The revised 12% ABSD for Singaporeans buying their second residential property and the 20% ABSD on foreign buyers dealt the private residential market a one-two punch, said a research report by Savills Singapore.

Although Savills believes that both developers’ and buyers’ resilience would hold out against the latest measures, it said that after five months the market is beginning to develop characteristics that differentiate it from previous cyclical epochs.

“Government measures and the tsunami of collective sales from May 2016 to July 2018 have, in our opinion, been the generating sets of this new topology, which we are only just beginning to get a glimpse of. We believe that some (there are others) of the new market characteristics which have revealed themselves are:

- Developers adopting a 5 July pricing strategy for RCR projects;

- Buying continuing past maiden launch;

- Losing the stepping up of prices at sequential launches.

Given that this is just a residential brief, we will not be showing the full slate of statistics to support the abovementioned characteristics. We will merely summarize what we have quantitatively found from a sample of projects that were launched from 6 July onwards.”

Savills said developers adopting 5 July pricing strategy for RCR residential property projects

Savills said developers adopting 5 July pricing strategy for RCR residential property projects

“Prior to 6 July, our in-house developed model showed that developers were pricing towards the right tail of the price per sq ft (psf) distribution. In two instances, one in Q2/2018 and another on 5 July 2018, new launch prices were closing in or exceeding the second positive standard error.

However, since the measures came into effect, developers have been pricing their new launches around the mean of our model, albeit slightly towards the right of the mean. This was the case for The Tre Ver and Jadescape. For Parc Esta, the average price of S$1,680 psf was slightly to the left of our mean.

The results from the first month of launches for these projects show that if there are no confounding effects, say competition from launches in the vicinity that the subject property cannot clearly differentiate itself from, healthy take-up rates were achieved. Jadescape and Parc Esta achieved 27.1% and 23.5% sales respectively in the first month or first weekend of launch. From the sample of developments that we analyzed, we believe that prices of new launches are generally in line with our mean statistic.

However, this may not imply that prices are flat because many of the recent launches in the RCR tended to take reference from Park Colonial, which not only had over 270 caveats registered on the eve of the cooling measures but was done at prices significantly higher than our model’s mean price.

In short, for subsequent launches in microlocations that had not seen any major new offerings for years, but where the developer was still benchmarking against Park Colonial, prices were still higher against the background sale prices in those micro-locations.

The time needed to allow for this adjustment in new launch prices across the island means that there will continue to be some mild positive momentum to prices for one to two quarters after the cooling measures have taken effect…”

The report also noted that buying continues for residential property past maiden launch weekend

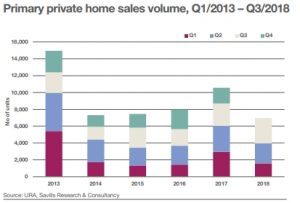

“In the aftermath of the implementation of the TDSR framework in June 2013, not only were sales at the initial weekend launch lower, but the rate of sales slowed to almost negligible in the months after that maiden launch.

This time round, we see continued sales at projects like Riverfront Residences, The Tre Ver, Jadescape, The Affinity at Serangoon, The Tapestry and Stirling Residences. We believe that continuing sales may be indicative of the psychological momentum of buyers.”

Condo buyers seem to be streaming back to the property market

Losing the stepping up of prices at sequential launches of residential property

“This effect was observed not in those Q3/2018 launches but for those done in November. In prior cycles, the norm was for developers to price subsequent launches higher. However, after the July cooling measures, developers appeared to adopt a more cautious stance and moved away from the old practice. We see that at play at Whistler Grand.

Although the median price achieved on the weekend of its launch was almost similar to Twin View’s (a neighboring project) launch price in May 2018, it was nevertheless placed significantly to the left of our model’s mean price. That strategy paid off because the developer managed to sell over 22% of the total number of units in the first weekend of

launch…

Although we believe that the market is still resilient against the backdrop of cooling measures, there are challenges ahead.”

Private residential properties prices increased marginally in Q3, URA statistics

Savills research report said that demand for residential property exists so long as pricing is in line with the attributes of the development and consumer sentiment remains strong. It added that developers will have to price the residential property with greater finesse, taking into account commission rates as well.

“Price undercutting may not generate the required sales levels because the cooling measures have affected the rate of sales, which is not necessarily price sensitive.

For instance, we are finding more HDB dwellers, who hitherto had not considered moving to private properties, now considering that option. However, it takes time, rather than a consideration of how high private residential prices are, for these households to make that decision to sell their HDB flats.

Ultimately, it now comes down to whether developers of large projects have the steely resolve to hold their ground and not give in to the noises generated by those in the negative quarters.”

How to Secure a Home Loan Quickly

Are you planning to upgrade from HDB to private residential property property but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers can help you secure luxury property as we have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for best home loans or to find the best rates for your refinancing needs, our Mortgage brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.