Dear Editor,

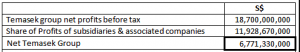

For financial year ended 31 March 2019, Temasek group reported a net profit before tax of S$18.7 billion. A big chunk of the profit came from government owned corporations which were transferred into the Temasek coffers long ago. A few of these GLCs reported record profit for 2018. Take away GLCs’ profit, what do we get?

The net figure is in fact lower as dividends received from the subsidiaries and associated companies have not been isolated.

Profits of subsidiaries & associated companies for y/e 31 Dec 2018 in the above table are as listed below. Several others have not been included as data is not available.

Each year Temasek publishes a very beautiful Annual Report with impressive explanatory notes. They show equally impressive simulation charts. They boast about how they are more transparent than the Santiago Principles.

But all we want are simple accounts to show us Executive compensation and what the company itself actually earns. Temasek hides behind group consolidated accounts, shying away from showing its actual performance, that is, it’s real investment activities outside of the GLCs.

Temasek has pulled wool over our eyes year-in year-out. It has never made those profits that it declared. For example, its 2019 profit is only about S$6.7 billion (probably less). A sizeable chunk of the profit it boasts come from GLCs, some operating with monopolistic advantages, with no effort on the part of Temasek.

We all know the Minister of Finance, as single shareholder, owns Temasek, but does not interfere with its operations. We also know Temasek does not interfere with the operations of its subsidiaries or associated companies. These came from the horses’ mouths. But they take credit for, and reward themselves with compensation based on, overall profits.

The vital statistics they won’t show us are what exactly does Temasek make from the reserves transferred to them from MOF or MAS. What is the 10 or 20 year annualised ROI if the GLC operations are peeled away. Stripped off GLC profit, Temasek’s vital statistics wouldn’t look sexy.

It seems to me the brick and mortar guys in GLCs are relegated to the backgroup while Wall Street types in Temasek scoop all the glory and earn handsome compensation packages without any sweat. And for all the inequity, there is not a squeak from members of parliament. I’m guessing the wool gets pulled over the eyes.

Patrick Low

The views expressed here are those of the author/contributor and do not necessarily represent the views of The Independent Singapore. /TISG