If paying down credit card debt is one of your goals for 2017, you are not alone. In 2016, the average household in Singapore was carrying S$1,816 in credit card debt. And that number is on the rise: credit card debt in Singapore has grown 8.9% per year since 2009. That rate is faster than overall household debt growth (which includes other loans like student loans, mortgages and auto loans), which grew by just 8.3% per year during the same time period.

Although credit card growth has been muted in 2016 compared to the previous few years, it still can be a serious problem for consumers who have built a rather large unpaid balance on their cards. To help people manage this balance down in the new year, we will explore the cost of credit card debt, what you should keep in mind when looking at your monthly credit card statement, and how to begin paying down your debt in 2017.

What is the Cost of Credit Card Debt?

The cost of holding debt on your credit card is shown by the card’s Annual Percentage Rate (APR). Your particular APR will vary based on the type of credit card you are using and your income level. In general, APRs in Singapore range between 24% and 29%. The simplest way to think about APR is the daily cost of holding a balance on your card. You just have to divide the APR by 365 to see how much interest is charged daily on your outstanding balance.

24% APR / 365 days = 0.066% daily interest charged

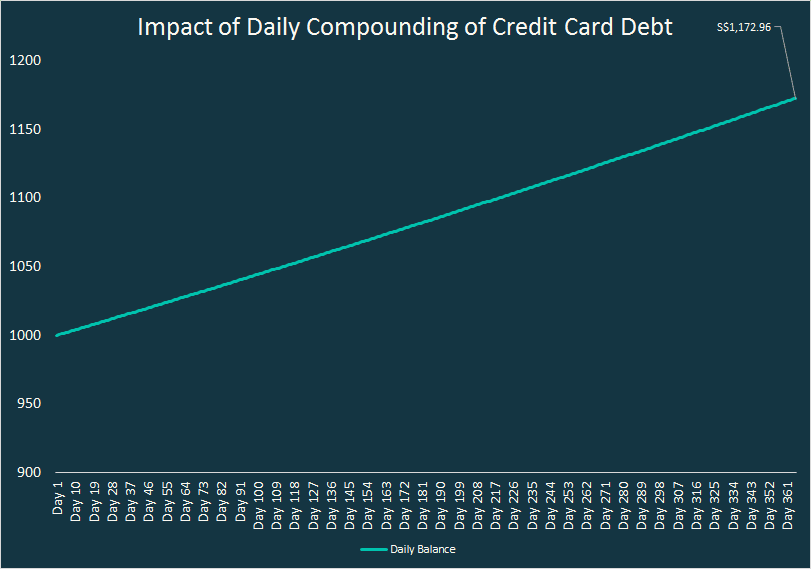

You only incur this cost when you don’t pay off your monthly credit card balance in full. After the monthly deadline, your card company will look at the total balance on the card at the end of each business day, multiply it by the daily interest rate, and add this interest charge to the total balance. These charges are typically compounded, meaning that you will be charged additional interest on top of your new balance with each passing day.

For example, let’s consider an imaginary card holder who is carrying a S$1,000 of unpaid balance on their card. In this scenario, we see:

- Day 1 Balance: S$1,000 + (0.066% x S$1,000) = S$1000.66

- Day 2 Balance: S$1,000.044 + (0.066% x S$1,000.44) = S$1,001.32

- Day 3 Balance: S$1,000.88 + (0.066% x S$1,000.88) = S$1,001.97

While 0.066% sounds like a small daily total, the compounding nature of these interest charges can add up significantly over the course of the year. In the example above, assuming no other purchases were made on the card, the total balance owed would be S$1,271.15 after 365 days.

In a perfect world, card holders would make purchases using their credit cards and pay down the entire balance each month. This is the best way to ensure you maintain a strong credit rating, earn some cash rebate or air miles as rewards, and pay as little interest as possible to your credit card company. However, as we all know, life can present challenges that require a balance be carried on the card from time to time. If you can’t pay down the entire balance, you should still aim to make more than the card’s minimum payment at the very least.

The Minimum Payment

When you look at your monthly credit card statement, you will see a “minimum payment due” amount prominently displayed. There are a number of ways this can be calculated, but the most common is a percentage of the total amount owed on the card. In most cases, this is between 1% and 3%. This is the minimum monthly payment which must be made for you to remain in good standing with the card issuer. Paying less than this amount will be considered a late payment, and may be subject to fees or negative marks on your credit score.

While you should try to never pay less than the minimum payment requirement, you should always try to pay meaningfully more than this amount. Card companies actually want you to pay this minimum — as opposed to your full card balance — as it means more interest generated by your account over the long run.

