69-year old Michael Toh Thiam Hock took to social media on Friday (September 6) claiming that that he only received S$15 for his monthly payout from the Central Provident Fund (CPF), and griped about having the bulk of his money stored in his MediSave account.

He also said that CPF transferred his money into different accounts without his permission.

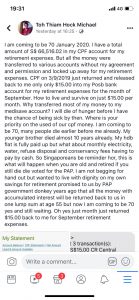

“CPF on 3/9/2019 just returned and released back to me only only $15.00 into my POSB bank account for my retirement expenses for the month of September. How to live and survive on just $15.00 per month.

Why transferred most of my money to my MediSave account? I will die of hunger before I have the chance of being sick by then”, he wrote.

He shared a screenshot of an SMS that allegedly showed his S$15 payout from CPF.

Toh added that he still had conservancy charges and utility bills to pay, and that he was “still waiting” for a lump sum payment “of all the money with accumulated interest” that he should have received at age 55.

Additionally, he alleged, “I have a total amount of S$66,516.02 in my CPF account for my retirement expenses. But all the money were transferred to various accounts without my agreement and permission and locked up away for my retirement expenses.”

To his claims, CPF Board responded with a statement on the evening of Monday (September 9). They wrote that there was “No truth to allegation that most of his CPF funds were transferred to MediSave without authorization. His Retirement Account had already been depleted following monthly payouts to him since 2013”.

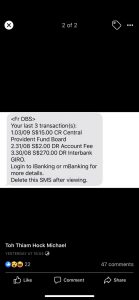

CPF Board’s full statement: Mr Michael Toh Thiam Hock claims that most of his CPF savings had been transferred to MediSave without his authorisation. This is not true. If there were such transfers, it would appear on his CPF statements.

In February 2019, in response to Mr Michael Toh’s allegation that his CPF savings were locked up, we had informed him that although he does not have enough CPF savings to meet his cohort Basic Retirement Sum, he is eligible to make a withdrawal of about $10,000 from his Ordinary Account (OA) and Special Account savings. To date, he has not applied for his lump sum withdrawal.

Like all CPF members, Mr Michael Toh’s CPF contributions are allocated to the Ordinary, MediSave and Special accounts for his housing, healthcare and retirement needs. We note that he has used over $86,000 of his CPF savings to meet these needs. Over $54,000 was used for his flat which is now fully paid up. Mr Toh has also withdrawn over $9,000 from his Retirement Account (RA) since 2013. Although his RA is now depleted, he continues to receive $15 monthly due to the government paying extra interest on his OA savings.

Like all homeowners, Mr Toh may wish to enhance his retirement income through options such as (a) renting out a room, (b) right-sizing his flat, or (c) selling a portion of his flat’s lease back to HDB under the Lease Buyback Scheme. HDB officers are available to guide him through the process.

[No truth to allegation that most of his CPF funds were transferred to MediSave without authorisation. His Retirement…

Posted by CPF Board on Monday, 9 September 2019

/TISG