Workers’ Party MP Jamus Lim weighed in on the S$7.4 billion loss recorded by the Monetary Authority of Singapore (MAS) for the last financial year, saying he saw no fault with MAS for these losses.

The Sengkang GRC Member of Parliament is an Associate Professor of Economics at ESSEC Business School. He is currently at Stanford University in the United States on a summer fellowship.

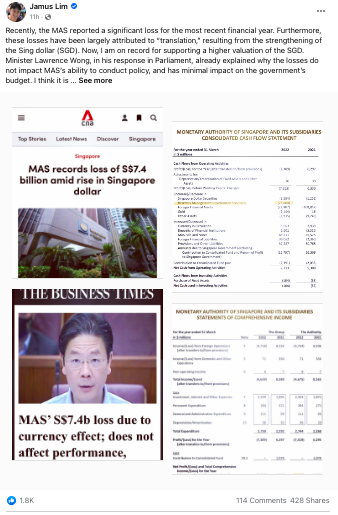

Assoc Prof Lim wrote in an Aug 3 Facebook post that the losses MAS reported last month “have been largely attributed to ‘translation,’ resulting from the strengthening of the Sing dollar (SGD),” an action that he supports.

He noted that Finance Minister Lawrence Wong already clarified in Parliament that these losses would have a minimal impact on the government’s budget, and added his own explanation as to why they are “largely innocuous in other ways.”

One possibility is that MAS sold or rolled over some foreign currency assets, which may have decreased in value as the SGD strengthened. These most likely would be the pound, yen, and euro, as the Sing dollar has not strengthened much against the US dollar.

He called this loss “hard to avoid” since it’s desirable for the central bank to hold a diversified portfolio of foreign currency assets, adding that “some losses that result from these due to currency movements is part and parcel of doing business.”

The second possibility he mentioned would be losses incurred in direct intervention to support the SGD.

“This means that financial markets were selling SGD, and MAS went ahead to bolster the currency by buying back SGD (and selling foreign currency reserves to do so). If this was indeed true, I would be willing to issue a mea culpa: I did not expect that it would be costly, given the undervaluation of the SGD by many metrics.”

But this, he added, is unlikely, and posted a cash flow statement from MAS to prove his point.

“Recently, traditional reserves have been transferred into a newly-created asset class, Reserve Management Government Securities.

The RMGS plays a similar role to Special Singapore Government Securities (SSGS), which is to facilitate the transfer of assets to our sovereign wealth funds for better investment management. Based on MAS financial statements, reported losses likely result from this conversion, at current exchange and interest rates.”

He also pointed out that if the losses had been due to MAS’ direct intervention, this would actually be to the advantage of Singaporeans.

Moreover, even if we accept that the losses are truly the result of direct intervention, it is also important to recognize what this is.

“If the MAS had not intervened, then the effect of higher resulting inflation (due to the higher price of imports of goods and financial assets) would have instead been borne by the consumer or borrower. So while the MAS did lose money, it is far from clear that this was an incorrect policy choice, since the country could have benefitted as a whole, from lower inflation.”

He ended his post by writing that he sees “little reason to fault the actions of MAS here, or to criticize the losses incurred,” and added that the WP, as “loyal opposition… focuses its critique on legitimate concerns, rather than knee-jerk objections to anything the government does.”

/TISG

Jamus Lim: Resident shares concerns over migrant professionals crowding out locals – Singapore News

Resident talks to Jamus Lim about challenges singles face in Singapore