SINGAPORE: Singaporeans are responding to news of the core inflation rate in Singapore remaining at 5.5 per cent in February, a 14-year-high.

According to a recent report, Singapore’s core inflation rate remained held steady at 5.5 per cent in February, which is the highest recorded since November of the year 2008.

In response, many Singaporeans took to the comments section of this report to share their concerns on the matter. While some held on to government vouchers as a ray of hope, others discussed what is included in the core inflation rate and what is excluded.

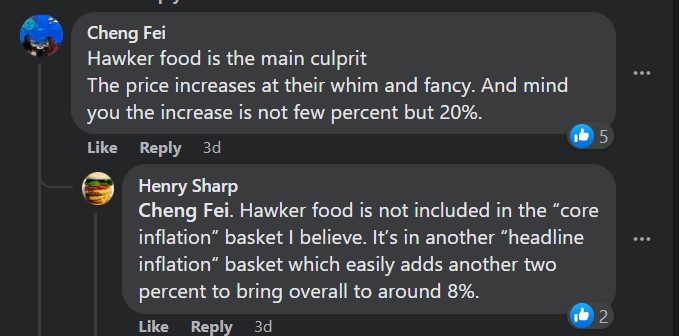

“Hawker food is the main culprit,” said one. “The price increases at their whim and fancy. And mind you, the increase is not a few percent but 20%.”

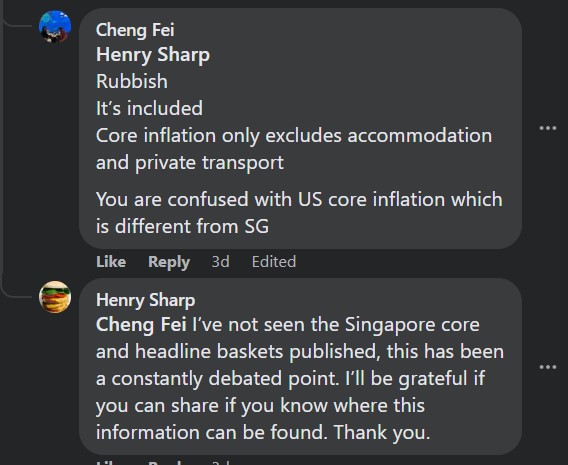

Another argued, “Hawker food is not included in the ‘core inflation’ basket I believe. It’s in another ‘headline inflation’ basket which easily adds another two percent to bring overall to around 8%.”

However, the first commenter responded by saying, “It’s included. Core inflation only excludes accommodation and private transport. You are confused with US core inflation, which is different from Singapore’s.”

Another shared, “Some of these inflations can be mitigated if we cap our GST at 7%, and reduce taxes on petrol and COE. All these will cause an increase in transport charges that will trigger an increase in (the) prices of goods and services.”

Still, a few referenced government vouchers, with one saying, “It’s okay, (we’ve) got GST voucher.”

“Going to hit in next levels, God bless,” wrote another.

One took a more optimistic take by saying, “Still not the worst on earth… some countries faced (a) much higher rate.”