SINGAPORE: Homebuyers looking at Plus and Prime flats, launched on Oct 16, will face a subsidy clawback rate from 6 to 9 per cent.

This is the percentage of the flat’s selling price that owners must return to the Housing and Development Board (HDB) when they sell after the 10-year minimum occupation period (MOP).

With the recent launch of over 8,000 flats across 15 projects, including seven Plus, one Prime, and seven Standard, many wonder what this means for resale prices and future profits.

Singaporean technopreneur and 1M65 movement founder Loo Cheng Chuan shared his insights on how buyers could still profit from these flats.

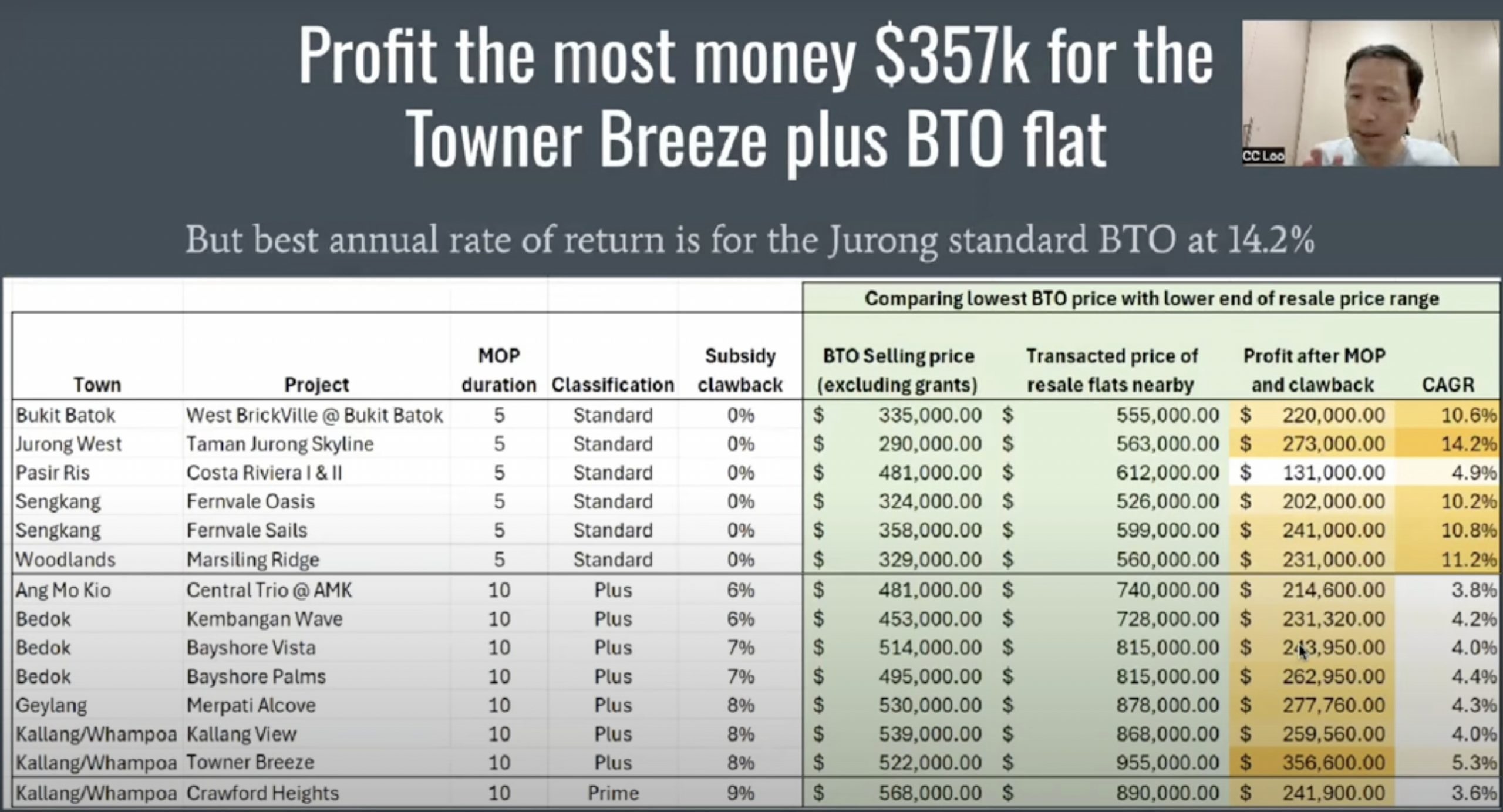

Using 4-room flats as an example, Mr Loo explained how the clawback affects profits depending on where the flats are located.

In his analysis, Mr Loo explained two strategies for buying and selling: “buying cheap and selling cheap” or “buying expensive and selling expensive.”

For Standard flats, after the 5-year MOP, with no subsidy clawback, buyers generally receive over S$200,000 in return.

Meanwhile, if a buyer purchased a Prime flat at Crawford Heights for around S$568,000, they could potentially sell it for about S$890,000 after the 10-year MOP, even without any market appreciation.

This would leave the owner with a profit of over S$200,000. The same goes for Plus flats.

