SINGAPORE: Latest data supplied by the Ministry of Law has shown that the number of people who applied for bankruptcy in the first quarter of this year is a notable 20 per cent higher than the number in the same period last year, with nearly 1,000 Singapore residents making bankruptcy filings in the first three months of this year alone.

The number of bankruptcy filings has stayed in the 700s range in the first three months across the past five years, except for 2020 when the COVID-19 pandemic ravaged the economy and led to a high of 1,278 bankruptcy applications.

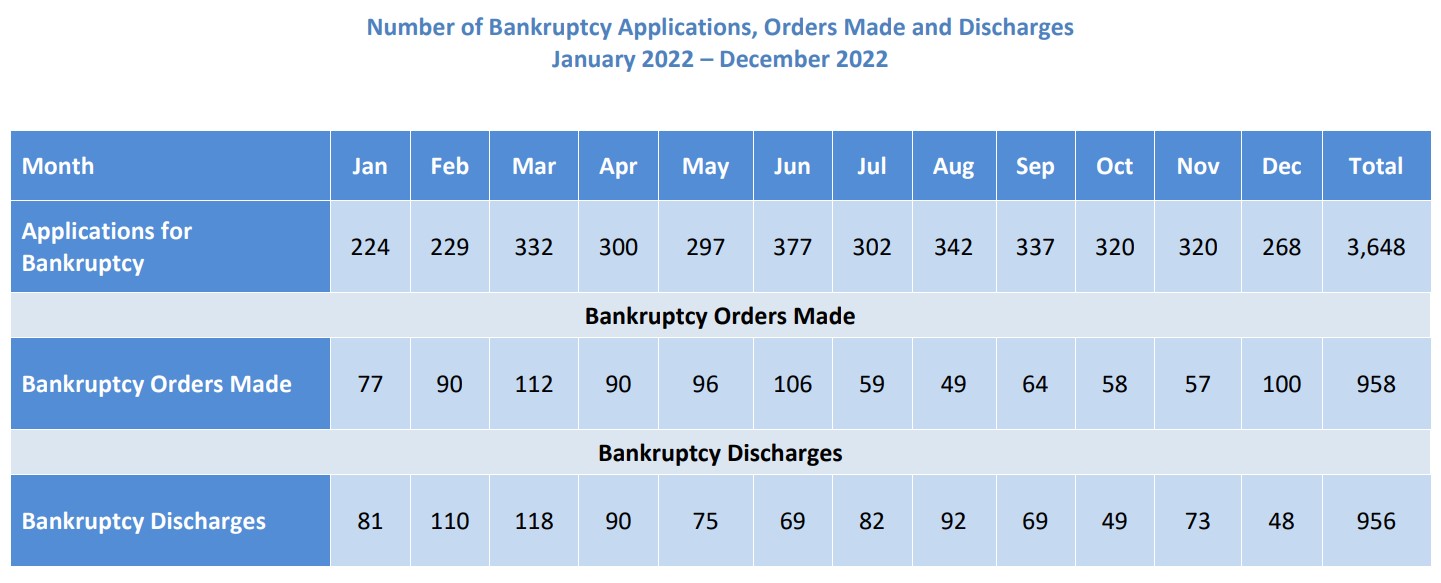

Pre-pandemic in the first quarters of 2018 and 2019, there were 743 and 757 bankruptcy filings respectively. After the number shot up in 2020, it came back down to 779 and 785 in the first three months of 2021 and 2022 respectively.

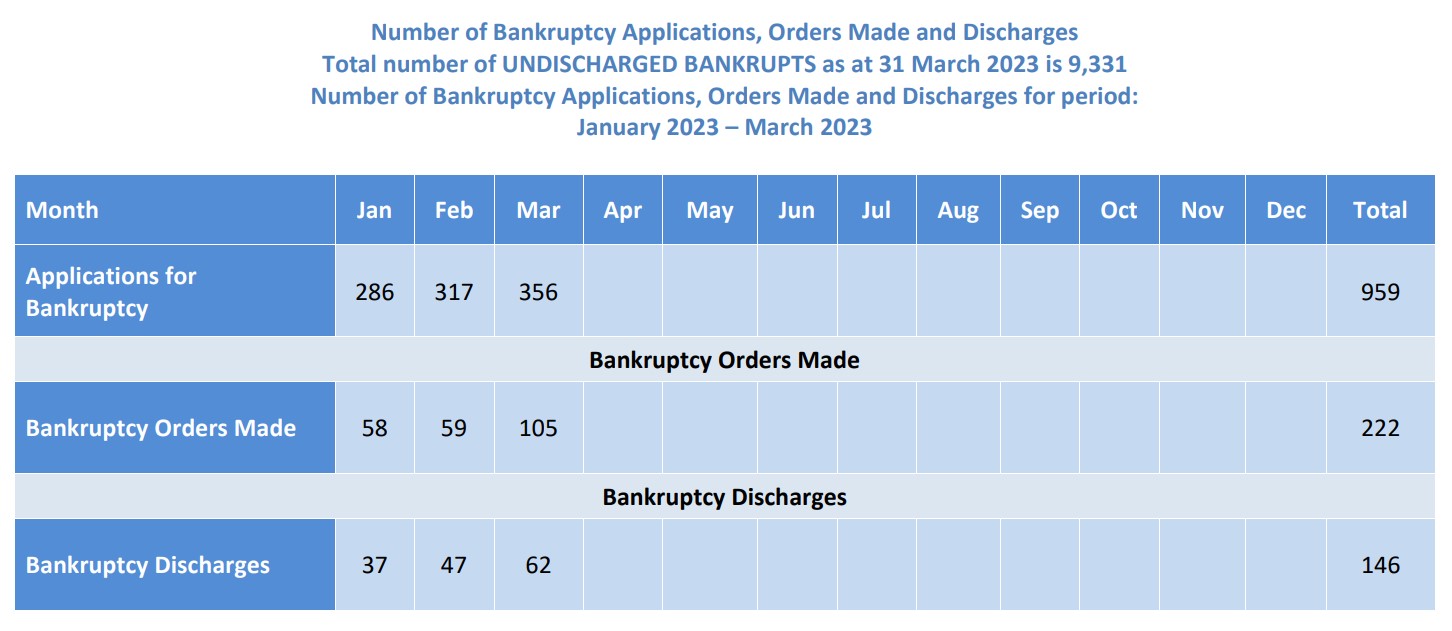

The first quarter of this year stands out, with a total of 959 people filed for bankruptcy between January to March this year. This brings the total number of bankrupted individuals in Singapore to over 9,300.

The Law Ministry’s data also shows that there were 222 bankruptcy orders that were made and 146 bankruptcy discharges in the first quarter of this year. The number of bankruptcy orders and the number of bankruptcy discharges thus far in the year is lower than the levels recorded in the first quarter of 2022.

Credit Counselling Singapore (CCS) has partnered with the Law Ministry to pilot a Bankruptcy Rehabilitation Programme, to support bankrupted individuals and their families in their journey to a fresh financial start.

The programme was first launched during the pandemic last year and CCS personnel reached out to bankrupted individuals via phone to understand the problems they face and provide consultation. The team leader of the programme told Channel 8 this week:

“Many times there is no chance for people to really understand some of their experiences and their inner feelings, so we listen and give them opportunities to explain to build a better relationship.”

54 people have participated in the lectures the non-profit runs to understand the project so far, while 12 people have sought help from the team dedicated to helping them find stable financial footing.

Although the pilot program ends this month, CCS intends to continue the program and explore new channels to help more people in need. /TISG