SINGAPORE: A woman took to social media after receiving successive texts from OCBC Bank, as she has no accounts there.

Ms Jeya KR posted on the COMPLAINT SINGAPORE Facebook page on Friday (Aug 18) screenshots of two messages she had received the day before.

The first was from 2:45 in the afternoon and it read: “Due to a system glitch, an amount was erroneously credited into your account on 23 Jul 2023. We will reverse this credit from your account between 17 Aug 2023 to 8 Sept 2023. Please ensure that you have sufficient funds in your account. We apologize for the inconvenience caused. Questions? Call OCBC Hotline.”

At 5 pm that day, she received another text: “We sent you an SMS earlier stating that money was credited to your account because of a system glitch and the amount would be deducted. Please ignore the SMS as it was sent in error. No money was incorrectly credited to your account and no deductions will be made in relation to that SMC. We are very sorry for the inconvenience caused.”

Ms Jeya wrote, “More like a scam. I received this message from OCBC yesterday. The best part is I don’t have an account with them. Please beware friends.”

The Independent Singapore has reached out to Ms Jeya and OCBC for further updates and comments.

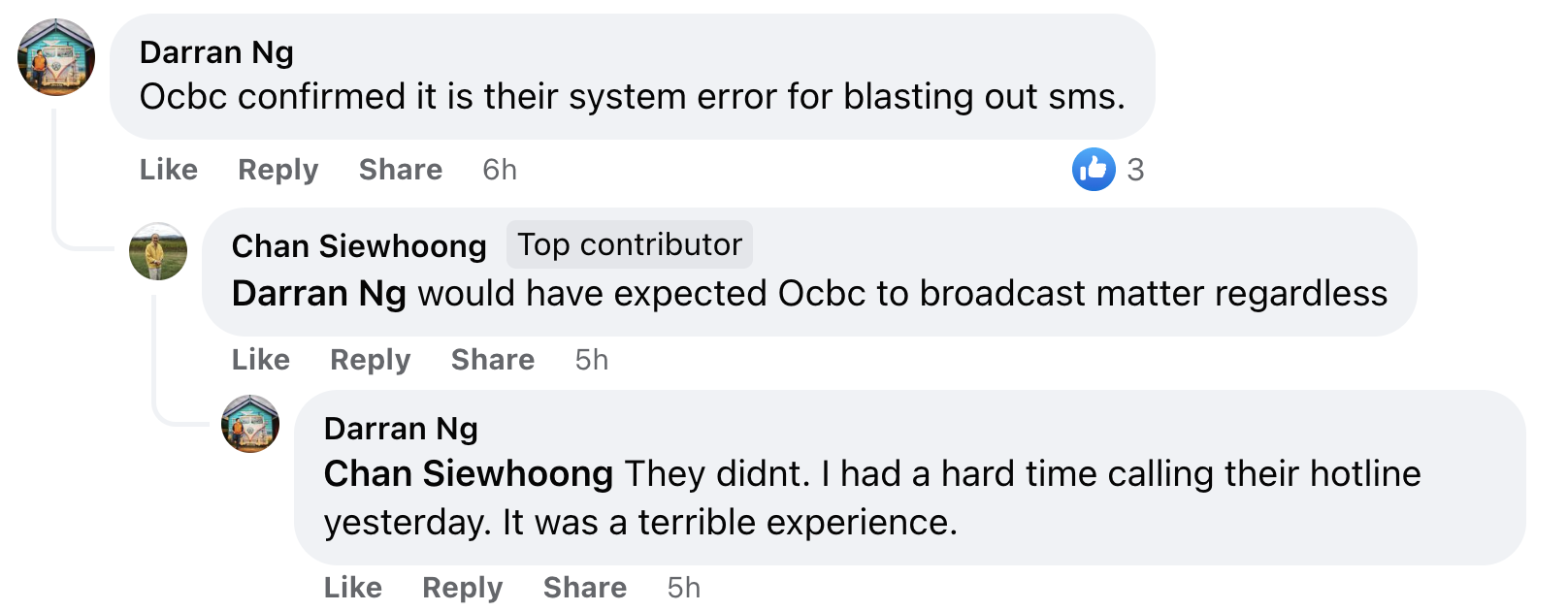

Some netizens commenting on her post said they had received the same message, and some had even called the bank to clarify matters.

Some clarified, however, that OCBC had confirmed that the messages had been sent in error.

This, however, does not address the issue of Ms Jeya getting a message despite not having an account. But this could have been just another mistake.

It does not come as a surprise that Ms Jeya is so wary of scams, as scammers have been known to send fake text alerts to the unsuspecting, and those who have been less than vigilant have lost money because of this type of scheme. /TISG

MAS fines DBS, OCBC, Citibank & Swiss Life a total of S$3.8 million over Wirecard breaches