If you are a university student or parent of a student, you may have considered using your credit card to pay for tuition. This may seem convenient or even savvy given the potential rewards offered by some credit card companies. However, is using a credit card to pay for university tuition really a good idea? In this article, we analyse whether or not you should use a credit card to pay for a university education.

Beware of Rewards Exclusions and Convenience Fees

Before you get too excited imagining accruing free flights or cashback from large tuition charges, it is important to note that payments to educational institutions are often excluded from credit card reward programs. For this reason, it is important to understand the terms and conditions for your credit card before considering using it to make tuition payments.

Additionally, even if your credit card company does provide rewards for tuition payments, not all schools accept credit card payments. Even the schools that do allow credit card payments charge relatively high convenience fees for these transactions. One study estimates that the average convience charge levied by universities in the United States is about 2.62%, which could negate the potential benefits of using a rewards credit card. Therefore it is important to also be cognisant of your school’s policy regarding credit card payments before paying for tuition with a credit card.

Credit Cards are Not the Cheapest Way to Finance Your Education

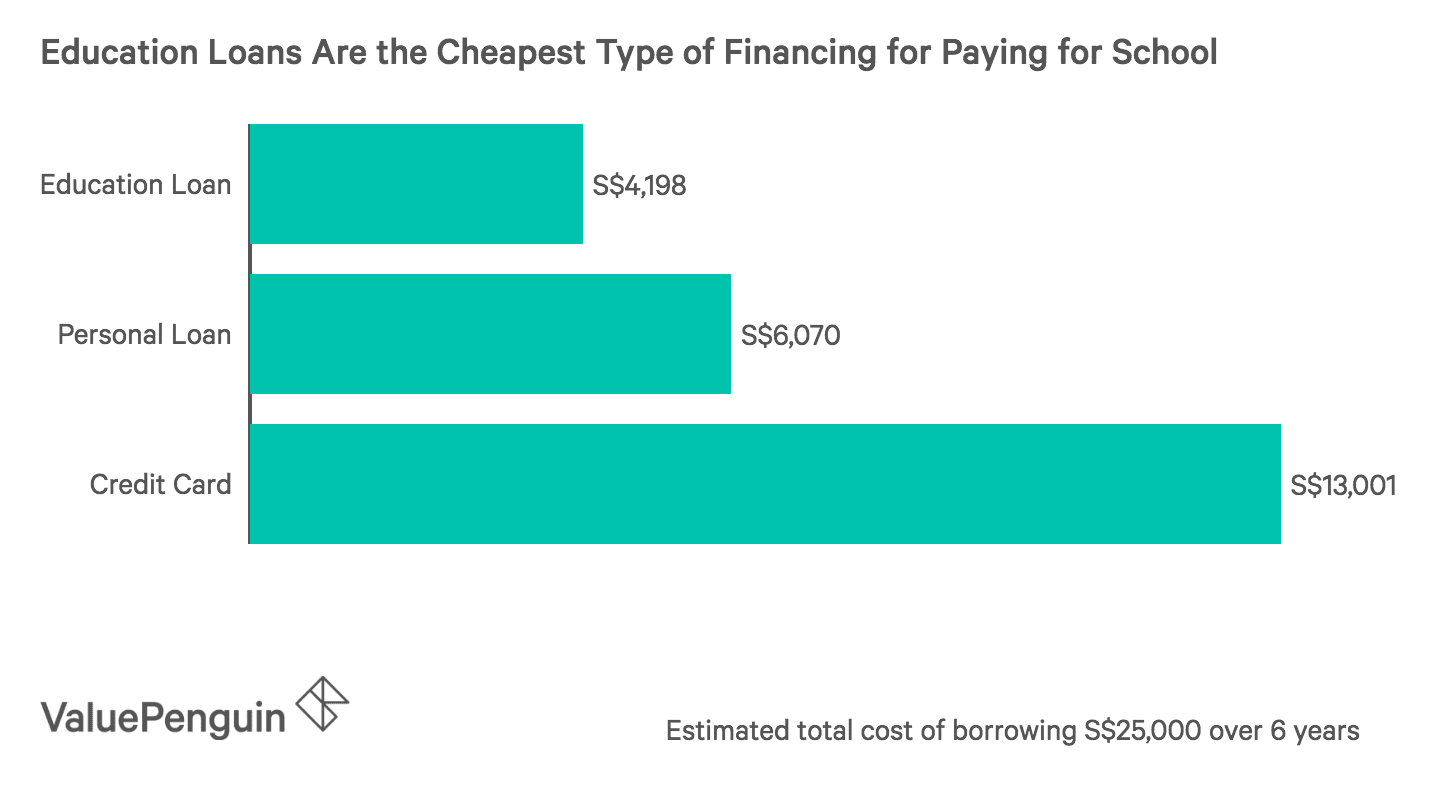

It is also crucial to understand that credit cards are not the cheapest way to pay for an education if you carry a balance from month to month. In fact, using a credit card can be thousands of dollars more expensive than taking an education loan or even a personal loan as credit cards charge annual interest rates around 30% on unpaid balances each month. In contrast, education loans are almost always the cheapest type of financing you can get for paying tuition. This is because these loans tend to charge much lower annual interest rates of 4% to 6%. Additionally, unlike credit cards or personal loans, some education loans even allow students to make smaller payments, or no payments at all, during their years of study.

When Should You Consider Using a Credit Card to Pay for Your Education?

There are clearly several reasons to not use a credit card to pay for your university tuition. That may leave you wondering if there is ever an appropriate time to break out your credit card for educational expenses. Because some credit cards offer interest-free periods of up to 36 months, students that are almost done with school and have a high-paying job lined up might consider using one of these 0% instalment cards for some of their tuition bill. Still, this should be considered a last resort (i.e. you would otherwise have to take on additional debt) since the additional payment fee is almost always going to outweigh the rebates one can earn on these transactions. Not only that, it is crucial to be certain that you will be able to repay your credit card debt before the interest-free period ends as these cards tend to charge interest rates of 25% to 30% after the grace period is over.

Don’t Rely on Credit Cards to Pay for University Tuition

It’s always a good idea to be strategic about using your credit card for large purchases in order to maximise rewards. However, credit cards are often not the best option for these charges due to their restrictions, fees and high interest rates. Students that require financing to pay for their degree should instead choose among the variety of available education loans, which are typically a more affordable way to pay for university.

The article Should You Use a Credit Card to Pay for University? originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

Source: VP