Grab is powerful; Its recent growth plus the Uber deal places Grab in a very dominant position, but vulnerable to competition

Monopolies lie to protect themselves. To avoid government scrutiny, they exaggerate the power of their non-existent competition. – Peter Thiel, Zero to One.

The recent acquisition of Uber’s Southeast Asia operations by Grab has been the most talked-about business deal of the year.

Logging onto the Grab app this week like millions of other customers I’ve found very slow service — up to 20 minutes for a pick up in Ho Chi Minh City — coupled with higher fares of up to three times normal and even six instances of very rude drivers. These experiences seem to be echoed by many across social media. I can see why people are concerned about the growing power of Grab, and how the lack of consumer choice could lead to a degrading of service quality.

Is Grab becoming a monopoly?

Peter Thiel, the billionaire founder of PayPal, observes key differences in how monopolistic and competitive businesses describe themselves. Undifferentiated businesses shrink down their apparent market to seem unique — for example “The only premium pizza restaurant on Castro Street, Palo Alto” — whilst placing great importance on generic distinctiveness like “Grandmother’s secret recipe”.

True monopolies, on the other hand, define their market as broadly as possible to appear a small fish in a huge pond — hoping thereby to avoid government scrutiny and regulation that would endanger their profits. Google, for example, is a giant in its industry. According to statscounter.com, it fulfilled 91.25% of web searches over the past 12 months. Comparing this to its closest competitor (Bing at 3.08%) and with this core business contributing 78% of total revenue, Google’s status as a powerful monopolist is clear.

But when did you hear a Google executive define its business as a search engine? Instead, spokespeople highlight their innovations in other industries, preferring to place themselves in huge markets like the global advertising market — in which their 12% market share is more humble — or even consumer tech.

So how does this test apply to Grab?

As it turns out there has been a clear change in the ways Grab executives talk about the company. In a 2016 interview, Co-founder Tan Hooi Ling boldly stated that “As a company, we’ve grown tremendously in an incredibly short amount of time. We’re now in 28 cities in 6 countries. We have the largest land fleet in the region with over 12 million downloads and more than 220,000 drivers registered in our network.”

Meanwhile Co-founder Anthony Tan spoke of the company’s “Clear advantage and head start.” As Grab fought for market share in 2016, the executives spoke with confidence — like the owner of the Palo Alto pizza restaurant — pretending the company to be unique and superior to its abundant competitors.

Now in 2018, things have changed at Grab. As the CCCS (Competition and Consumer Commission of Singapore) investigates the legality of the Uber deal, the executives — now in the position of maturing monopolists — sound very different. Grab Singapore Head Lim Kell Jay issued a statement saying “We trust that the CCCS review takes into account a dynamic industry that is constantly evolving and highly competitive.” Hearing these words, it’s far easier to picture Grab as a small innovative disruptor rather than an industry Behemoth. And that’s exactly how they want the regulators to see it.

However, there is a twist to the classic story of an exploitative monopoly — the type which inspired the namesake board game and how most people first learn the word — that this article cannot ignore. Whilst some Government departments actively oppose monopolies, others offer legal protection to them. Copyright and patent law entitles the owner of the property to exclusive commercial utilisation — in other words, it protects their monopoly.

Patent and IP law is of course one of the triumphs of capitalism. By protecting the right to commercialise innovations, the brightest minds can invest in the new technologies we all benefit from, safe in the knowledge that their success will bring a reward.

Therefore, the key distinction in differentiating these two types of monopoly is whether a monopoly is forward-looking or backward-looking. A forward-looking monopoly will create something new — and thus exclusively its own — in order to create durable competitive advantage. By innovating, it adds to the total resources of the world. The barrier to competitor entry may be a patent, or simply strong internal capability that is hard to imitate.

On the other hand, a backward-looking monopoly will look to gain control of a market or resource in order to restrict supply, raise prices and exploit the people who depend upon that resource. This type of monopoly may be created by industry mergers or exclusivity contracts or licences that act as barriers to entry. It can at times be beneficial, but in an open market must always be regulated to prevent the inevitable abuse of customers.

