SINGAPORE: State-owned Temasek has denied a May 1 (Monday) report that it invested US$10 million (S$13.34 million) in Array, a company described as a “developer of the algorithmic currency system based on smart contracts and artificial intelligence”.

Temasek issued a statement denying the “fake news” on May 2. It stated that it had seen a tweet and news articles about the alleged investment and clarified that the news was incorrect.

“Temasek has not invested in Array and we have no relationship with them,” the company added in a notice posted on its website.

A May 1 tweet from cointelegraph.com says, “Singapore’s Temasek is still bullish on the crypto industry despite losing $275 million to FTX”, and provides a link to an article with the headline, “FTX investor Temasek pours $10M into algorithmic currency system Array.”

Clicking the link, however, leads to the amended headline: “Temasek denies $10M investment in algorithmic currency system Array.” The article explains that it had been updated after Temasek issued its statement.

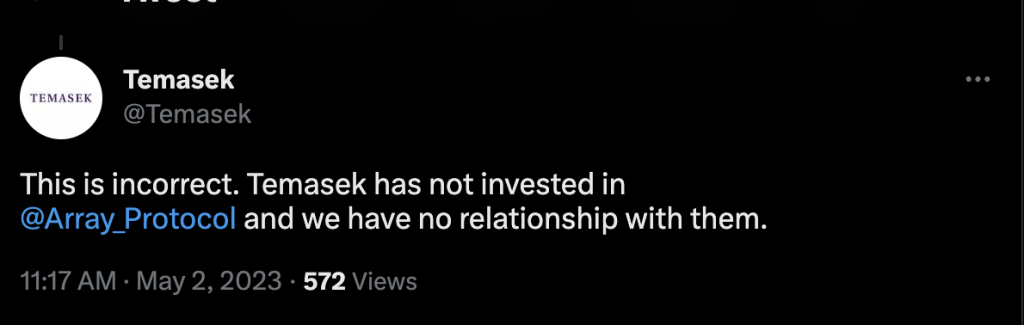

Temasek responded to cointelegraph.com’s tweet, saying, “This is incorrect. Temasek has not invested in @Array_Protocol and we have no relationship with them.”

It also tweeted the following message:

Temasek had invested in crypto exchange company FTX, which filed for bankruptcy in the US on Nov 11, 2022.

By Nov 17, Temasek Holdings issued a statement saying it would write down its investment in FTX worth US$275 million (S$377 million) regardless of the firm’s bankruptcy protection filing outcome.

To write down an asset is to reduce its value for tax and accounting purposes, but it still retains some value. It is not the same as writing off an asset, which negates its present and future value.

FTX was the third biggest cryptocurrency exchange in the world and had been worth nearly S$44 billion just last January.

Temasek clarified in its Nov 17 statement that it had “no direct exposure in cryptocurrencies”. /TISG

Temasek: We have decided to write down our full investment (S$377 million) in FTX