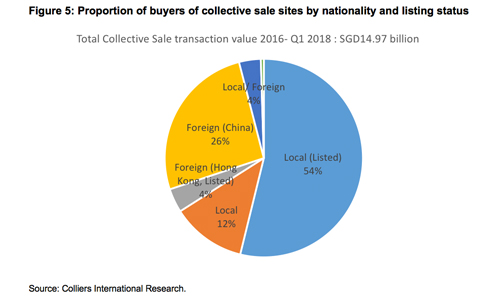

A significant minority of the residential collective sale sites sold in Q1 2018 were acquired by Chinese developers. A press release by Colliers International, a leading global real estate consultancy services firm, said that Chinese developers made up about 26 per cent of acquisitions, whilst 4 per cent were listed in Hong Kong.

The firm expects the residential collective sale market in Singapore to stay active at least for the rest of 2018, paving the way for total transaction values to surpass that of 2017.

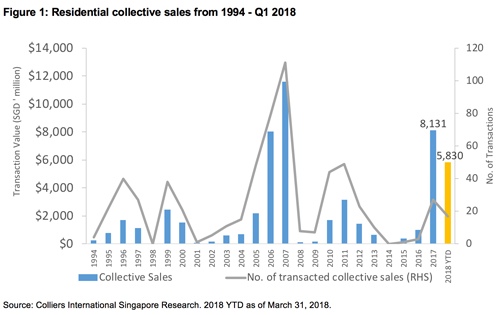

The positive momentum rides on the continued recovery in the property market and brighter economic outlook, amid healthy home sales and rising confidence among developers. In Q1 2018, 17 residential collective sales which amounted to SGD5.83 billion were transacted – up by 29.3% from SGD4.51 billion worth of deals done in Q4 2017. There were no residential collective sale transactions in Q1 2017.

The value of deals brokered in Q1 2018 already accounted for 71.7% of the SGD8.13 billion from 27 residential collective sale transactions in the whole of 2017. With a large pipeline of developments – estimated at 140-150 sites – at varying stages of the sale process Colliers believes this year’s collective sale transactions will trump that of 2017.

Ms. Tang Wei Leng, Managing Director at Colliers International, says, “The collective sale cycle, which started in 2016 and hit fever pitch last year, does not appear to be losing steam anytime soon. Brisk collective sale activity in Q1 as well as the premiums paid on land price by developers for some sites signaled that there is still a healthy appetite for well-located developments. However, given the deluge of sites on the market, we think the balance has tilted in favour of developers, who are likely to cherry-pick the best sites and/or those that are realistically priced.”

From January 2016 to Q1 2018, there were 47 residential collective sales valued at SGD14.97 billion, fiwhich represented 68.7% of the SGD21.8 billion in deals done in the previous collective sale cycle in 2005-2007.

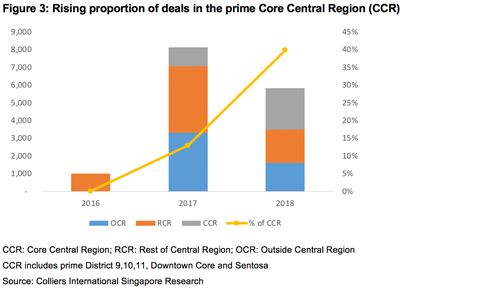

Collective sale market: A shift from suburban to prime sites

Notably, eight sites worth SGD2.32 billion in the prime Core Central Region (mainly Districts 9 and 10) were sold via collective sale in Q1 2018 alone, compared with the eight worth SGD1.05 billion transacted in the entire 2017. The proportion, by value, has jumped to 40% compared to just 13% in 2017. Colliers expects sites in the prime areas to continue to find favour among developers in tandem with sales and price recovery in the high-end residential segment.

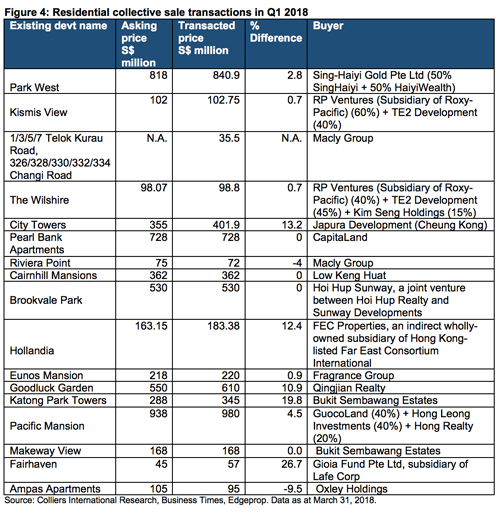

According to Colliers’ research, the top three collective sale deals by value transacted in Q1 2018 were: Pacific Mansion in River Valley at SGD980 million – also the largest since 2007’s Farrer Court; Park West in Clementi at SGD840.9 million; and Pearl Bank Apartments in Outram at SGD728 million.