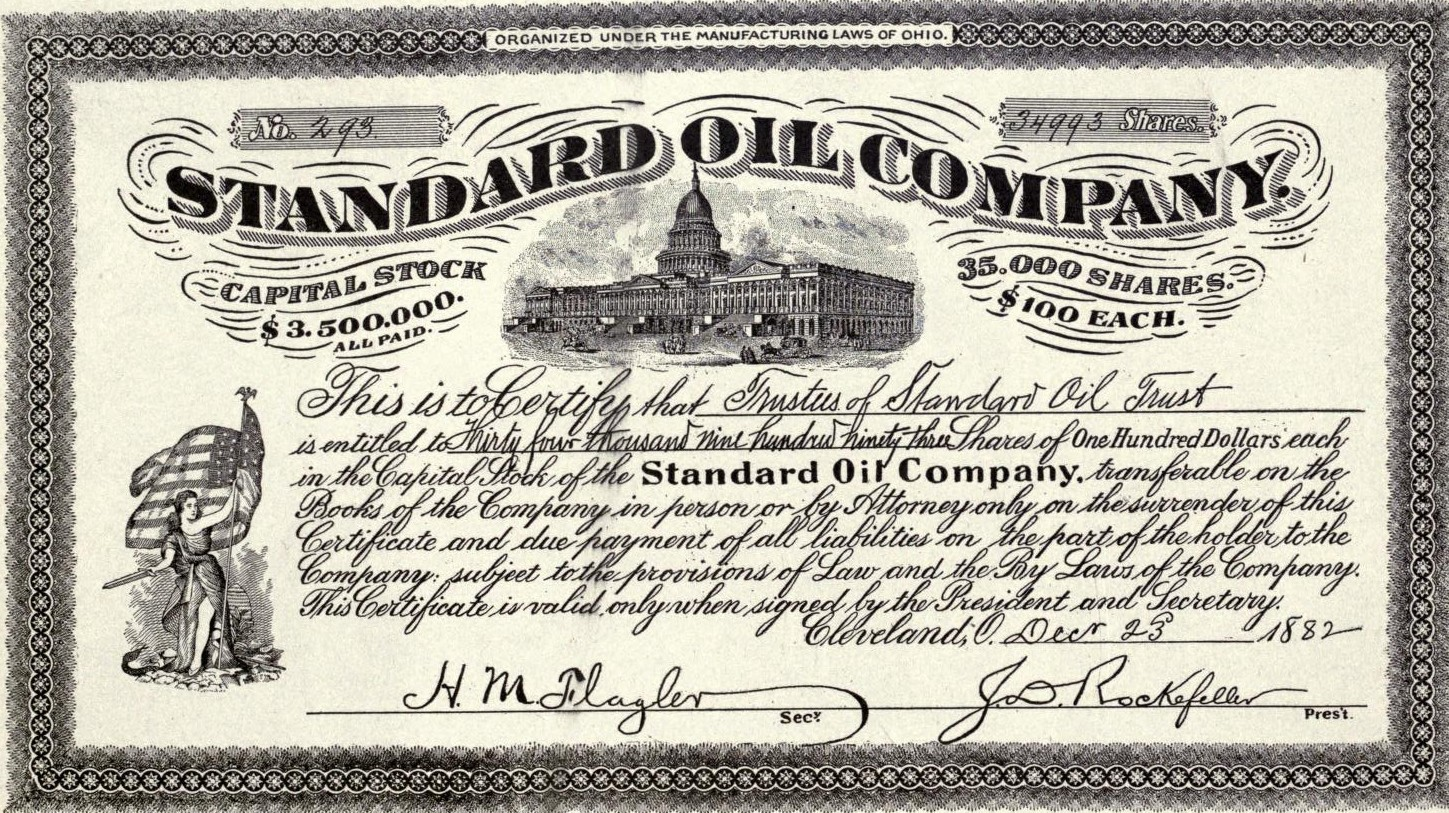

Standard Oil is a backward-looking monopoly — photo credit: Unsplash

Therefore to answer the questions of whether Grab is a monopoly, and if so what type of monopoly, we need to examine the business model, history and competitive landscape using this framework. We need to determine if the goal is creating a new resource or controlling an existing one.

