Singapore – News of the surge of phishing scams involving OCBC Bank has made many other bank customers come forward with their own stories of scams that they fell for.

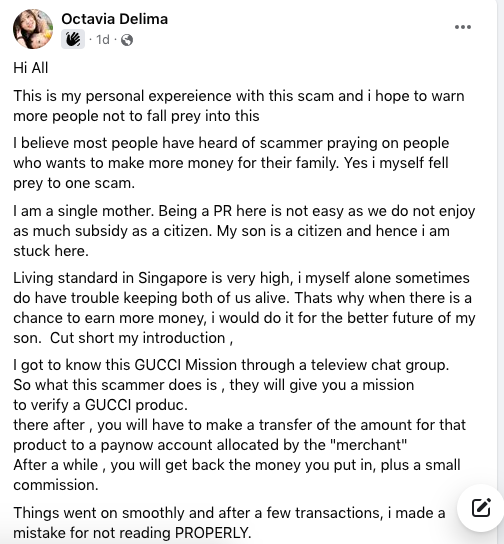

A single mother, Ms Octavia Delima, said in one post that because she is permanent resident and does not “enjoy as much subsidy as a citizen”, she sought to make some quick money quickly for herself and her son.

In a public post to multiple Facebook groups including Complaint Singapore, Ms Delima shared her experience with a ‘Gucci’ scam.

“I believe most people have heard of scammer preying on people who want to make more money for their family. Yes [I] myself fell prey to one scam”, she said.

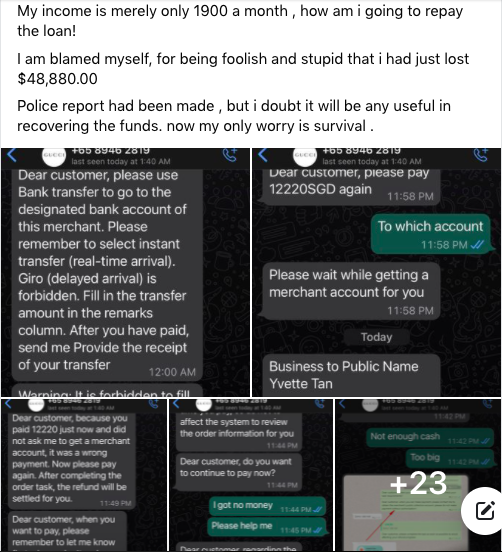

Ms Delima said that she got to know of this scheme through a chat group. Those who joined would then be given a mission to verify a Gucci product. What people would have to do is make a transfer of the value of the product to a PayNow account, she wrote. After a while, she added, that they would receive the money they initially transferred, along with a small commission.

According to Ms Delima, “Things went on smoothly and after a few transactions, [I] made a mistake for not reading PROPERLY”.