Ms. Tang adds, “We believe larger sites will continue to appeal to developers. Bigger plots allow for more functional facilities and lavish landscaping, a luxury many smallish projects in prime locations are unable to offer. Young families, local and expatriate, increasingly appreciate more sizeable and spacious residential developments that offer recreational as well as social areas where residents can mingle and build bonds, complementing the modern efficient housing formats.”

En bloc law needs amendment to prevent triumph of majoritarianism?

Of the 17 successful deals in Q1, 10 were done at 0.7-26.7% premium over the owners’ asking prices. The development that recorded the highest premium during the quarter was Fairhaven at Sophia Road which was sold in March to a subsidiary of Singapore-listed Lafe Corp for SGD57 million – 26.7% over the asking price of SGD45 million. For larger deals, Katong Park Towers was sold in March to Bukit Sembawang Estates for SGD345 million – 19.8% over the asking price. Four other deals – Pearl Bank Apartments, Cairnhill Mansions, Brookvale Park and Makeway View – met the owners’ asking price, while Riveria Point was sold for SGD72 million, slightly below the asking price of SGD75 million. Ampas Apartments was eventually sold, nine weeks after its tender close in January, at SGD95 million, 9.5% below its asking price of SGD105 million.

Ms Tricia Song, Head of Research for Singapore at Colliers International, says, “While premiums appeared to have weakened, from an average of 10.5% in 2017 to 4.9% in Q1 2018, it does not mean that the collective sale market is starting to cool. We think this could have been due to higher indicative prices, higher development charges and more selective bidding by developers. Attractive sites with realistic asking price still find ample bidding interest such as Katong Park Towers which saw 10 bids and a top bid of 20% premium.”

Majority of the residential collective sale sites sold in Q1 2018 were acquired by local developers, reflecting their positive long-term outlook on the Singapore property market – which is in the midst of a multi-year upturn – following higher demand for homes and the modest growth in private residential prices last year.

Developers are selective about collective sale sites

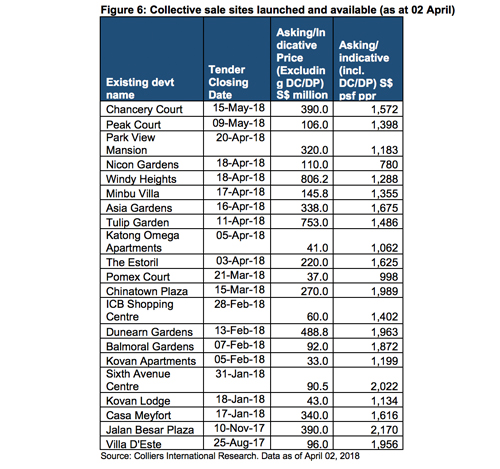

Amid a slew of private redevelopment sites sold since 2016, 11 sites have yet to find buyers since their respective tender closed. Based on data tracked by Colliers International Research, mixed commercial and residential sites appear to be less popular, as are those in areas with large impending housing supply from recent Government land tenders and/or the collective sale market.

In certain cases, developers may have needed more time to assess the redevelopment potential and pricing of sites beyond the close of tender. In Q1 2018, six sites were sold via private treaty after the tender period lapsed. These were: Cairnhill Mansion, Riviera Point, Pearlbank Apartments, Brookvale Park, Makeway View and Ampas Apartments. According to laws governing collective sales, the owners may enter into a private treaty contract with a buyer within 10 weeks from the close of the public tender.

Speed to market and a realistic asking price are crucial as sites launched in high-supply areas coupled with higher selling prices find themselves out cold. For example, Kovan Apartments and Kovan Lodge could be less appealing to developers in view of the impending new supply from a handful of sites in the vicinity – Serangoon North Avenue 1 from Government land tender, and three collective sale sites: Serangoon Ville, Rio Casa and Florence Regency. The same could be said of Casa Meyfort in Marine Parade which had a string of collective sale transactions last year, namely The Albracca, Nanak Mansions, Amber Park and Parkway Mansion.

Collective sale 2018 outlook

At the current pace of transaction and sizeable pipeline of redevelopment sites, Colliers expects the collective sale market to outperform 2017, barring unforeseen events. The positive outlook is further supported by broadening economic growth, pent-up demand for homes, and developers’ push to replenish their land banks amid depleting inventory.

En bloc law needs amendment to prevent triumph of majoritarianism?

Ms. Tang notes, “Based on our observations, there is growing interest in development sites in Singapore among many Hong Kong and Chinese developers who could be more active in the collective sale market this year. In addition, Singapore developers are also sharpening their pencils and bidding smartly against the foreign competitor. This collective sale cycle still has legs.”

Since September 2017, Colliers International has successfully brokered four residential collective sale deals valued at more than SGD1.3 billion: Jervois Gardens, Parkway Mansion, City Towers and Pearlbank Apartments. It is currently marketing Tulip Garden in prime District 10 in a collective sale tender that will close on April 11 at 3 pm.