SINGAPORE: A man who lost nearly S$30,000 to scammers earlier this year took to social media to air his grievances, alleging that his bank failed to keep his account secure.

In a post on the COMPLAINT SINGAPORE Facebook group page on Wednesday (Dec 11), Finton Yeo asked his bank why the money of account holders is “not safe”.

Mr Yeo shared his experience with the bank in light of recent news about a Singaporean couple whose bank cards were blocked after identity thieves called their banks to cancel their cards and block their accounts, citing a lost wallet while they were on a trip to Japan.

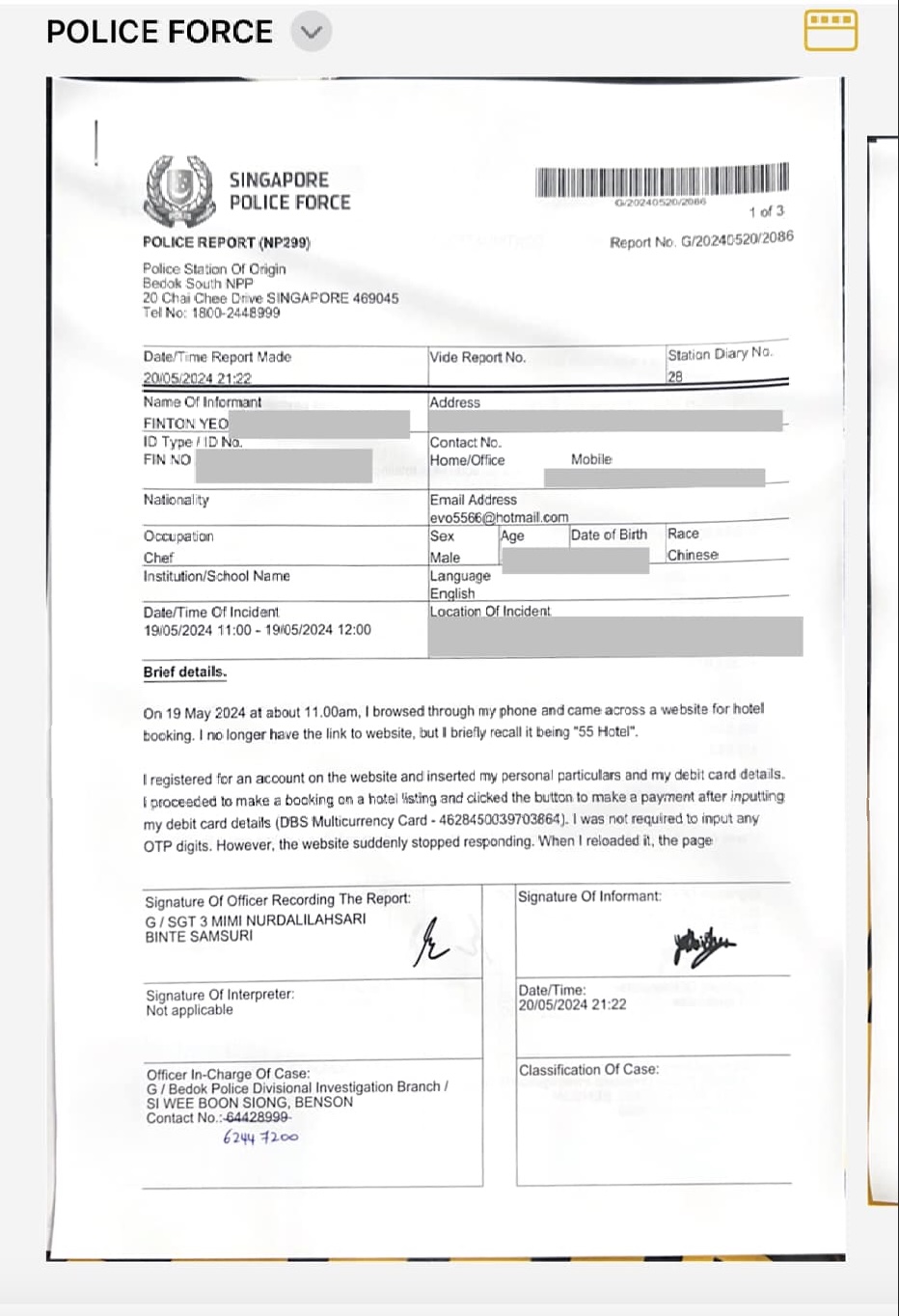

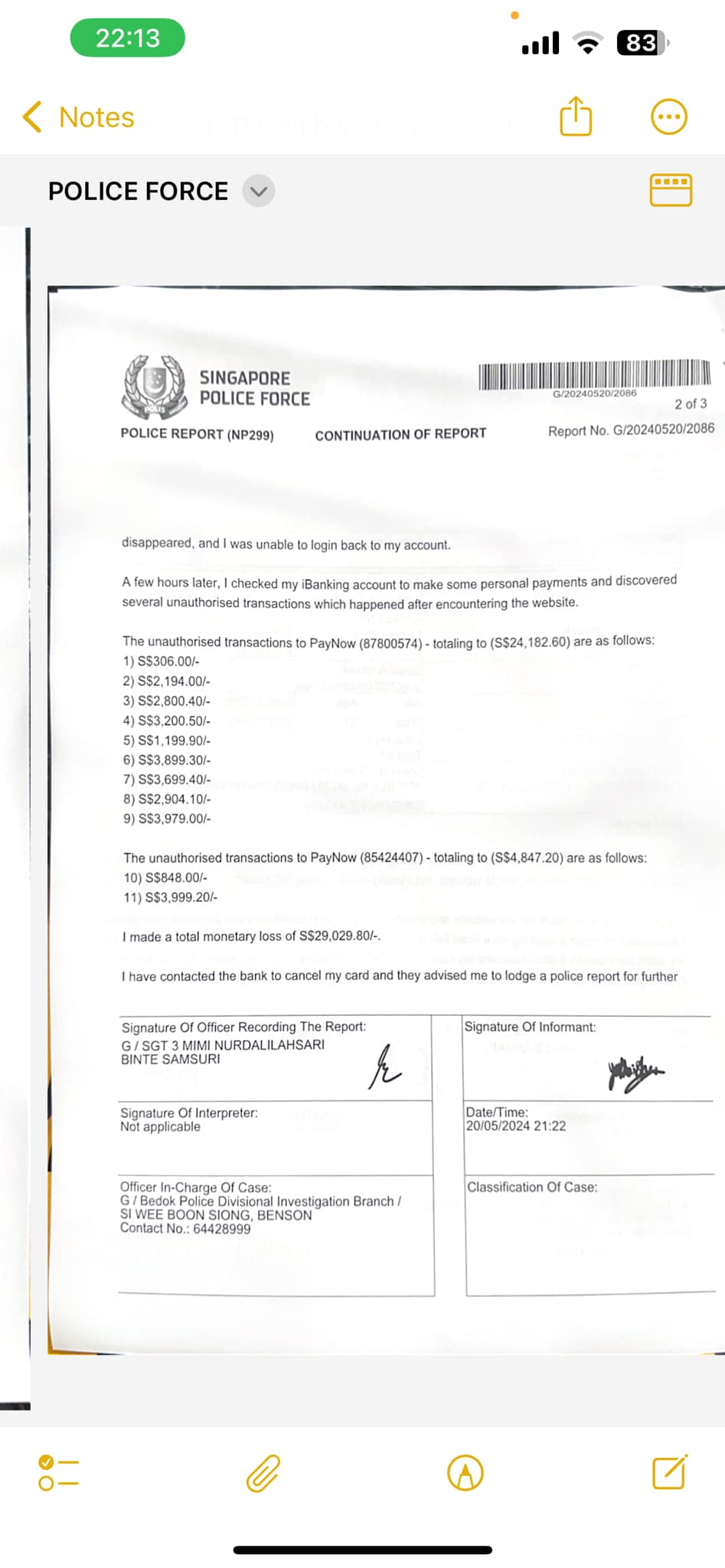

He claimed to have lost S$29,000 from his DBS account earlier this year after he had clicked on a Facebook ad for a website called Hotel 55.

Mr Yeo also wrote that he told both DBS and the police about the incident immediately.

“To me, this is not just money—it’s 2 years of hard work. As a chef working long hours in a 5-star hotel, this amount represents my blood, sweat, and tears. And now, it’s all gone in an instant,” he added.

He also included several questions for the bank, asking, ” Why weren’t there any alerts or checks for such a large and suspicious transaction?”

“How did this happen when I myself can’t transfer large amounts without going through multiple security steps?” he added.

Mr Yeo asked if this is “a weakness in DBS’s system”.

He also wrote that after having trusted the bank to keep his money safe, he no longer feels secure following the incident.

Though money was taken from his account last May, there has been no resolution yet and the bank is still investigating the issue.

“Meanwhile, I’m left with nothing,” he wrote, adding that what happened to him can happen to anyone since clicking on an ad on social media is not a crime.

He also asked whether or not banks should take responsibility for not safeguarding clients’ money.

He attached screenshots of the police report he filed to show that the incident had indeed happened.

“DBS, you must do better. Your customers deserve security and accountability,” he wrote.

The Independent Singapore has reached out to Mr Yeo, as well as to DBS, for further comments or updates. /TISG

Read also: Identity thief sabotages Singapore couple’s Tokyo DisneySea trip by blocking their bank cards