Lately, there have been quite a few shake-ups in the rewards structures for credit cards across the market. Issuers like UOB, Citi and more have adopted new programmes and policies that have seemingly boosted value for consumers. In fact, CIMB itself just finished overhauling its World MasterCard, improving benefits for affluent cardholders (especially those who love golf and entertainment). However, the dust has yet to settle. As of June 2019, CIMB’s Visa Signature and Platinum MasterCards will change dramatically–do you stand to benefit?

Changes Will Reward Balanced Spenders with Higher Budgets

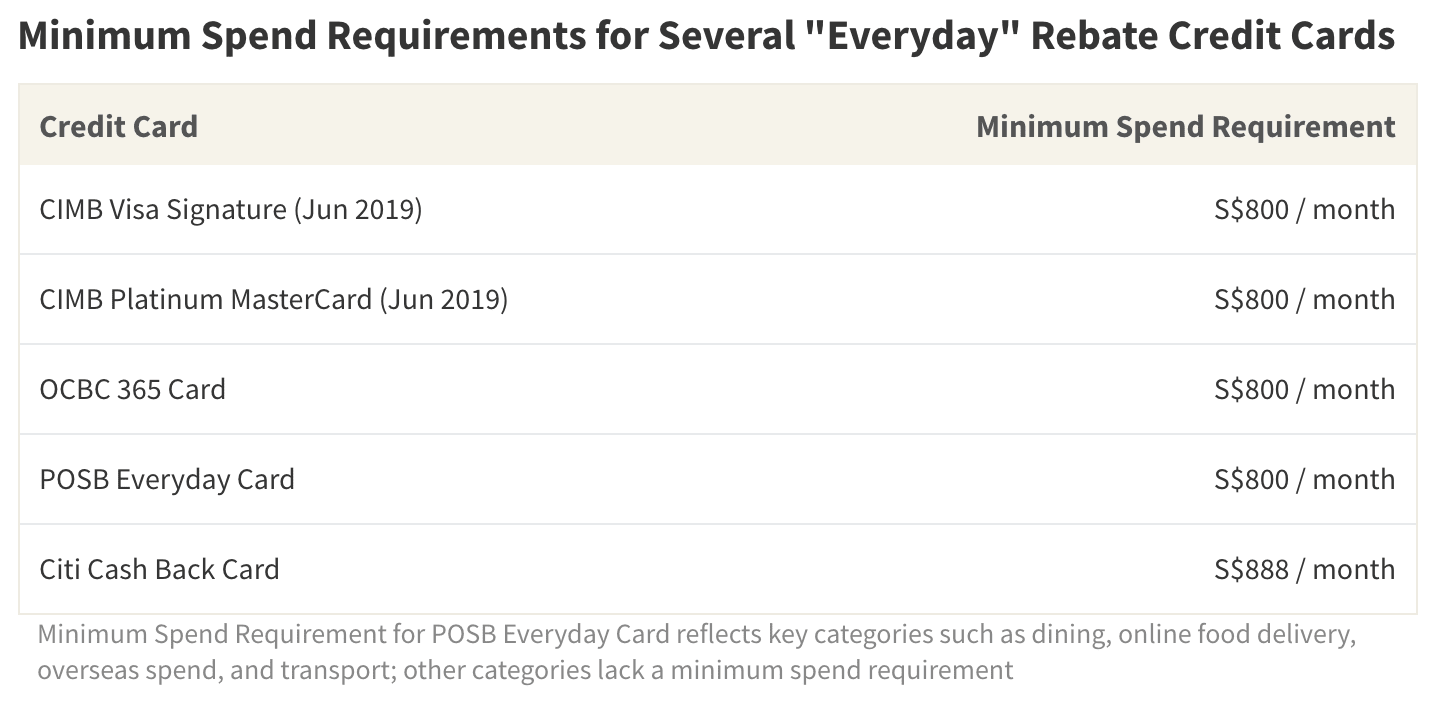

If you have either of the soon-to-be affected credit cards, you’ll immediately notice a few changes. First of all, the minimum spend requirement (or, amount you’ll need to spend to earn top cashback rates) is set to increase from S$600/month to S$800/month. If you want to earn at 10%–the advertised rebate rate–you’ll need to spend S$200 more per month, which will expand your budget by +S$2,400/year. An S$800 minimum spend requirement is more in-line with the market standard, however, so your CIMB card will remain competitive to this extent.

