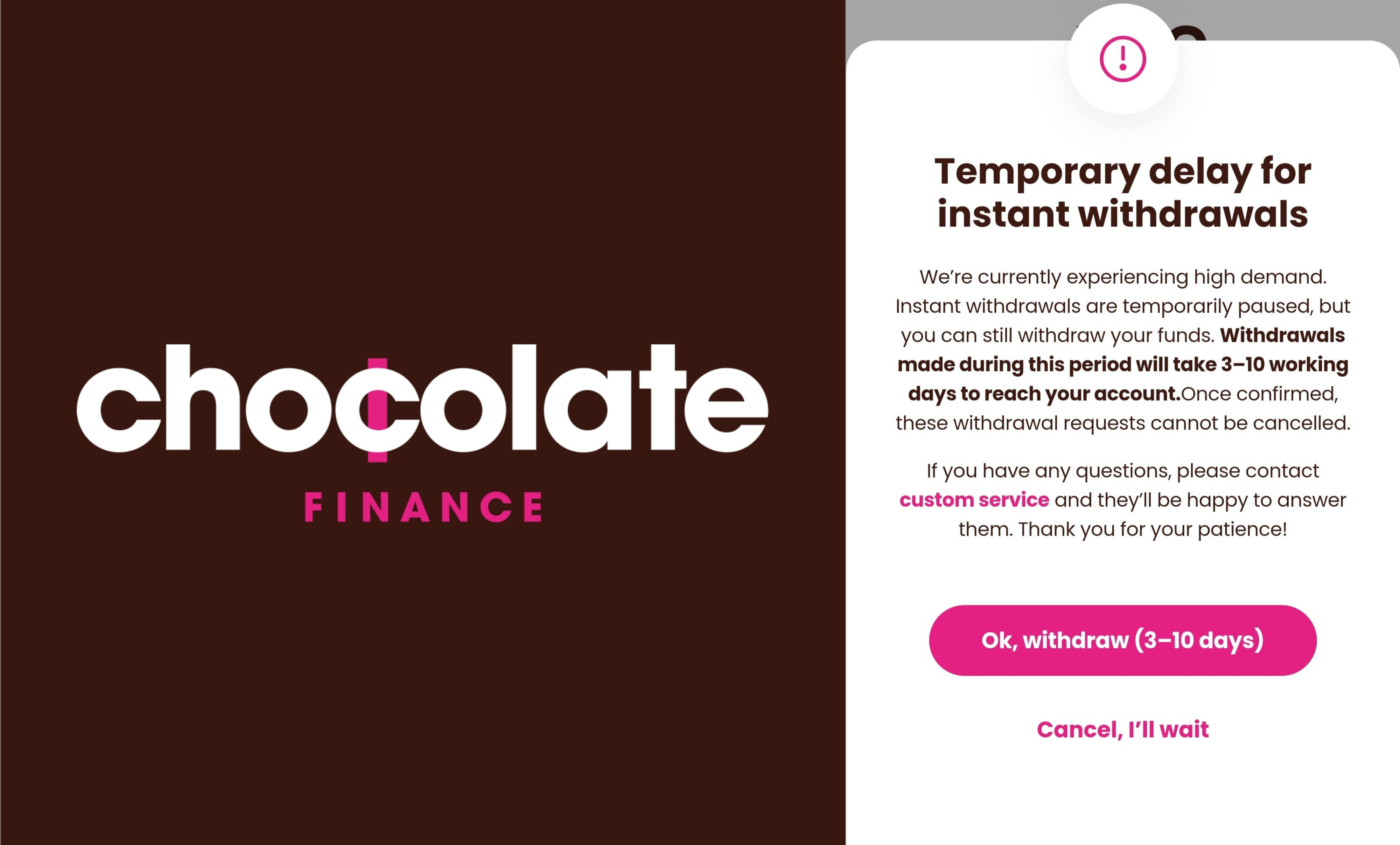

SINGAPORE: On Wednesday (March 12), Chocolate Finance announced that customers will have to wait for three to six business days to receive the funds they withdraw, following standard industry practice. This comes after the platform suspended instant withdrawals on Monday, citing “high demand” and stating that withdrawals could take three to 10 working days to reflect in users’ bank accounts.

The company and fund distribution platform Allfunds reassured customers that investment funds remain secure and withdrawals are being processed as expected.

Chocolate Finance explained that the delays were caused by customers “gaming” its miles reward system by making large payments on AXS machines. In response, the platform quickly ended the benefit, which frustrated many users, founder and CEO Walter de Oude told Channel News Asia (CNA) on Monday (March 10).

The sudden change, which was not properly communicated, led to a surge in withdrawals, depleting the company’s liquidity for instant withdrawals. As a result, the withdrawal service had to be temporarily suspended.

In a statement on Tuesday, the company said that customers can now expect to receive their monies within three to six days, following normal investment fund redemption cycles.

“Both Chocolate and Allfunds confirm that withdrawals (redemption orders) are being processed as expected and in line with industry-standard settlement periods,” it stated.

The company also assured customers that all investment funds are securely held in “segregated, ringfenced accounts” with both Chocolate Finance and Allfunds.

“As a licensed custodian, Allfunds provides fund dealing and custody services to Chocolate, ensuring that Chocolate customers’ investments are securely custodised and safeguarded within Singapore’s regulatory framework,” it stated.

David Pérez de Albéniz, CEO of Allfunds Singapore, stated that their custodian framework guarantees the safety of customer holdings. “Our robust custodian framework ensures that all investments remain protected and accessible to Chocolate in accordance with standard redemption processes,” he said.

Addressing customer concerns, Mr De Oude said, “Chocolate is committed to providing a secure and transparent experience for our customers. While we have seen a spike in withdrawals, all are being processed in an orderly manner. We assure customers that their funds are secure, and withdrawals are proceeding as scheduled.”

On the same day, the Monetary Authority of Singapore (MAS) confirmed that both Chocolate Finance and Allfunds have fully met regulatory requirements.

MAS said digital advisors are required to segregate customer assets from their own. Customers’ assets and monies must be held in independent custody by MAS-licensed custodians and cannot be used to meet the liabilities of the digital adviser at all times.

MAS added that it continues to engage Chocolate Finance to ensure all withdrawals are processed in an orderly manner. /TISG

Featured image by Depositphotos (for illustration purposes only)