SINGAPORE: NTUC Enterprise has reaffirmed its commitment to Income Insurance’s long-term competitiveness and social initiatives, amid criticism over German conglomerate Allianz’s plan to acquire a majority stake in the Singapore company that was borne out of the social need to provide affordable insurance solutions to the working population.

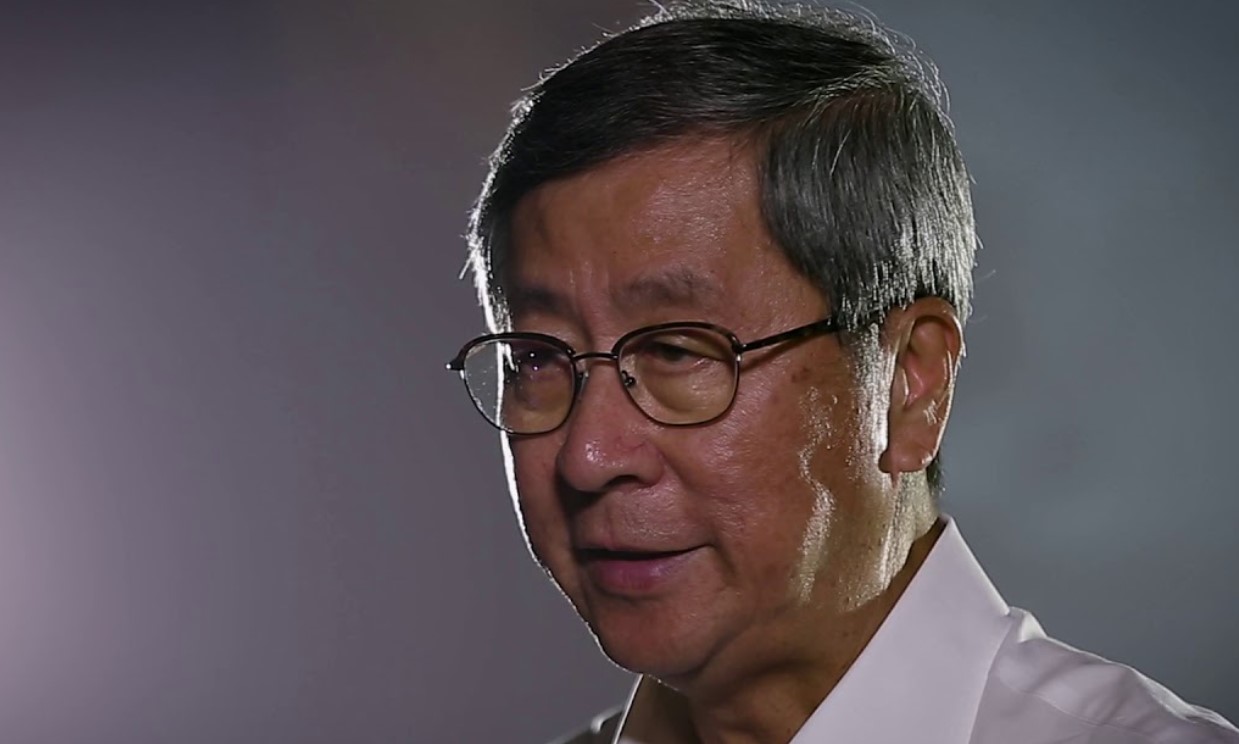

Assuring that Income Insurance will persist in offering affordable and accessible insurance options to underserved and lower-income customers, NTUC Enterprise chairman Lim Boon Heng said: “Income Insurance will continue to provide affordable and accessible insurance options to the underserved and lower-income customers, through products such as the LUV and SilverCare policies,”

The company is set to continue its participation in national insurance programs in collaboration with the CPF Board and will maintain competitive pricing for its products. NTUC Enterprise assured that it will remain an active shareholder, ensuring that Income Insurance upholds its foundational purpose and social commitments.

The labour movement-linked organisation added that by partnering with Allianz, Income Insurance aims to compete more effectively in a market dominated by regional and global competitors.

With a life insurance market share of less than 10% over the past decade, Allianz’s offer to become a majority shareholder will enhance Income Insurance’s relevance and resilience, enabling it to better serve Singaporean families and fulfil its policyholder obligations, NTUC Enterprise posited.

Mr Lim, a former ruling party MP who retired prior to the 2011 election, highlighted that NTUC Enterprise has historically provided crucial capital support to Income Insurance, such as the capital injection in 2020 during the peak of the COVID-19 pandemic.

As insurance is a capital-intensive business, Allianz’s strong financial position will offer additional support for Income Insurance’s growth, he indicated.

Since Income Insurance became a public non-listed company in 2022, there have reportedly been calls from minority shareholders for share liquidity. Allianz’s offer of S$40.58 per share presents these shareholders with the opportunity to sell their shares. Upon the launch of the offer, minority shareholders will have the option to tender all, some, or none of their shares.

Mr Lim’s comments follow a chorus of criticism of the planned acquisition from both ordinary Singaporeans and more prominent individuals alike, with concerns being raised about the impact of foreign ownership on Income Insurance’s foundational values.

Veteran diplomat Tommy Koh did not mince words, as he asserted on social media that selling Income is not a good idea, and the social purpose it was aimed at is still valid today. He wrote:

“INCOME started life as a cooperative of NTUC like Fairprice. The idea was to offer insurance to the people at affordable rates. A few years ago it was made into a company and ceased to be a cooperative. Now we are told that it may be sold to a German insurance company.

“I don’t think it’s a good idea to sell INCOME. It was founded to serve a social purpose and a social need. They remain valid today. I wish to argue that INCOME and Fairprice should never be sold.”

Former mainstream media editor PN Balji commented, “I am against selling Income. Will we dare sell SIA?”

Ex-NTUC Income chief Tan Kin Lian criticised the takeover bid, as well. Responding to a question about whether the company’s “noble socialist philosophy has lost its roots,” the two-time former presidential candidate, who led NTUC Income for 30 years, said last week:

“This is sad. But it reflects what has been happening in Singapore for the past three decades. We are following the bad practices of America. America is now in decay. Singapore may follow.”

Another former NTUC Income CEO also expressed concerns over the deal. Tan Suee Chieh, who had been the Chief Executive Officer of NTUC Income Insurance Co-operative Limited from 2007 to 2013, called the transaction a “breach of good faith” in an interview with CNA.

Sharing that he had been assured that NTUC Enterprise was committed to Income Insurance, he added: “This was what I had hoped would not happen. I did not expect the sale of majority shareholding to a very commercial European insurer to happen. My concern about the fair treatment of minority shareholders when the corporatisation happened remains.”

TISG/