Another change is how your rewards earnings will be capped. Currently, total monthly cashback is capped at S$100–this remains constant. However, cashback cap per category will change. Right now, you can earn up to S$50 rebate in a given category, like dining; this means you can benefit even if you’re a highly focused spender. After the changes, however, you will only be able to earn up to S$20 per category. This may limit focused spenders, though people who have well-rounded spending habits are less likely to be impacted. The following sections focus on category changes to each CIMB credit card.

CIMB Visa Signature: Once for Modern Foodies, Now for Pet-Owning Self-Pamperers

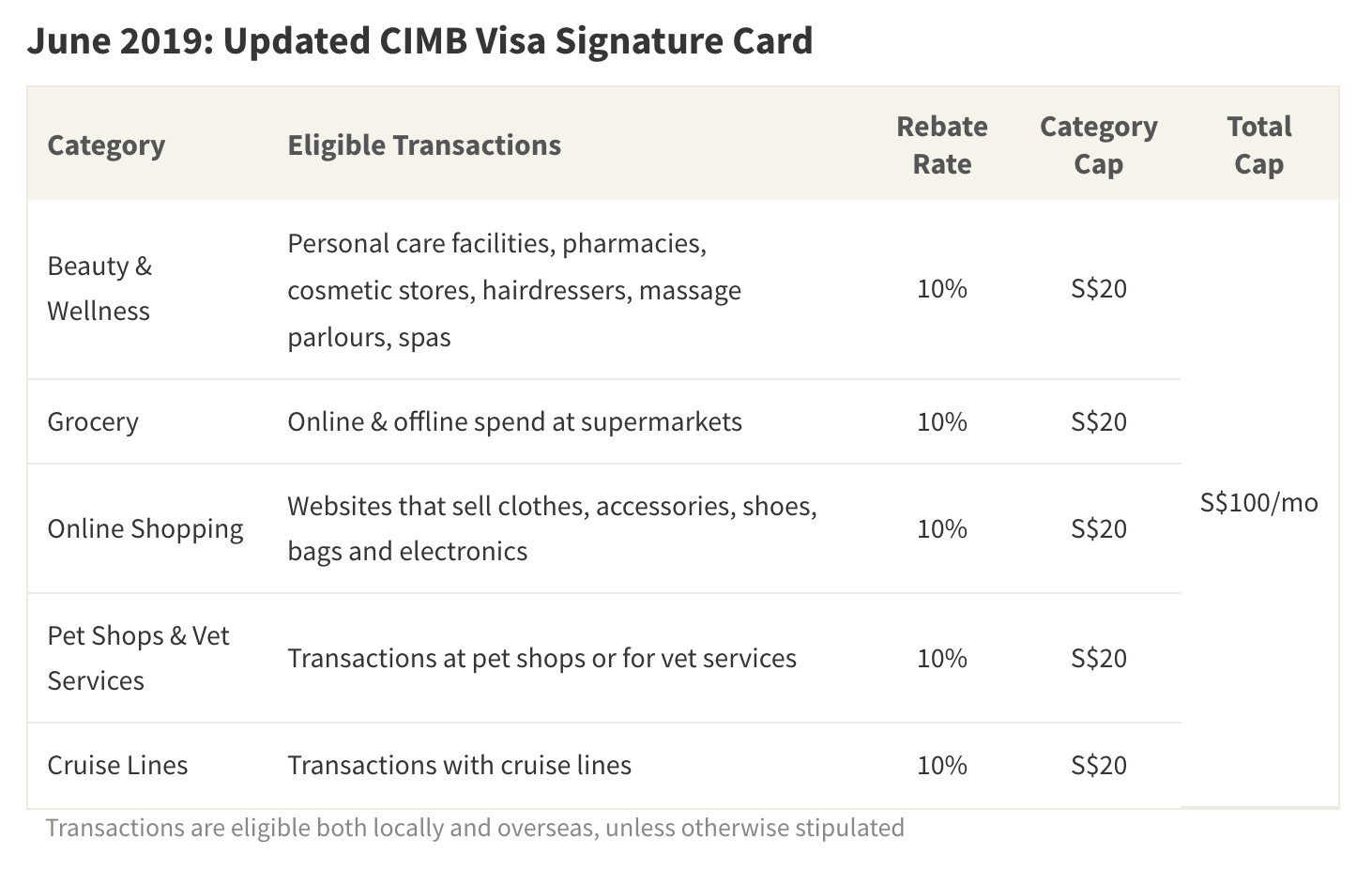

CIMB Visa Signature Card is currently one of the best no-fee cashback credit cards on the market. As of right now, cardholders earn 10% rebates on dining, groceries, and online spend both locally and overseas–perfect for foodies who make most of their purchases online. As of June, however, these categories will change. Cardholders will earn across 5 categories, retaining only 1 of the previous: groceries. The other categories will include beauty/wellness, pet shops, spend on cruises, and online shopping. To be clear, this new “online” category refers only to online purchases of shoes, apparel, and accessories, and excludes online travel bookings, ticket purchases, and food or beverage purchases.

As you might be able to see, this new rewards structure caters to a very different kind of consumer. CIMB Visa Signature Card will now become one of the best cashback credit cards for pet owners. With almost all other rebate cards, you would earn just a base rate of 0.2%–1.5% on pet food or veterinary services–after the update, this card will provide up to 50x that amount! Another group that will benefit are people who enjoy indulgence and pampering; those who enjoy shopping, beauty treatments and cruise vacations will accrue cashback far more quickly than before. However, those who enjoy dining out or who make non-retail purchases online may want to look elsewhere for these benefits. Citi Cash Back Card, for example, offers 8% cashback on dining and groceries worldwide; HSBC Revolution Card offers 2 miles per S$1 spend on both local dining and all online purchases (including travel bookings and bill-pay).

