Minister for National Development Lawrence Wong in answering a parliamentary question in November, said 4 in 10 recent HDB flat buyers did not voluntarily take up Home Protection Scheme (HPS).

Mr Wong was answering a question of “whether HDB will reconsider to make it compulsory for HDB owners who either use cash or CPF to service their housing loan to sign up for the Home Protection Scheme (HPS); and in the past three years, how many HDB owners did not use CPF to service their housing loan instalment and did not purchase HPS as well.”

The Minister answered the take up rate for Home Protection Scheme by recent HDB flat buyers said:

“About 20% of HDB flat buyers in 2017 who took a mortgage loan used cash to service their loans. Among them, 4 in 10 did not voluntarily take up the Home Protection Scheme (HPS).”

He added: “Effectively this means that around 92% of recent HDB flat buyers with outstanding loans are covered under the HPS policy, or have voluntarily taken up HPS,” and that “besides HPS, some home buyers may have purchased mortgage-reducing products from the private sector.”

Mr Wong said that his Ministry did not have detailed records of such purchases, but that many commercial banks offer such mortgage-reducing insurance (MRI) products as part of their loan financing package to home buyers.

In saying that the overall insurance coverage may well be higher, the Minister assured that HDB will continue to work with CPF Board to further encourage take-up of HPS. He promised to continue to monitor the situation and assess whether to implement further measures if the need arises.

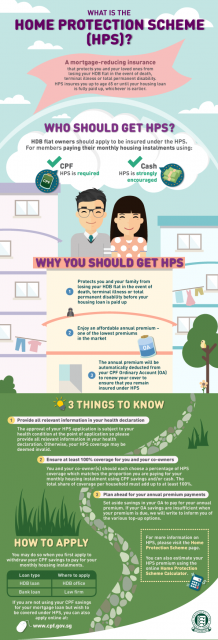

The Home Protection Scheme is a mortgage-reducing insurance that protects members and their families against losing their HDB flat in the event of death, terminal illness or total permanent disability.

https://www.icompareloan.com/resources/cpf-hps/

HPS insures members up to age 65 or until the housing loans are paid up, whichever is earlier. You have to be insured under Home Protection Scheme if you are using your CPF savings to pay your monthly housing loan instalments on your HDB flat. HPS does not cover private residential properties, such as executive condominiums (ECs) or privatised Housing and Urban Development Company (HUDC) flats.

The Home Protection Scheme has been faulted by some HDB flat owners for failing to better protect CPF members.

In September, a widow of a taxi driver faulted the CPF Home Protection Scheme in late September for failing to cover her husband even though he had been prompt in paying his premiums. In writing to the Chinese publication, Lianhe Zaobao, the widow said how she was hopeful that the Scheme would help her family from losing their HDB flat after her husband’s death, and how her hopes were dashed by the CPF Board.

The CPF Board and HDB responded to the widow on Oct 2 and said that it had a duty to ensure integrity of Home Protection Scheme administration.

https://www.icompareloan.com/resources/cpf-home-protection-scheme/

In clarifying how the Home Protection Scheme worked, CPF Board and HDB said:

“HPS is an insurance scheme where claims are paid out from premiums collected. To keep premiums low and the application process simple, members are required to fully disclose their health conditions when they apply for HPS. Members who declare in the HPS form that they are healthy would generally not be inconvenienced by further underwriting and an HPS cover would be issued in good faith…

“As part of sound insurance practice, CPFB has a duty to ensure the integrity of HPS administration. Therefore, upon detection of non-disclosure by any insured member, we will terminate the HPS cover and refund the unused premiums into the insured’s Ordinary Account. It would not be fair otherwise to members whose HPS applications are rejected for similar reasons.

“The vast majority of HPS claims by beneficiaries have been successful. Nonetheless, CPFB will look into how the HPS application and underwriting process can be improved.”

Home Protection Scheme pays off the outstanding housing loan, up to the sum assured, based on the percentage share of cover of the insured in the event of death or permanent incapacity. For example, if you are paying 80% of the monthly housing installments, and your co-owner pays the remaining 20%, you should be insured for 80% of the loan and your co-owner 20%. The total share of cover per household for CPF HPS should add up to at least 100%.

However, you may each choose to insure for a higher or lower share based on your individual needs and circumstances, up to 100% share of cover per owner. For example, if you and your co-owner are paying 80% and 20% of the loan respectively, you can both be insured for 100%. This means that the CPF Board would settle 100% of the outstanding housing loan up to the insured sum in the event of death or permanent incapacity.

How to Secure a Home Loan Quickly

Are you planning to on selling your HDB flat to upgrade to a condo, but unsure if you have enough funds? Don’t worry, because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.