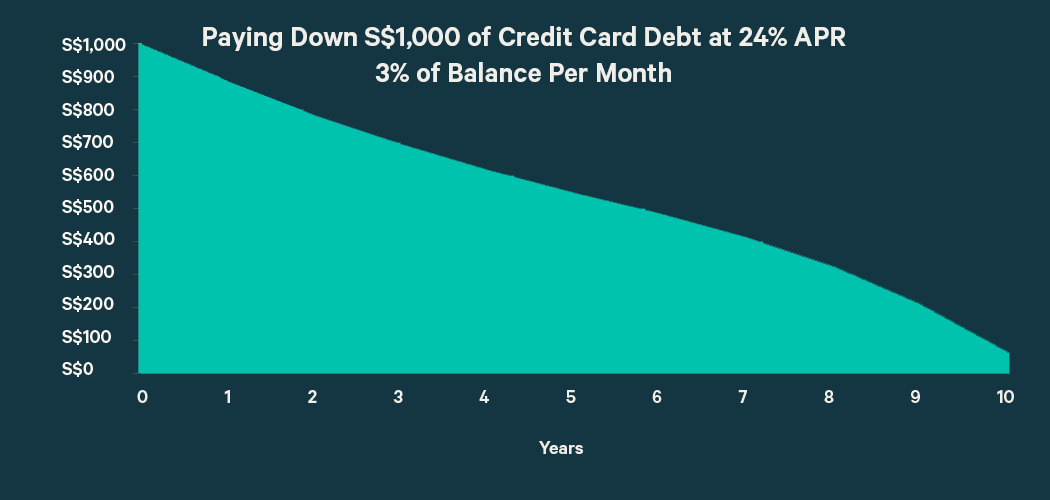

To see how this works, consider the example we provided before, where a Singapore family has S$1,000 in card debt with an APR of 24% and a minimum payment each month of 3%. By just paying the minimum it would take 124 months (10.5 years) to pay down the balance. More importantly, the family would make total payments of S$2,332.18 in order to pay off the original S$1,000 balance!

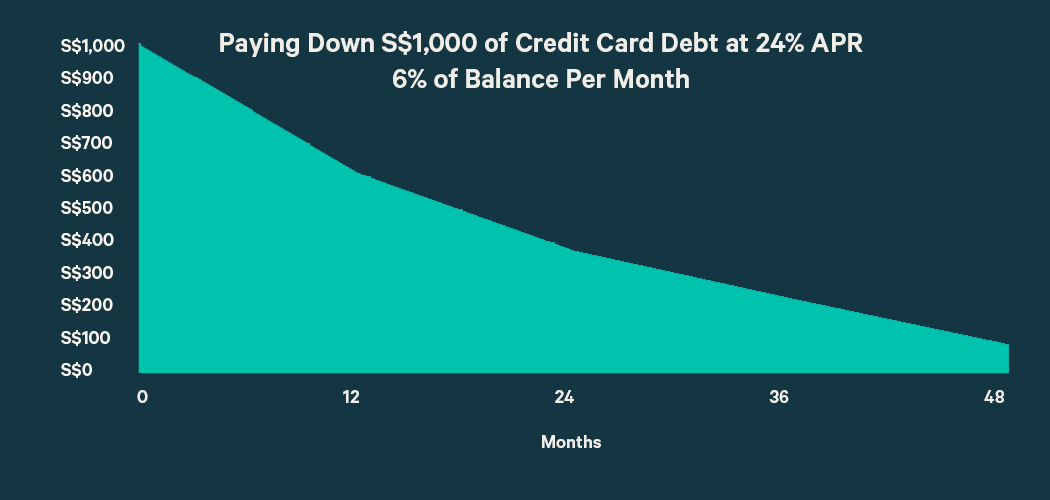

If the family decides to pay 6% each month (rather than the 3% required) this original debt will be paid off in just 54 months (4.5 years) at a cost of S$1,432.18. These examples highlight the importance of making payments which exceed the minimum balance due, on a monthly basis, as you will be debt-free in less time and save significantly when it comes to interest payments. Here’s a calculator you can use to see the math in action.

Forming a Plan

Armed with you knowledge of credit card interest charges and minimum payments, you can form a plan to pay down outstanding credit card debt in 2017. The best way to do this is to “work backwards.”

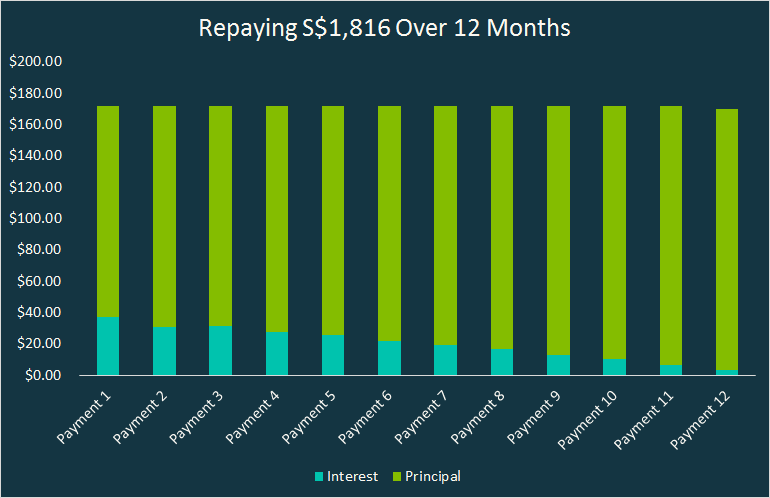

Ask yourself the question: “In how many years would I like to be debt free?” If the answer is 1 year, you now know that you will need to make steady payments over the next 12 months to make it happen. To figure out what those payments should look like, consider the amount of outstanding debt you hold.

For the average family in Singapore holding S$1,816 in debt, this means making around S$170 of repayment each month in addition to any new charges on the card. By breaking payments into manageable monthly installments, rather than focusing on the existing balance, you will feel more empowered to pay off your credit card debt.

Finding a plan that works for the entire family is critical in this process, so consider holding weekly (or monthly) family meetings to discuss the credit card balance and your progress. You can also read more about how to manage your finances better in our guide for the new year.

The article How to Pay Down Your Credit Card Debt in 2017 originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

- Best Credit Cards with Promotion and Bonus 2017

- Best Travel Insurance 2017

- What Are The Best Balance Transfer Credit Cards of 2017?

Source: ValuePen