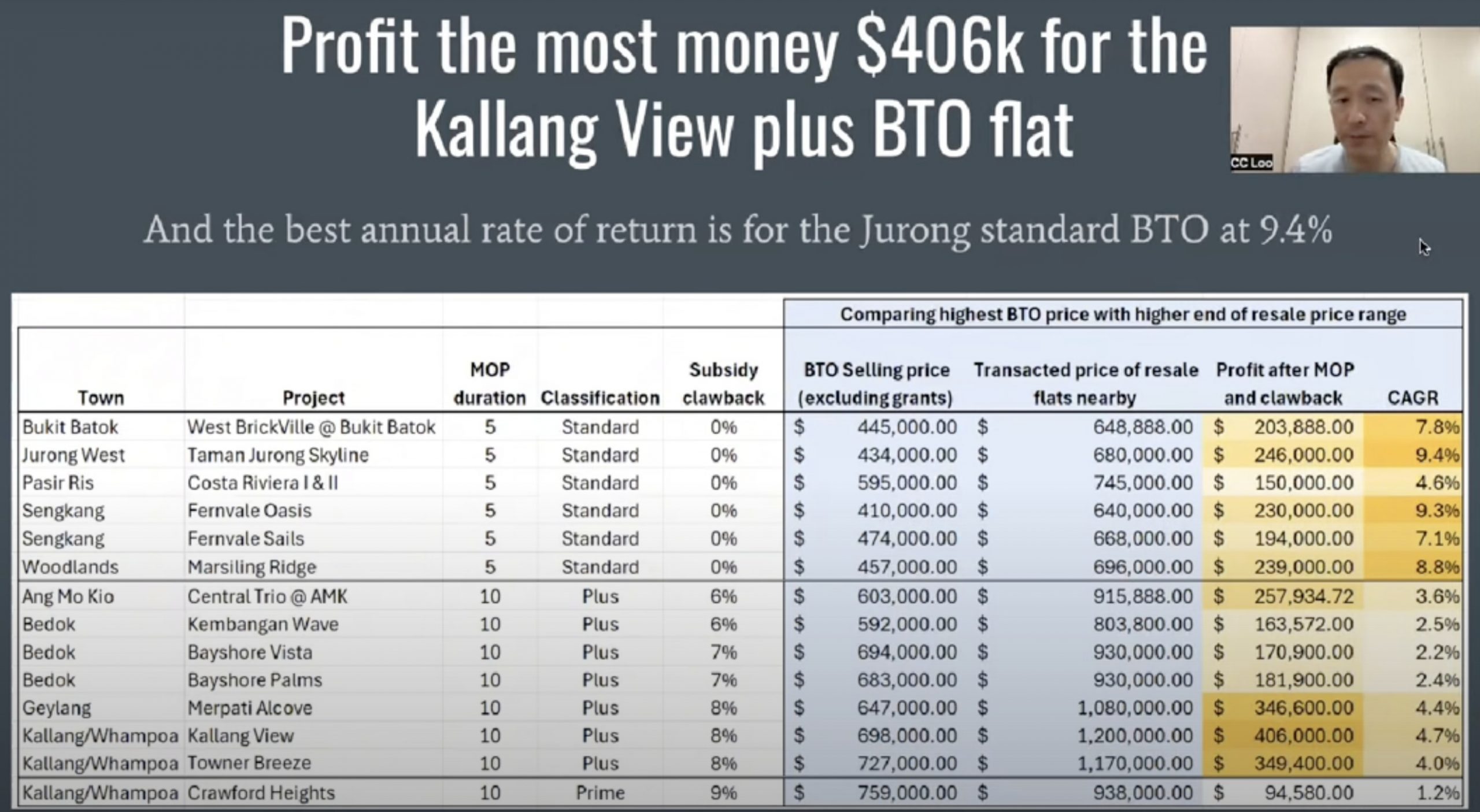

How about when buying expensive and selling expensive? “This is where the story paints a very different picture,” said Mr Loo.

Although buyers can still gain returns of around S$200,000 for Standard flats in most locations, buying an expensive Prime flat at S$759,000, which could be resold for S$938,000, would result in a profit below S$100,000.

Meanwhile, Plus flats are bringing big returns of up to S$406,000.

While this strategy can still yield a profit, Mr Loo stressed that location plays a significant role, as prices can vary greatly depending on the area.

“It doesn’t mean Prime is good, and it doesn’t mean Standard is bad… It’s very important where you choose your house,” said Mr Loo.

He added, “I think it’s important that we pick the good location that has, at the current state right now, the biggest spread between the BTO price and the transaction prices of nearby flats.”

However, he noted this isn’t an easy judgement call.