The first taxi-calling app was actually My Taxi launched in 2008 — but soon afterwards Uber and a large number of competitors entered the market. This was a golden age for the consumer, as companies gave away free rides, slashed prices and incrementally improved the apps in order to win market share.

Amongst this intense competition, the big players have been losing a lot of money. As Uber is starting to become profitable in its core markets, it continues to lose hundreds of millions of dollars per quarter in frontier markets. Likewise Grab, despite billions in investments, is still yet to turn a profit. Consolidation in this type of industry can be beneficial. Instead of spending the money fighting each other, the money can be invested in services and the company can move towards profitability.

It is mergers like this however that can give great power in an industry. Historical mergers — such as the 1867 merger between Andrew Carnegie’s Woodruff railway car business and George Pullman’s Palace Car company — were shrewd deals for the parties involved, but began to turn public opinion against monopolies. This led in turn to the first “anti-trust”, or anti-monopoly laws rolling out in the USA and across the world.

Following the recent deal Grab can certainly be placed at a certain point on a spectrum of monopolistic practices. On one hand the deal seems to be an attempt to gain control of the app based taxi market with an impressive market share. In addition, the exclusivity clauses imposed on drivers aim to gain control of the limited resource of taxi drivers. These factors will allow for price increases to take place.

However there are three factors that reduce its ability to perform as a monopolist

Grab does not have full market share — other taxi apps such as Vato, Fastgo, MaiLinh and Vinasun are springing up to fill the void left by Uber and may provide meaningful competition. Go-Jek is dominant in Indonesia and Didi-Chuxing will compete in Japan. Though Grab is attempting to gain control of the supply of taxi drivers, they are not a finite resource as drivers can enter and leave the workforce fairly easily.

Finally, app based taxis are not an essential product like water, healthcare or fuel. There are myriad substitute choices for the consumer looking for urban transportation including hailing taxis, booking by phone, private vehicles and public transport — so Grab needs to remain an appealing alternative to these.

Go-Jek is Grab biggest rival in SEA at the moment

It is my belief that the current customer dissatisfaction with the deal is due to a mismanagement of it, rather than an inherent unsoundness. Both Uber and Grab have lost billions of dollars contesting the Southeast Asian market, and with no turn towards profitability there needs to be a change to allow sustainable service provision. Deals of consolidation are common and effective in crowded marketplaces — it just remains to be seen whether the CCCS feels it has crossed the line. It may be that some safeguards are put in place for consumer protection.

However the immediate change over has caused problems. It seems there is insufficient capacity in the Grab driver network to offer a good service and wait times are long. The Grab app is technically inferior to the Uber offering, with in particular the location services and ETA being inaccurate and no in-route destination change feature. Failing to solve these issues before full roll-out has resulted in dissatisfied customers searching for alternatives, and may just have opened the door to new enterprising upstarts.

If Uber were committed to the success of Grab (the company they now own 27% of!) they would have sent a team to collaborate with Grab before their service stopped, thus making sure the Grab app contained the features Uber customers use and enjoy. They would have ensured the app was technically fit for purpose before forcing its customers to change. And Grab would make sure their recruitment and incentive structure put enough drivers on the road to handle the increased demand.

And what if the CCCS blocks the Uber deal? Their abrupt and complete exit from the market will make it hard to rejoin. No doubt this would lead to a messy situation, but given the power Grab would have in any negotiations it is hard to imagine a poor outcome for Grab.

Grab CEO Anthony Tan — photo credit: Grab

Grab is powerful. Its recent growth plus the Uber deal places Grab in a very dominant position. However given the threats to this dominance, poor decisions will leave the company vulnerable to competition. They have taken steps in the wrong direction. Now we see if management can steer the company back.

—-

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Featured Image Copyright: hanoiphotography / 123RF Stock Photo

The post Is Grab making a grab for your wallet? appeared first on e27.

Source: e27