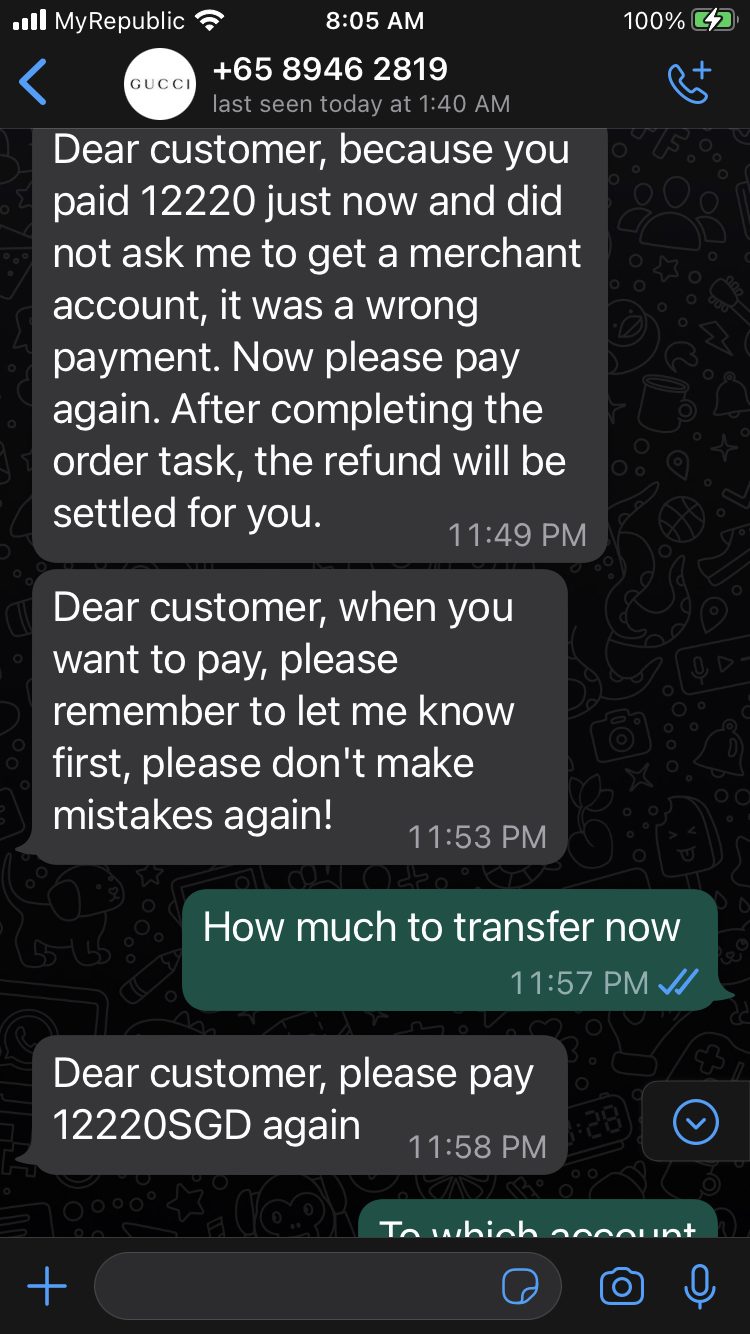

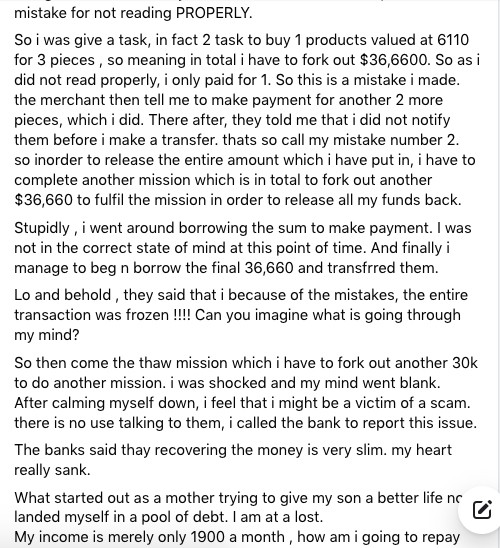

Ms Delima wrote that she was asked to make a transfer for S$36,660. However, she did not read the instructions properly and only made a transfer for half the amount, S$18,330. She said the merchants told her this was her first mistake.

She continued that her second mistake was when she “did not notify them before” she made a transfer.

For them to return all her money, the merchants informed her that she would have to fork out another S$36,660.

“Stupidly , [I] went around borrowing the sum to make payment. I was not in the correct state of mind at this point of time. And finally [I] manage[d] to beg n borrow the final 36,660 and transfrred (sic) them.

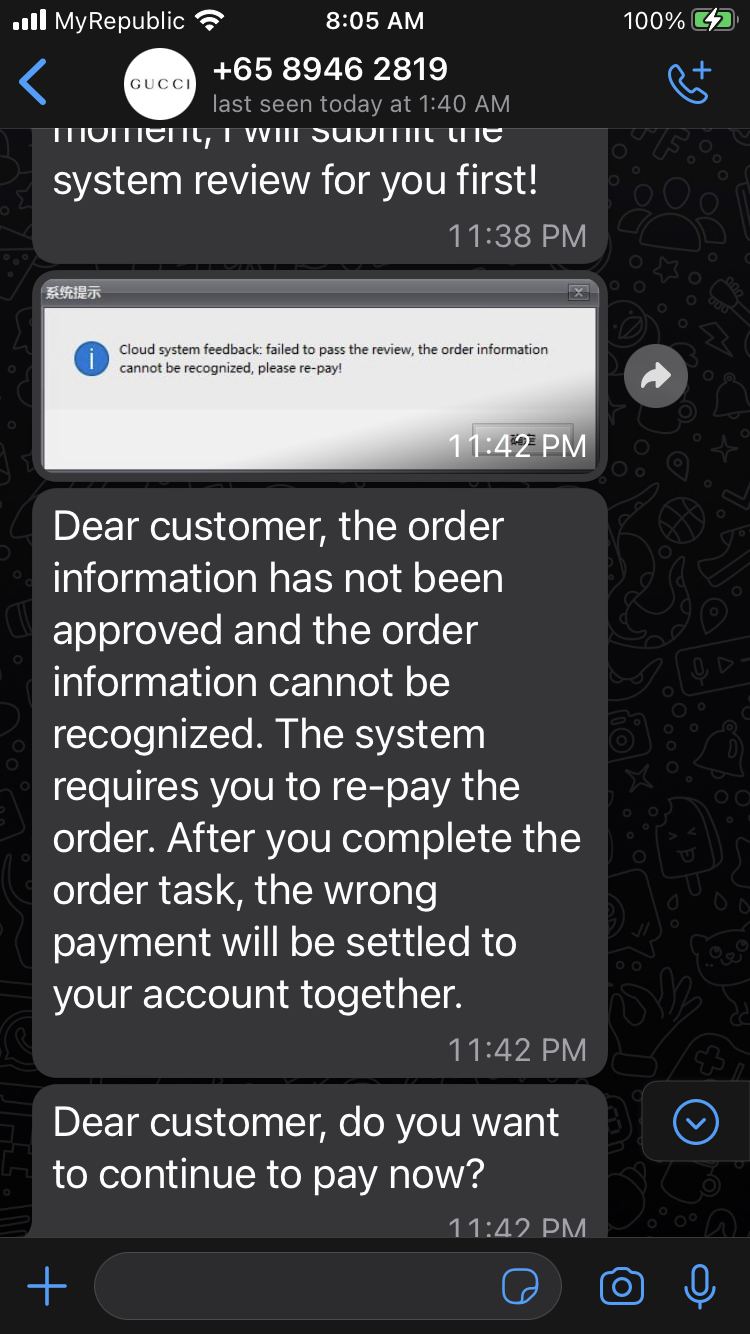

Lo and behold , they said that…because of the mistakes, the entire transaction was frozen !!!! Can you imagine what is going through my mind?”, Ms Delima wrote.

The scammers then told her that she was then tasked with a ‘thaw mission’ to retrieve all her money. To do that, she had to fork out another S$30,000.

That shocked her and it occurred to her then that she could possibly be the victim of a scam. When Ms Delima called her bank to report the issue, the bank told her that she had a very slim chance of recovering the money.

She’s just a mother wanting to give her son a better life, she said, but instead, she has landed herself in a pool of debt.

On a salary of just S$1,900 a month, she said, she blames herself “for being foolish and stupid” that she has just lost $48,880.00