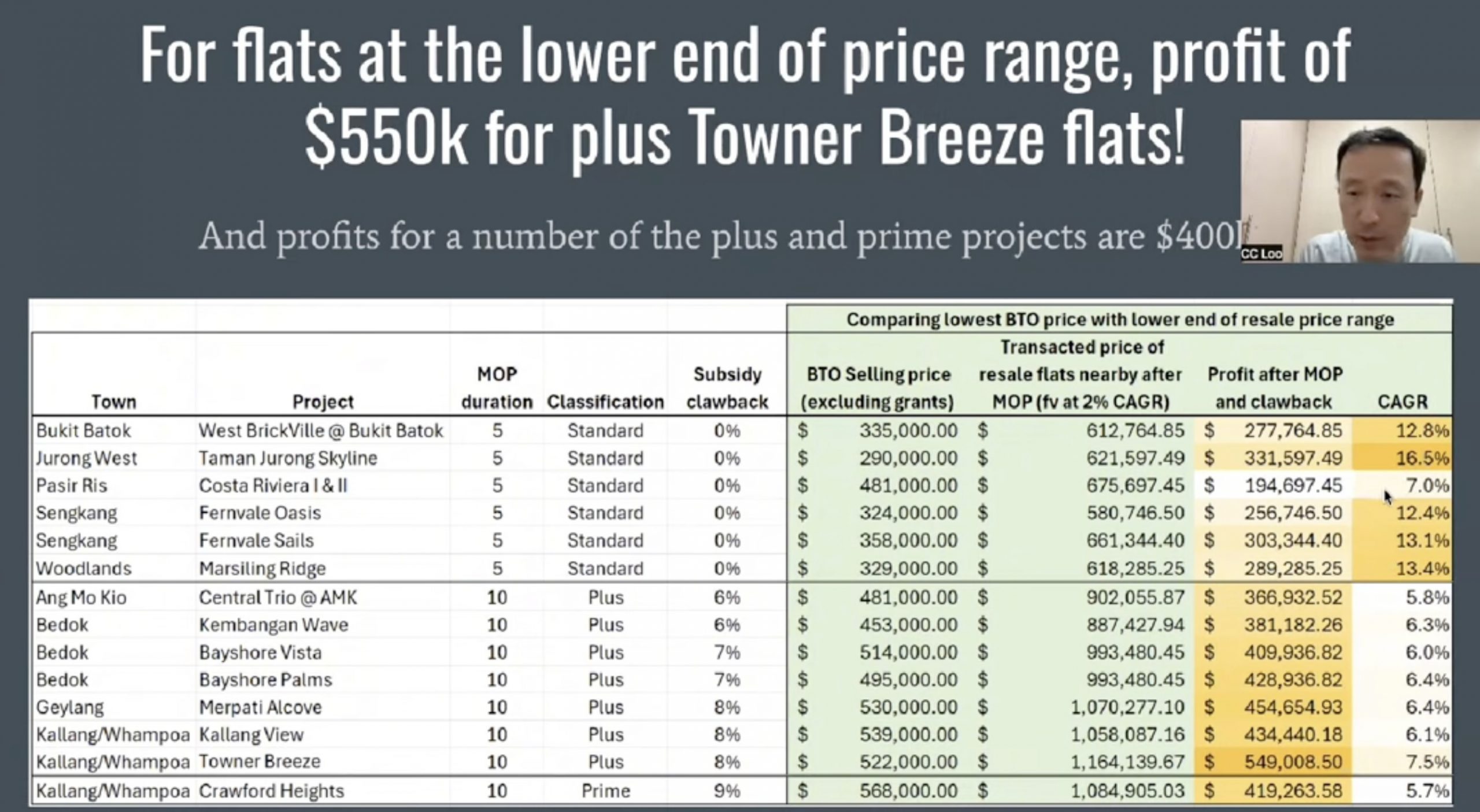

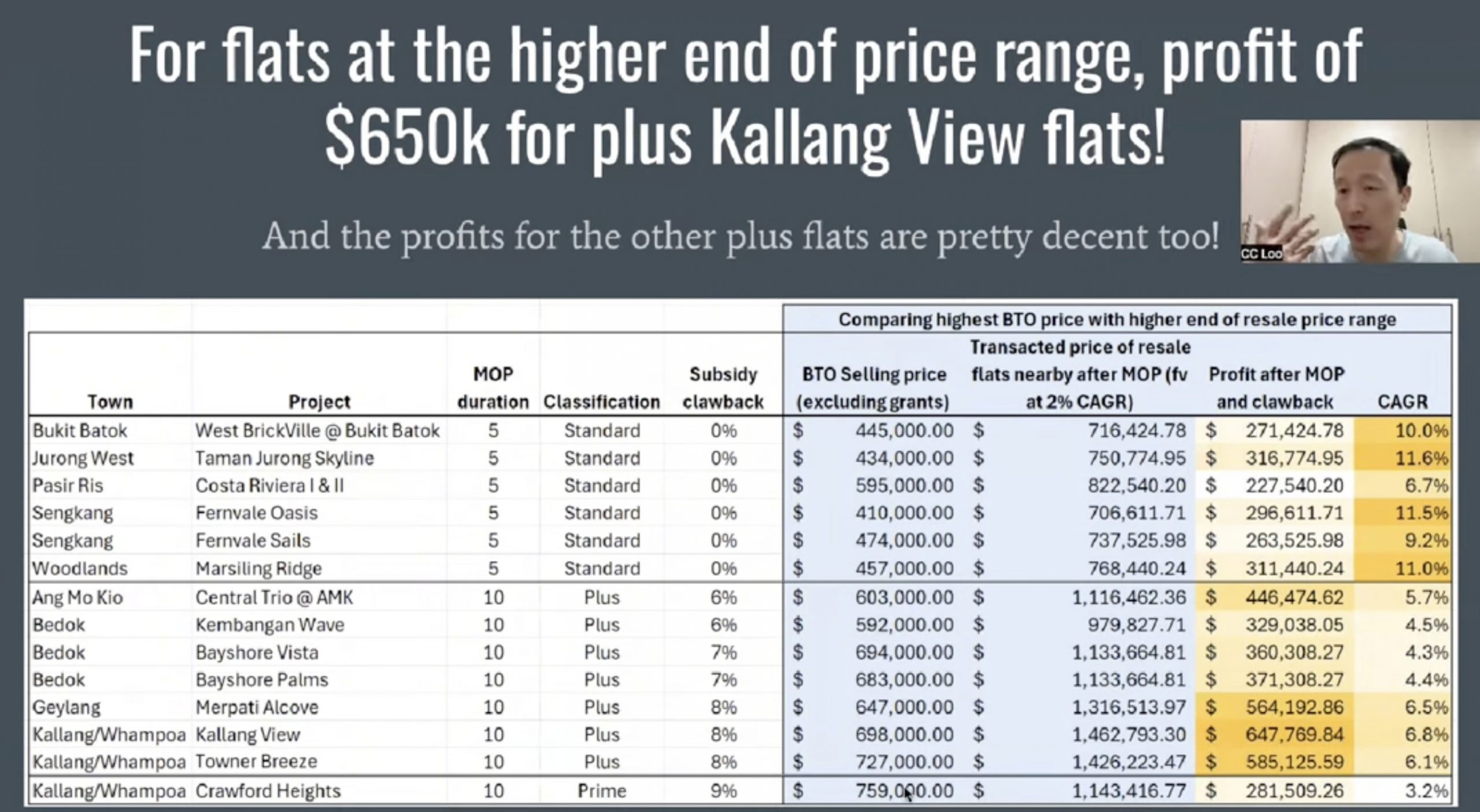

Pointing out that between Q3 2014 and Q3 2024, HDB flats have seen an average growth rate of around 3.3% per year, Mr Loo also considered how a conservative assumption of a 2% annual growth rate could impact the housing market.

When you “buy cheap and sell cheap,” buyers of Standard flats priced between S$300,000 and S$400,000 could see profits of S$200,000 to S$300,000 after five years.

This would give a solid annual growth rate of up to 16%.

Even with a lower 2% growth rate, Plus flats could still provide decent returns, with potential profits of S$300,000 to S$500,000. Prime flats in Kallang/Whampoa could also see potential profits of over S$400,000.

However, with “buying expensive and selling expensive,” while Standard flats offer decent returns and Plus flats offer returns between S$300,000 to S$600,000, Prime flats tend to yield lesser returns.