CIMB Platinum MasterCard: Once for Fun Indulgers, Now for Practical Socialites

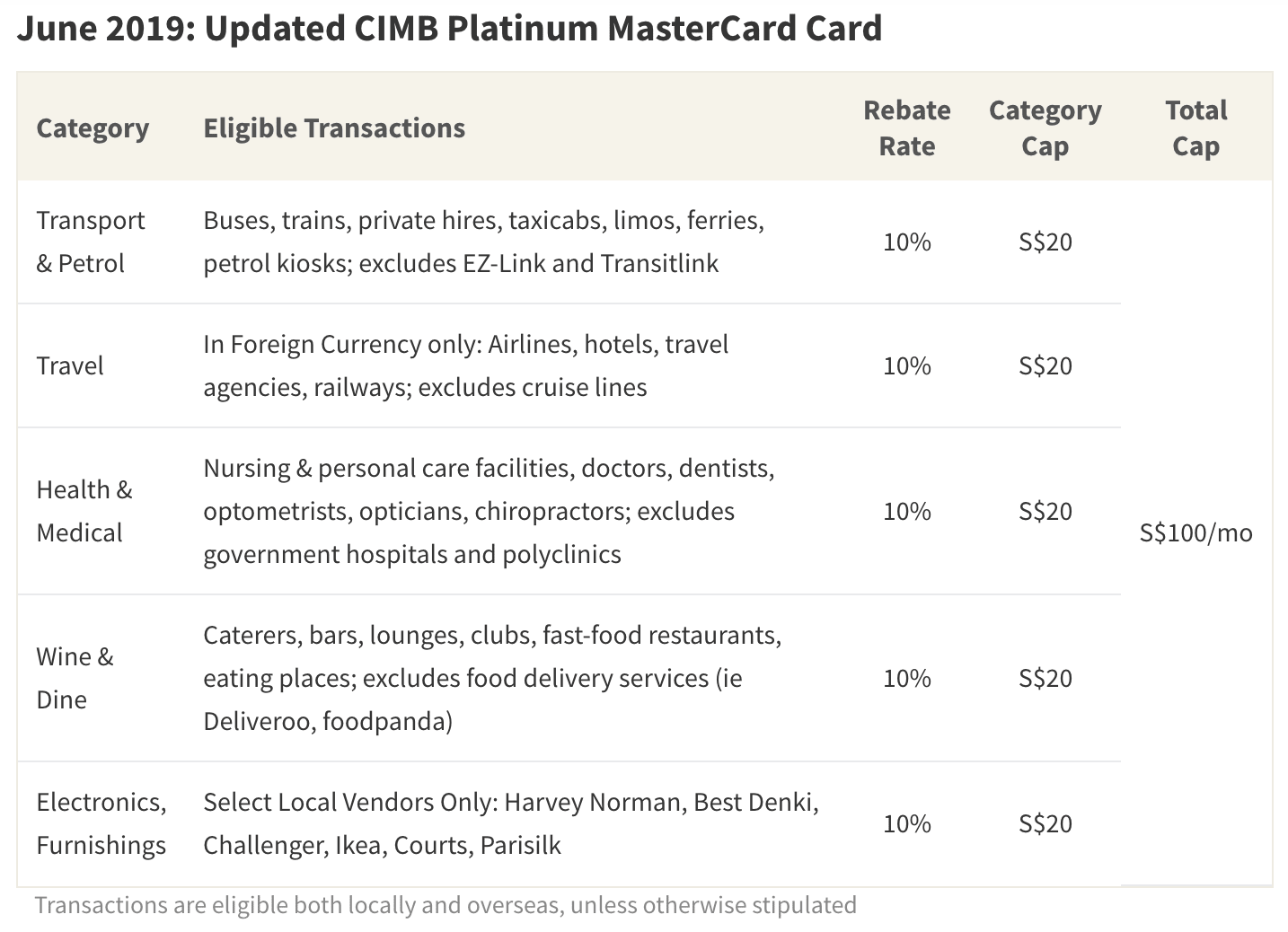

The second CIMB credit card set for an update is CIMB Platinum MasterCard. Previously, this card offered 10% cashback on all travel and overseas expenses, transport and petrol, as well as beauty/wellness/health. The upcoming update will broaden eligible categories dramatically, as demonstrated in the table below:

Unlike with CIMB Visa Signature Card, most of CIMB Platinum MasterCard’s categories will remain intact. Cardholders will still earn cashback on transport and petrol as well as on travel–though it’s worth pointing out that travel will now be limited to spend with airlines, hotels, travel agencies and railways in foreign currency only; cruises will also be excluded. Wellness will also still earn rewards, but only for medical expenses. Beauty treatments are no longer included in this category; it seems they’ve been shifted to CIMB Visa Signature’s rewards scheme.

What’s most exciting is the addition of a “Wine and Dine” category, which essentially covers all dining and some entertainment expenses. Again, there seems to be a shuffling of benefits, as this category is currently part of CIMB Visa Signature, but will soon be stripped. A tad less exciting–but useful for functional types–is an added rewards category for electronics and furnishings at select merchants. Overall, this card has taken a turn, appealing to both social individuals as well as to practical folks seeking rewards for functional expenses.

Some Categories Lost or Altered, But Others Added to Boost Variety

Overall, the upcoming changes to CIMB Visa Signature and Platinum MasterCard aren’t necessarily “good” or “bad”–while some categories have been sacrificed or shifted to another credit card, others have been added to offer greater variety. Those who stand to benefit most are people with broad spending habits, and with a slightly larger budget. Nonetheless, CIMB credit cards still stand out for never charging an annual fee–so regardless of your spending behavior, having a “free” card is an excellent, low-risk way to build your credit score.

The article Have a CIMB Credit Card? Here’s How Your Benefits Are Changing Next Month originally appeared on ValueChampion’s blog.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Source: VP