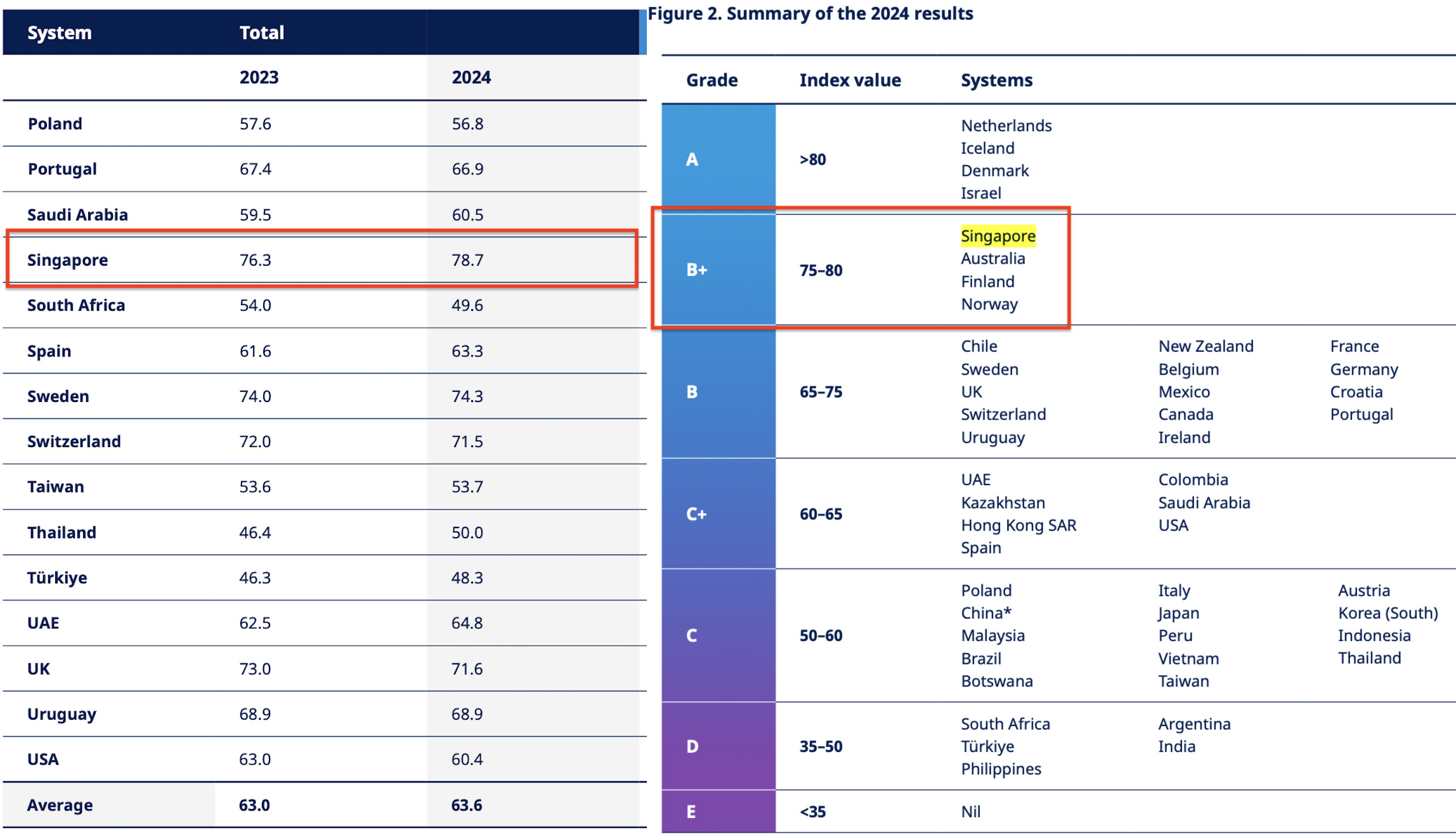

SINGAPORE: Singapore’s Central Provident Fund (CPF) ranked fifth in the world for pension systems, according to the 2024 Mercer CFA Institute Global Pension Index, scoring 78.7 with a B+ grade.

The CPF also scored high in sustainability, achieving a score of 74.3. Sustainability measures whether a pension system can continue supporting retirees long-term.

The CPF plays a central role in helping Singaporeans save for retirement and housing, healthcare, and education.

Through mandatory contributions from employees and employers, it builds a substantial fund supporting citizens throughout their lives.

This approach ensures the CPF provides adequate retirement income, reflected in its adequacy score of 79.8, as reported by Yahoo News.

With an ageing population, this aspect is increasingly important.

In terms of integrity, the CPF ranked high with a score of 83.0. Strong governance and transparency are critical for public trust in any pension system.

This ensures pension providers can reliably deliver retirement benefits over the long term, helping people trust that their savings will be safe and accessible when they retire.

Despite its strengths, Singapore’s pension system faces future challenges. An ageing population means more retirees will increase demands on the CPF over time.

Improving financial literacy and offering continuous public education will be crucial for helping citizens prepare for retirement.

Check the full report on the Mercer Global Pension Index to learn more about Singapore’s CPF and its ranking here./TISG

Read also: Malaysia ranks 8th in best places to retire list; the only Asian country in Top 10