Because of the higher clawback and restrictions like income limits for buyers, the returns might not be as high.

According to HDB’s released statement on Oct 9, families buying Prime flats must earn S$14,000 below, while singles must earn S$7,000 or less to be eligible.

On top of that, private property owners must wait 30 months before buying a Prime or Plus flat, compared to just 15 months for Standard resale flats.

Mr Loo advised, “If you want more profit, buying Plus flats seems to be a better choice. But if you want fast, quick money at a high CAGR, then Standard flats are the way to go.”

However, he noted that nobody really knows the future transaction prices.

Channel News Asia reported that Christine Sun, chief researcher and strategist at OrangeTee Group, said that the long-term trend of resale prices is uncertain, as the impact of the new classification system remains unknown.

She explained that since price growth is closely tied to market activity, areas with standard flats could experience faster price increases as these flats are put up in the market at a faster pace.

Mr Loo said, “I would take the assumption that the impact on the resale flats may not be that high but I would certainly consider Plus flats versus Standard flats more.”

He advised, “If you are just simply looking at capital gains if you want quick money, it’s not bad to take a look at Standard flats.”

“If you want big money, (there) may not be faster growth, and you’re willing to wait for it; I think the Plus flats are not bad and also try not to be a ‘cheapo’ and pick the cheap ones.

Be daring to pick the more expensive ones; of course, it holds the assumption that demand will not be affected in future,” he added. /TISG

Featured image by Depositphotos (for illustration purposes only)