Singapore — The phishing scams that burst into media headlines in Singapore last month have also swept through other countries in Asia.

People in Hong Kong, Malaysia, India, the Philippines, and elsewhere have also lost millions of dollars to similar scams, as fraudsters have become more sophisticated in carrying out their schemes.

As with the con jobs that are known to have cost some 470 OCBC customers at least $8.5 million, the phishing messages that the crooks sent out elswhere look and seem so authentic that the victims can’t tell they’re being scammed.

OCBC’s announcement that it would fully reimburse customers who lost their money to phishing has been welcomed, but the scale of the scams and the ease with which the crooks have exploited digital banking have provoked calls in Singapore for better security to protect potential targets.

Across Asia, many others have also fallen victim, according to a recent report from the South China Morning Post.

It reports that in the last four and a half years, scammers have laundered almost HK$29 billion (S$5 biillion) from more than 10,000 people in Hong Kong through cryptocurrency wallets and bank accounts.

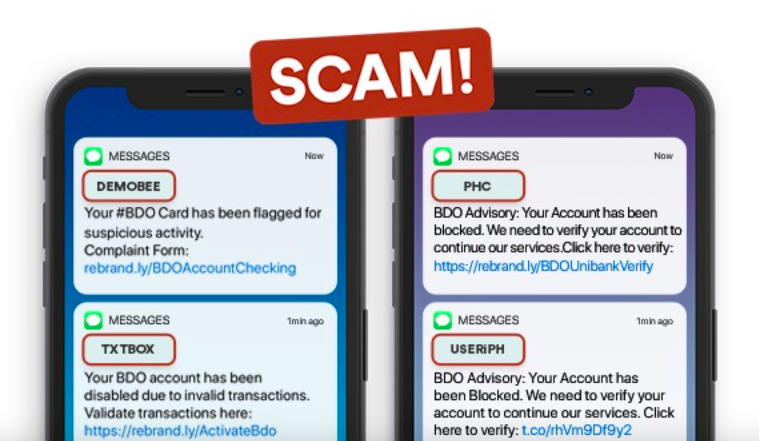

In the Philippines, five people were arrested last week over a massive online banking fraud that happened shorty before the Christmas holidays. That compromised the accounts of more than 700 clients of BDO Unibank, one of the country’s biggest. The clients reported that unauthorised transfer of funds seemed to have happened overnight.

In India, the elderly have been among the most vulnerable to such scams, especially those who are not digitally savvy. SCMP reported that in that country, US$25 million monthly (S$33 million) is lost through digital scams to cyber criminals.

The report quotes cybersecurity expert and Supreme Court lawyer Pavan Duggal as saying, “Senior citizens are being targeted by scammers primarily because they have been forced to adopt digital payments without being appropriately trained for this shift.”

Last year in Malaysia, there were 8,992 cases of online scams that saw losses of 58 million ringgit (S$18.65 million), compared with 2019 when there were 2,512 cases involving losses of 30 million ringgit (S$9.65 million).

In the wake of the scam, the Monetary Authority of Singapore (MAS) said on Jan 19 that another layer of measures to fortify digital banking security would be added, but told the public that “customer vigilance is paramount”.

In the meantime, a local data scientist who goes by the nom de plume Captain Singkie warned that “The next attack might not happen on OCBC anymore. But customers of other platforms, businesses and organisations are still vulnerable to being phished.

“One Singaporean scammed is one too many. We must work together to stop the scams from happening.”

He also urged Singaporeans to sign a petition on change.org calling for more awareness about the issue. /TISG

Read also: Data scientist proves IMDA’s protection scheme against SMS phishing is still vulnerable to hackers

Data scientist proves IMDA’s protection scheme against SMS phishing is still vulnerable to hackers