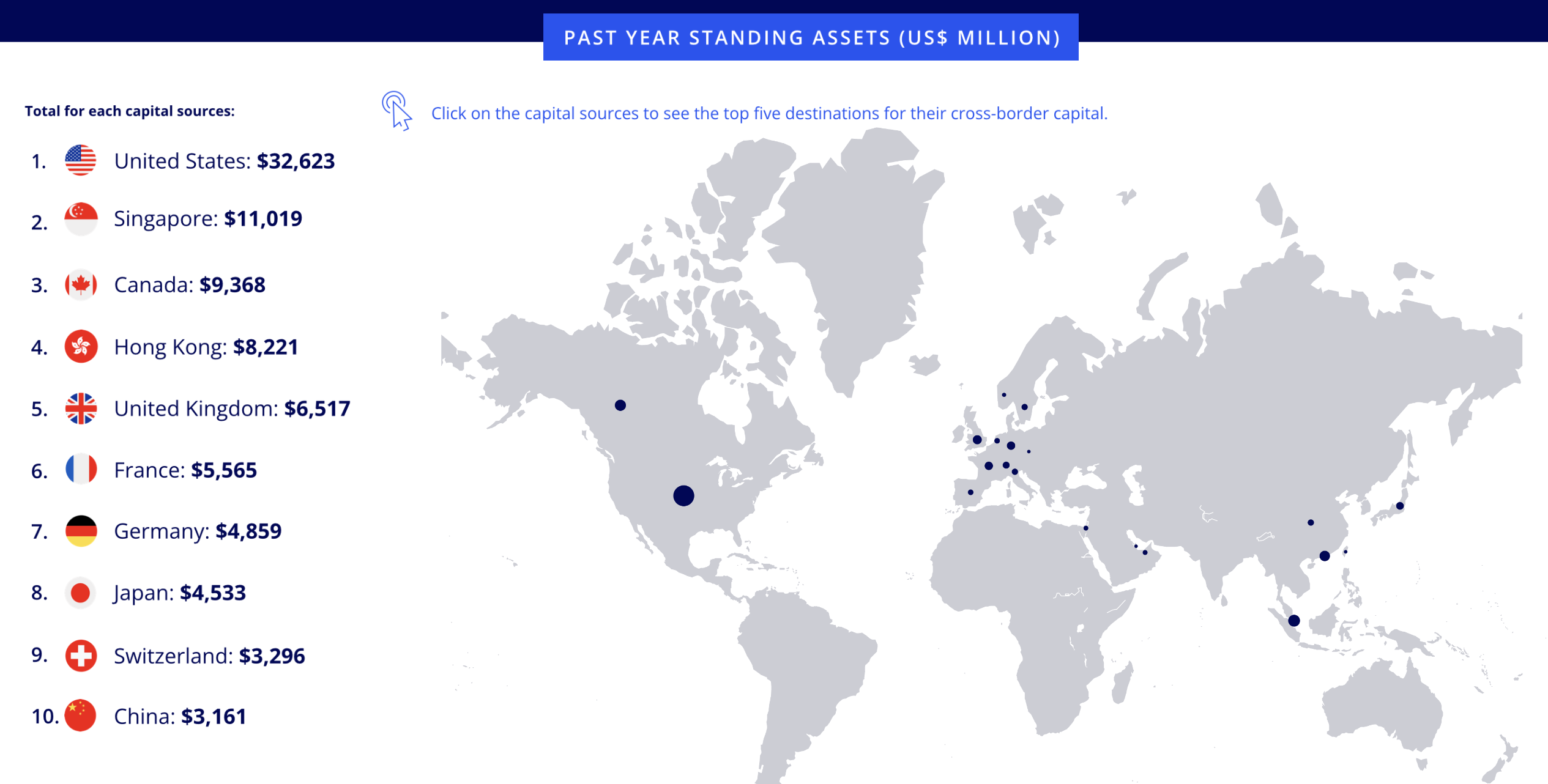

SINGAPORE: Singapore has ranked as the second leading source of global cross-border capital for the first half of 2024. According to Colliers’ Global Capital Flows September 2024 report, Singapore’s total transactions reached 1,929 during this period.

Following Singapore, the top ten sources of cross-border capital from the Asia Pacific region are Hong Kong (fourth), Japan (eighth), and China (tenth).

According to Singapore Business Review, Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets for Asia Pacific, noted that the current market conditions are expected to bring new investment opportunities.

He also said global rate cuts will likely boost the real estate market.

He added that while the market gains in 2024 are expected to be moderate, 2025 is likely to witness a broader yield spread. This will make the market more accessible to buyers and sellers as property values change.

Mr Pilgrim noted that most major global economies have moved beyond concerns about a recession, with GDP rates improving each year. Growth forecasts for developed economies are expected to rise further in 2025 and 2026, aided by anticipated rate cuts.

Meanwhile, developing economies like China and India continue growing strongly, although their GDP growth rates are expected to normalise gradually over time.

Mr Pilgrim explained that the Asia Pacific region provides strong economic growth and attractive returns for global investors compared to more developed regions. It also offers a chance to diversify investment portfolios across the region’s dynamic and varied markets.

He added that “APAC is a powerhouse of economic activity,” presenting diverse investment opportunities in traditional sectors like residential, commercial and industrial, and logistics and emerging areas such as data centres and cold storage.

More information on Colliers’ Global Capital Flows September 2024 report can be viewed here. /TISG

Read also: SG ranked 3rd “wealth magnet” in the world but one Singaporean notes “most citizens are not wealthy”

Featured image by Depositphotos