Edmund Tie & Company (ET&Co), the sole marketing agent for Three Buckley, on October 3rd launched the freehold residential project in the Newton area for sale by Expression of Interest (EOI).

The freehold residential project has a land area of approximately 1,444.64 square metres (sq m) or 15,550 square feet (sq ft) and is zoned for Residential use at Gross Plot Ratio of 1.4 under Master Plan 2014. The development was completed in 2010 and comprises 11 duplex units.

Three Buckley boasts a strategic central location in the prime and well sought-after District 11. Located within an established residential enclave, it is just a short walk away to an array of amenities including shopping and dining establishments, entertainment and lifestyle options, as well as top-notch healthcare facilities.

Other key landmarks in the area of the freehold residential project include Newton Food Court, Novena Square, Square 2, Oasia Hotel Novena, Mount Elizabeth Hospital and Revenue House.

The CBD and Orchard Road shopping belt is just a short drive away from the freehold residential project, while prominent educational institutions, such as Anglo-Chinese School (Barker Road), Anglo-Chinese School (Junior) and St Joseph’s Institution Junior, are located within a kilometre. With the Newton Interchange and Novena MRT station just a short distance away, the freehold residential project also enjoys excellent connectivity to other parts of Singapore via major roads and expressways, such as the main Newton Road, Scotts Road, Dunearn Road, Bukit Timah Road, the Central Expressway (CTE) and the Pan Island Expressway (PIE).

Senior director of investment advisory Tan Chun Ming, commented, “The property has many positive attributes such as a highly coveted freehold tenure, single ownership, prestigious District 11 address and many more. The property offers investors the flexibility of leasing out to different resident profiles – young families who prefer to stay in proximity to educational institutions, expatriates or working adults who prefer to live closer to the CBD and the future health hub.”

“Most of the units are tenanted, offering stable rental income. Investors who are looking for long-term investments would find this a timely opportunity. Future en bloc or redevelopment plan would be an ideal exit strategy.” he added.

The asking price for the freehold residential project is $41m, which reflects $1,657 per sq ft.

ET&Co said interested parties may also submit bids for single or multiple strata units. The EOI exercise for Three Buckley will close on Thursday, 8 November 2018 at 2 pm.

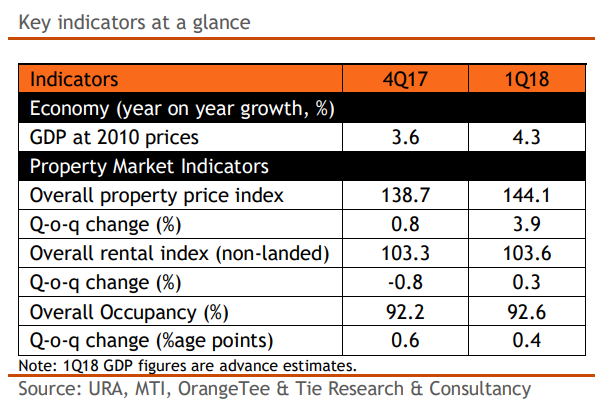

The EOI sale of the freehold residential project in District 11 comes at a time when sentiment in the private residential market continued to be buoyant.

As developers’ existing stock continues to diminish and supply of completed homes remain low, many projects especially those in the CCR have raised prices of their unsold units, some by even double-digits this year. Private residential market continued to gain traction with individual re-sellers have also seized the opportunity of increasing their asking prices in light of the more positive market sentiment fueled by the recent collective sales frenzy.

An earlier report by ET&Co said that higher launch prices at some new projects slowed the buying momentum in the primary market, as sales volume dipped 15.2% quarter-on-quarter. Some developers have also held back their launches in the first quarter in anticipation of higher asking prices. While overall sales had slipped 14.2% q-o-q, volume rose 2.4% on a y-o-y basis.

With positive sentiments of the private residential market, sales is predicted to pick up significantly in the months ahead as more projects are slated to be launched and the prevailing market valuations be supported by banks at the higher benchmark prices.

OrangeTee & Tie research and consultancy head Christine Sun noted: “As it seems, demand for resale homes had rebounded strongly by 67.3 per cent year-on-year, the highest number of Q1 resales since 2012.”

She added: “Owing to higher land cost, stronger economic growth and pent-up demand, we expect prices to trend even higher. Some new homes may even see prices rise beyond 15%, going by the recent pricier enbloc acquisitions.”

Mr Paul Ho, chief mortgage consultant at icompareloan.com noted that Core Central Region (CCR) has risen less compared to Rest of Central Region (RCR) for many years now, and that the price differential is narrowing.

“Either RCR is overpriced or CCR is underpriced. For investors who are looking at superlatives, definitely the best of the best will do. Savvy investors (those who already have more than 1 property) will stay away from the market as the prices are crazy and the fundamentals are weak and there is huge supply in the pipeline.

“Current investors, such as those that bought the New Futura comprise mainly of foreigners. I doubt how they will recover their investment given the low rental yields, rising interest costs.

“I got a sense that it is more a portfolio diversification play given that they feel bullish about the Singapore Property market – given that the malaise of over supply has been digested for many years.

“The situation is nowhere as dire. So, this is more about the confidence and the sentiments. The fundamentals of the Singapore property market remains weak.”

How to Secure a Home Loan Quickly

Are you planning to invest in properties but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.