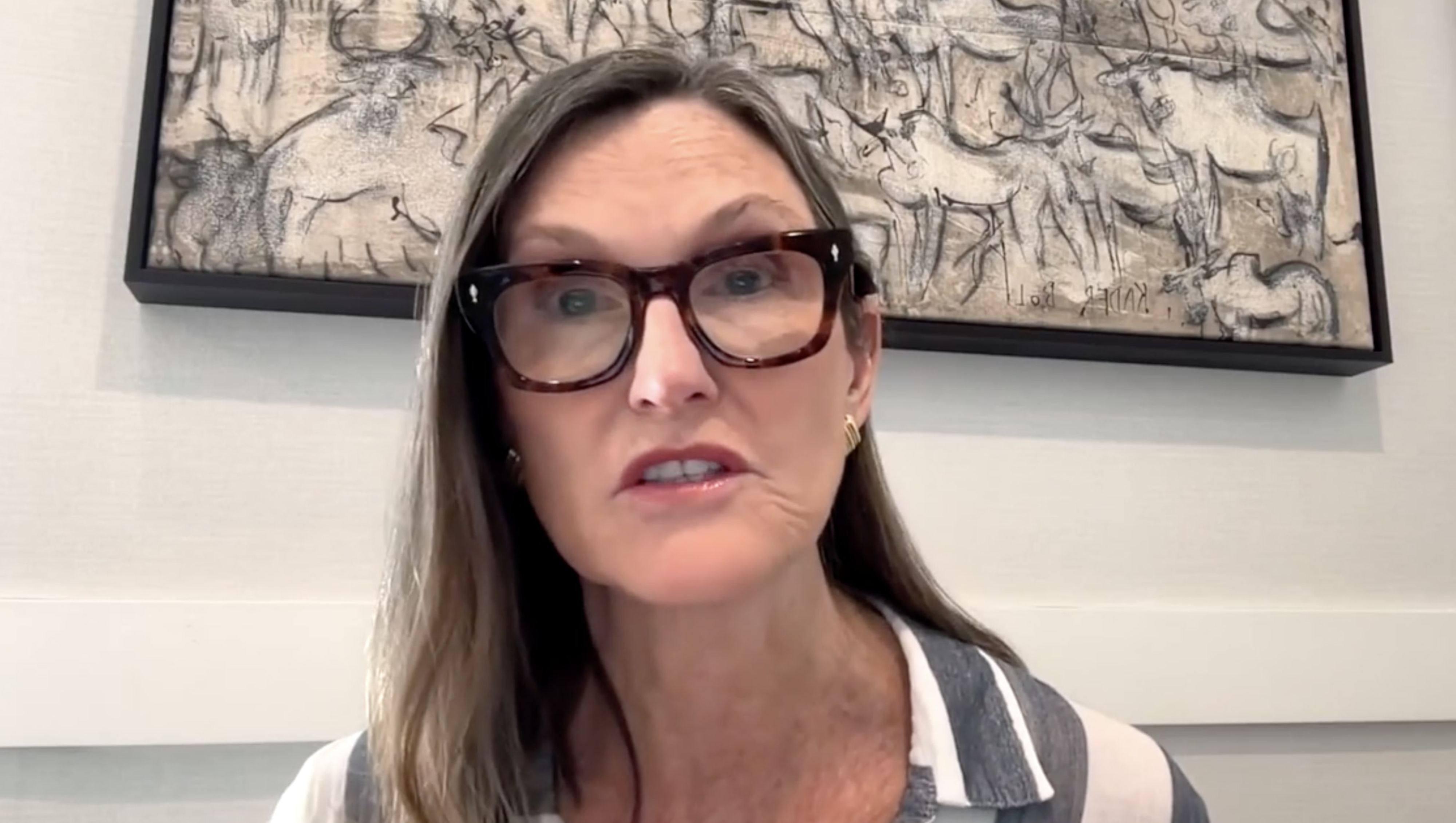

US: While Tesla’s stock has dropped over 50% in the past three months, Ark Investment Management CEO Cathie Wood told Bloomberg TV at the HSBC Global Investment Summit in Hong Kong on Tuesday that she expects it to reach US$2,600 (S$3,473) in five years—nearly 10 times its current price.

According to The Edge Singapore, Ms Wood said Tesla’s robo taxis would drive most of this future value, accounting for 90% of the company’s worth. She added that Tesla’s initiatives in humanoid robots have not been factored into Ark’s price prediction.

Ms Wood rose to fame during the pandemic for her bold bets on companies like Tesla, Zoom, and Roku. Her views led to Ark’s funds peaking at over US$60 billion in assets by early 2021.

Ark’s confidence in Tesla is not new. In a 2023 analysis, the firm estimated that Tesla’s stock would reach US$2,000 by 2027 as the company gains market share from traditional automakers. In July, Ms Wood said that launching an autonomous taxi platform could push Tesla’s stock up by 10 times.

While Ms Wood believes Tesla remains competitive in terms of range and power for a given price, the company has faced challenges recently, with declining sales and shipments in key markets like Europe and China, partly because of Tesla CEO Elon Musk’s political push-back.

BYD’s sales last year exceeded US$100 billion, beating its estimates and Tesla’s US$97.7 billion revenue.

According to information from Ark’s website, Tesla remained the largest holding in Ark’s ARK Innovation ETF, making up 10% of the fund’s US$5.8 billion assets as of Mar 24. This is down from nearly 16% at the end of 2024.

Despite these challenges, Mr Musk recently encouraged employees to hold onto their stock, calling the current situation “a little bit of stormy weather” but assuring them that the company’s future is “incredibly bright and exciting.” This also encouraged Tesla supporters to buy more stock during the downturn.

However, not everyone is convinced that Tesla can recover. Some commenters expressed doubts, citing declining overseas sales, growing competition, and “Mr Musk’s antics.” One commenter highlighted the shift of buyers towards electric vehicles (EVs) from competitors, especially in the Chinese market, suggesting that Tesla would need to become a leading global car company to sustain its valuation.

Another commenter noted that it’s hard to imagine Tesla recovering when Mr Musk is associated with the company. Another remarked that the stock’s recovery is “not gonna happen” as there are a lot better EVs for the dollar.

However, one supporter in the comments argued, “So many underestimate Musk. He’ll adjust with the times and come out on top. He didn’t get where he is by listening to Facebook experts.” /TISG