In assessing the economy of the United States of America, the Federal Open Market Committee (FOMC) kept the Federal Reserve interest rates unchanged for now, but hinted at another rate hike as soon as September. The Federal Reserve unanimously voted to keep its benchmark federal-funds rate in a range of 1.75 – 2 per cent at the end of their two-day meeting that ended Wednesday.

The Federal Reserve’s decision comes after President Donald Trump expressed frustration with the monetary policy regulators and said the central bank could disrupt the economic recovery.

The Federal Reserve raised the benchmark lending rate on June 13. Being the second increase of the year, the hike signaled that the US Federal Reserve will be more aggressive about rate increases this year.

The humble mortgage calculator is an essential tool for all types of home buyers

Although President Trump acknowledged that he had a good man in Chairman Jerome Powell at the helm of the US Fed, Trump said that he was not thrilled “because we go up and every time you go up they want to raise rates again. I don’t really — I am not happy about it. But at the same time I’m letting them do what they feel is best.” Adding: “But I don’t like all of this work that goes into doing what we’re doing.

In keeping the interest rates unchanged for now, the Federal Reserve said:

“Information received since the Federal Open Market Committee met in June indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Household spending and business fixed investment have grown strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

If indeed the Federal Reserve put the brake on its interest rates hike temporarily considering President Trump’s unhappiness, it is be good news for borrowers in Singapore.

This is because the US Fed rate hike has an impact on credit cards, mortgages, vehicle loans and bank savings accounts here. This is because Singapore interest rates are closely correlated with those in the US.

Mortgage market may be temporarily boosted from July rush for properties

The SIBOR (Singapore interbank offered rate) for example is expected to go up. This could dent some of the enthusiasm in the buoyant property market.

Since the beginning of this year, banks have raised interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already upped their mortgage rate to 2.05 per cent, to keep pace with the increasing interest rates.

Since the beginning of this year, banks have raised interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already upped their mortgage rate to 2.05 per cent, to keep pace with the increasing interest rates.

The 3-month SIBOR has hovered at 1.41 per cent since May. The further increase announced by the US Federal Reserve on Wednesday is expected to drive the interest rates for mortgage loans even higher.

DBS is now charging 1.95 percent a year for each of the three years for its 3-year fixed rate package, while UOB recently increased its 3-year fixed rate package to 2.05 percent a year for each of the three years. OCBC, on the other hand, raised its 2-year fixed rate package to 1.85 per cent.

Tin Min Ying, an investment analyst at Phillip Securities Research Pte Ltd, said in early June that SIBOR and SOR will continue their upward trend.

“3-month SIBOR crept up in May to near 10-year highs. We expect the Singapore banks’ NIMs (Net Interest Margin Securities) to be on a gradual upward trend given expectations of 3 or more Fed rate hikes in 2018. NIM expansion will be the main share price catalyst for the next few quarters. Despite the 40bps increase in SIBOR this year, mortgage loans growth has remained resilient at 4.4% YoY. Therefore, we do not expect new mortgage loans to be adversely affected by the gradual increase in SIBOR.”

Tin also said that Singapore’s domestic loans in April grew 5.7% year-on-year.

Banks, however, are usually slow off the mark in raising the interest rates in response to global news like the US Federal Reserve rate hikes. This lag time is where a mortgage consultant can best help a distressed buyer to finance a new purchase or to refinance their current property.

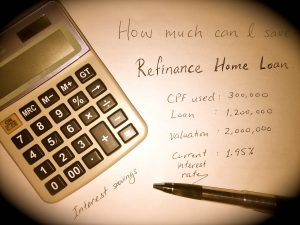

Mr Paul Ho, chief mortgage consultant said, “there may be a short window of opportunity for home-owners to refinance their home loans before the Federal Reserve interest rates are increased in September.”

He added, “the mortgage consultants at iCompareLoan can get the best rates for home owners who want to refinance their home loans by comparing across 16 banks and financial institutions – and best of all, our services are free.”

How to Secure a Home Loan Quickly

Are planning to purchase a HDB resale flat but unsure of the funds you have? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a home loan in a quick and seamless manner.

Alternatively you can read more about the Best Home Loans in Singapore before deciding. Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs.

Whether you are looking for a new home loan or refinance, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.

For advice on a new home loan or Personal Finance advice.

To speak to our Panel of Property agents.

For refinancing advice.