The owners appointed Jones Lang LaSalle Property Consultants (JLL) to market the property.

Located off Meyer Road and Mountbatten Road, Margate Point has a land area of about 12,800 sq ft and is zoned Residential with an allowable gross plot ratio (GPR) of 2.1 under the 2014 Master Plan. Subject to design and approval from the relevant authorities, the site may be redeveloped into a maximum of 35 apartments with an average size of 70 sqm per unit.

“Margate Road happens to be the dividing line that segregates the high-rise residential zone from the safeguarded 2-storey landed estate. When redeveloped, the new high-rise development at Margate Point’s site would stand to enjoy excellent, unobstructed views across the vast Meyer Road and Goodman Road landed zones, to the low-rise residential areas in Joo Chiat. The stunning views, combined with its central Katong location and its close proximity to a future MRT station, would be sought-after selling points,” says Mr Karamjit Singh, senior consultant at JLL.

This part of District 15 has been a traditional favourite amongst many well-heeled families and investors due to its proximity to the Central Business District, Changi Airport and the beach. With the new Thomson-East Coast Line underway, the plan to upgrade East Coast Park into a key leisure destination, and with the developments at Changi Airport’s Terminal 5 taking shape, this whole location can expect new vibrancy and asset appreciation if the collective sale attempt materialises.

Mr Singh says, “This current collective sale cycle has performed quite differently from the previous cycle, where the average transacted value per site has increased. Many mega-sized projects have been launched and sold over the past year, with more of such mega-sites in the process of garnering their requisite consent levels.”

The collective sale attempt of Margate Point comes on the heels of some 24 en bloc sites being sold within the first four months of 2018 at an average deal size of approximately $338 million per transaction.

Last year in 2017, 32 sites were sold at an average of $275 million per transaction. During the previous peak of the collective sale cycle in 2007, the average deal size was only about $131 million.

“Margate Point’s minimum expected price of $38 million offers boutique developers and contractors an attractive and affordable redevelopment proposition, particularly if they have found themselves priced out of the market due to the high investment quantum needed for the larger private and government sites. Further, this property may also appeal to institutional investors or families looking to acquire a complete residential development to hold as a long-term investment to hedge against the rising property prices in this area. The existing typical apartment size of 1,280 sq ft makes it quite rentable.”

“Subject to confirmation on the property’s development baseline, Margate Point’s reserve price translates to a land rate of approx. $1,417 per sq ft per plot ratio (psf ppr) for a redevelopment up to GPR 2.1, i.e. before any bonus gross floor area for balconies, which is reasonable in view of the transacted prices and asking prices of other land parcels in the vicinity.”

“There is a high chance of getting 100% consent from the owners towards this collective sale. At the moment, owners representing 14 out of 15 of the apartments have already inked their consent to the collective sale. Should the last unit’s consent be obtained, the owners can then bypass the Strata Titles Board application process and work towards legal completion taking place within three months of contract,” says Mr Singh.

Mr Paul Ho, chief mortgage consultant of icompareloan said that it is good that most owners have made a fast decision on the sale, as this would mean that the sale can be concluded with minimal delay and maximum benefit to the owners.

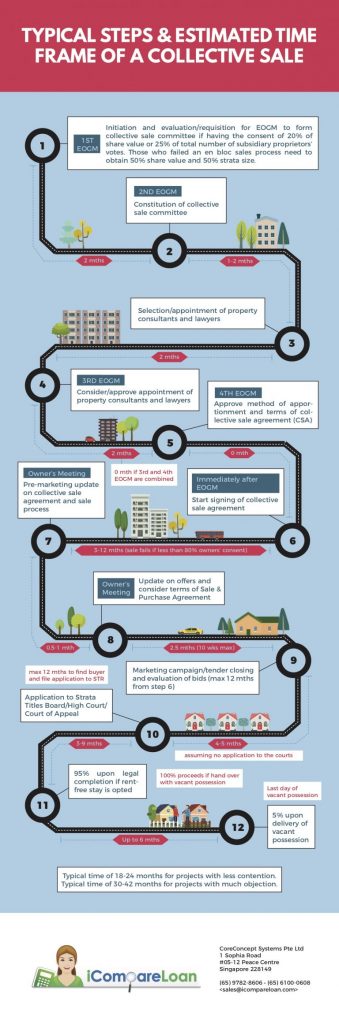

Collective sale attempt process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for downpayment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

Mr Ho said that owners of properties which are attempting en bloc, must be mindful that property prices typically move up 10 to 20 per cent by the time they complete the sale of their real estate.

“Owners need to consider the cost of a replacement apartment by that time their current property is sold, so it is in the owners interest to hold their collective sale attempt at a higher selling price,” Mr Ho added.

Owners who have refinanced their mortgage loans to fixed rate home loans, or those with 2 years locked-in (or 3 years locked-in) period will incur full home loan redemption penalty. This penalty is usually 1.5 per cent of the loan amount. The penalty may affect those who have bought their properties in recent years as their loan size is often bigger and so their corresponding home loan redemption penalty higher.

Mr Ho advised: “If your home is at risk of en bloc, you should consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost.”

He added: “The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. You may contact a mortgage broker to assist you to find such packages with waiver of locked-in penalty.”

The tender for Margate Point closes on 6 June 2018 at 2.30pm.

—

If you are home-hunting, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and a promotional home loan. Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at [email protected].