Private home buyers are exercising greater caution in their purchase decisions now said the Chief Executive Officer of Propnex Realty, Mr Ismail Gafoor. 616 units being sold in August outpacing the 534 units launched in the same month, showed that private home buyers remains cautiously upbeat despite sales slump. Data released by the Urban Redevelopment Authority (URA) today showed that excluding executive condominiums (EC), developers sold 616 units in August, which is a drop of 50.6 per cent year-on-year. The new home sales is about half of the 1,246 units sold in the same month in 2017.

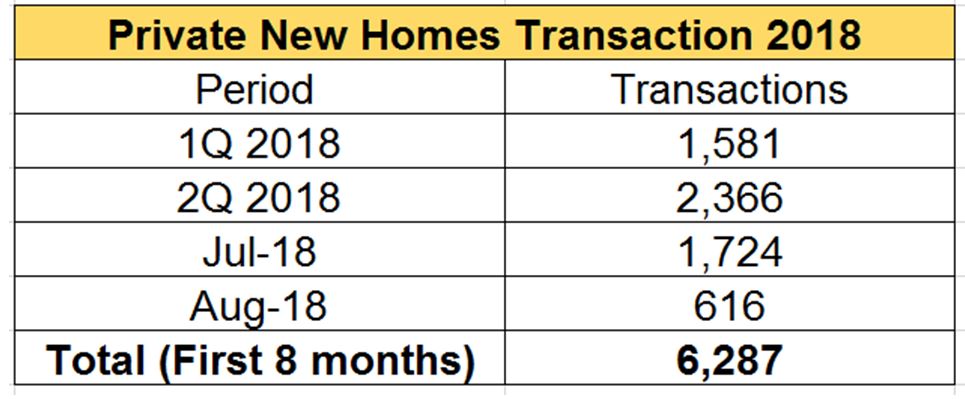

Propnex noted that August recorded the lowest number of transactions (616 units) of private new homes (excluding ECs) in the last six months of 2018.

Noting this data, Chief Executive Officer of PropNex Realty, Mr Ismail Gafoor said:“Buyers are definitely exercising greater caution in their purchase decisions now. It is understandable that August performance is slower as it is the first month right after the cooling measures were implemented, with buyers and investors still trying to understand and ‘digest’ the effects of future pricing.”

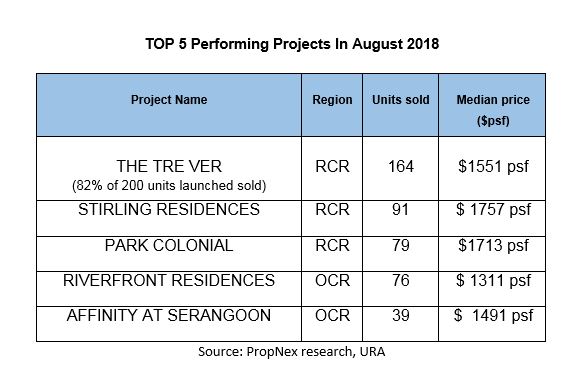

The top 5 performing projects which captured the interest of private home buyers, The Tre Ver, Stirling Residences, Park Colonial, Riverfront Residences and Affinity at Serangoon accounted for 72 per cent of total sales in August.

Mr Ismail highlighted why these projects are moving units despite the cooling measures. “Developers who priced their units sensitively are still able to attract buyers to their development. The success of The Tre Ver moving 82 per cent of units launched in August, post-cooling measures, signals silver linings for rightly priced projects.”

Mr Ismail believes that based on the first eight months performance and the market sentiments, the month of September is set to outperform August.

Private home buyers are expecting new launches such as JadeScape and Mayfair Gardens.

He expects transaction to hit more than 800 units for September 2018. For 3Q 2018, Mr Ismail predicts that sales figures exceed the 3,000 mark and ending the year with overall of 9,000 to 9,500 private new homes being transacted. This would be around 10 per cent lower than 2017’s performance of 10,566 units.

Noting the new private home launches of Mayfair Gardens and JadeScape, PropNex CEO Ismail Gafoor suggested that sales volume will rebound in September. “It is understandable that August performance is slower as it is the first month right after the cooling measures were implemented, with buyers and investors still trying to understand and ‘digest’ the effects of future pricing,” he said. Mr Ismail predicted new home sales to hit more than 800 units next month.

Cushman & Wakefield predicted in July that the new property cooling measure’s impact will only be felt in August 2018. Citing a survey by the Urban Redevelopment Authority which showed that 654 private homes were sold by developers in June, Cushman & Wakefield said new property cooling measure impact will only be felt in August 2018. The survey said that sales of private residential units in June were down 41.7 per cent from May’s sales of 1,122 units.

The real estate services agency noted that new property cooling measure impact will only be seen in August, as sales are hit by a double whammy; market slowdown due to cooling measures and the hungry ghost festival which starts in mid Aug to early Sept, when buyers tend to avoid buying property.

It predicted that August sales could potentially fall by around 40 – 50 per cent from July’s sales as the market adjusts to the new property cooling measure’s impact. Nonetheless, new home sales momentum will largely remain upbeat as market fundamentals remain unchanged, noted Cushman & Wakefield.

Although geopolitical tensions and the new property cooling measure impact have injected some uncertainty into the market, the property market is still positioned for growth, it said. Adding, Singapore’s economic outlook remains firm and Singapore aggregated household balances remain healthy and flush with cash. Furthermore, downside risks remains relatively low due to current new property cooling measure impact and loan curbs. Despite a higher barrier of entry, the value proposition of the Singapore residential sector remains attractive.

Desmond Sim, CBRE’s Head of Research for Singapore & Southeast Asia said: “August new home sales of 616 units points to continued momentum of price quantum-led buying, post the July cooling measures. This momentum has exorcised any fears behind the Hungry Ghost month, as sales take-up outpaced the number of units launched (534 units). The genuine fear could be that of missing out on value deals, on the back of possible rising home prices due to escalating land costs in future launches.”

He added: “Although a function of units launched, this monthly sales volume is still higher than sales in January (527 units) and February (384 units) this year before the measures were introduced. CBRE would like to caution that the high volume of potential new launches injected into the market over the next 12 – 24 months might outpace take-up, resulting in higher unsold inventory, even if this momentum continues.”

How to Secure a Home Loan Quickly

Private home buyers, are you ensure of funds availability for purchase of your property? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.