SINGAPORE: After receiving a phone call that aroused her suspicion, a woman took to social media to warn the public about scammers some may find very convincing, especially since they speak with a Singaporean accent.

People who perpetuate scams have become increasingly more clever over the years, and a report from October 2023 showed that S$1.4 trillion is lost annually around the globe through scams, with one out of every four persons getting victimized. Victims in Singapore have lost the most money on average, around S$5,533.10 per victim.

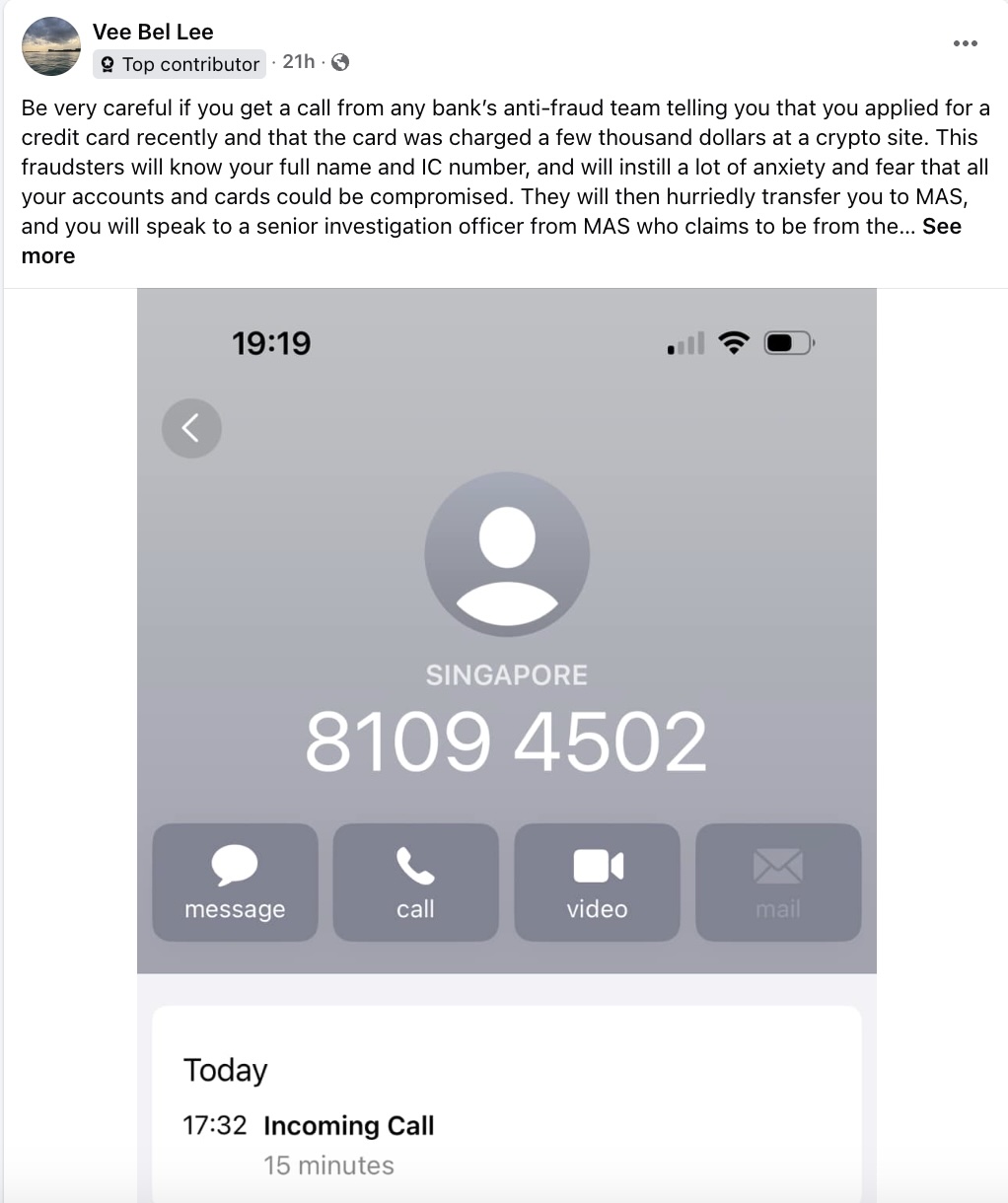

In a Jan 9 (Thursday) post on the COMPLAINT SINGAPORE Facebook page, Vee Bel Lee warned others to “be very careful” when receiving a call purportedly from the anti-fraud team of a bank. The callers claim the person they are calling applied for a credit card, which was then charged a few thousand dollars at a site for cryptocurrency. According to Ms Lee, the callers know the full names and identity card (IC) numbers of the people they call.

Ms Vee added that the MO of these fraudsters is to “instil a lot of anxiety and fear” by telling the people they call that their accounts and cards have been compromised. As a further step to prove that they are legitimate bank officers, the callers then transfer the call to purported employees of the Monetary Authority of Singapore (MAS), the city-state’s central bank.

A “senior investigation officer from MAS who claims to be from the CAD (Commercial Affairs Department)” then comes on the phone to help the person on the line file a police report, adding that while they can do so on their own, to do so would require a 45-minute wait while MAS files a police report first. Those who express disbelief are then urged to go to the MAS office at Shenton Way.

“These scammers speak with a very Singaporean accent, very local. No hint of a foreign accent at all. You can be very easily convinced especially when they know your IC and full name,” the post author wrote.

She also posted several red flags and warnings that Singaporeans can take note of, which she got after she spoke to the real anti-fraud team of HSBC. First, bank officers do not need to transfer calls to the MAS, and never do so. Next, the CAD is part of the police, not MAS. Third, those who receive such calls should never reveal their credit card numbers even when asked to do so, and finally, the public is never told to wait 45 minutes or any amount of time to file a police report. In contrast, reports should be made as soon as possible. Neither does MAS offer to help people file police reports, Ms Vee added.

Read also: Singaporeans Hit Hardest by Global Scams, Losing Over US$4,000 Per Victim