SINGAPORE: In a surprising turn of events amid the collapse of the cryptocurrency hedge fund Three Arrows Capital (3AC), Tao Yaqiong—better known as Evelyn Zhu—has successfully sold her lavish Singapore mansion for S$51 million ($38.5 million).

Despite a court-imposed freeze on several of the couple’s assets, this sale comes.

Property records obtained by Bloomberg News reveal that the transaction, finalized last month, was set in motion in July.

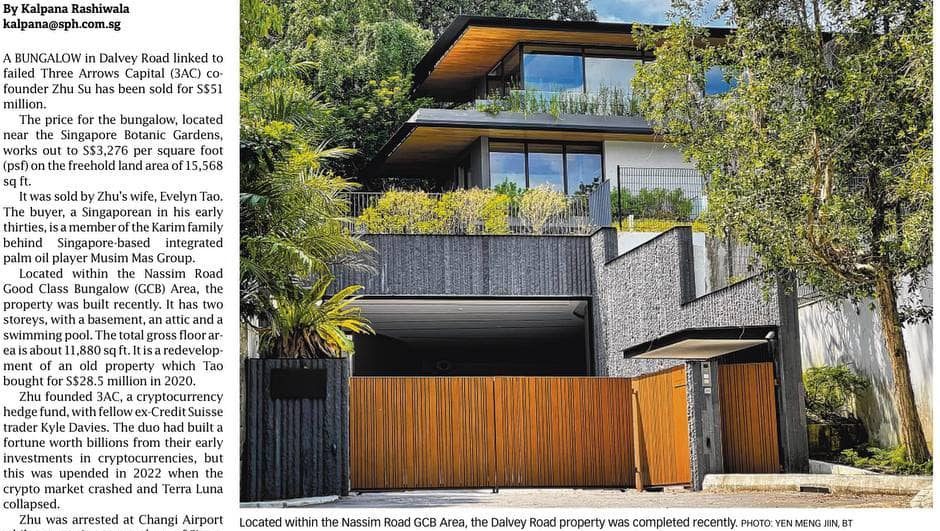

The luxurious bungalow on Dalvey Road, near the picturesque Singapore Botanic Gardens, is 1,446 square meters (15,568 square feet).

Evelyn purchased the property for S$28.5 million in 2020 and has since undertaken significant renovations.

Zhu Su, alongside co-founder Kyle Davies, once led 3AC to become a titan in the cryptocurrency sector.

However, the hedge fund’s fortunes plummeted in 2022 due to a series of poor investment decisions coinciding with a broader downturn in the crypto market.

Since the fund’s collapse, Zhu’s situation has worsened significantly. In 2023, Singapore’s financial regulator imposed a nine-year ban on both Zhu and Davies from engaging in regulated financial activities.

Additionally, Zhu faced a brief stint in jail last year for failing to assist in the winding-up process of 3AC.

The liquidators of 3AC, Teneo, successfully secured a worldwide asset freeze of $1.14 billion against Zhu, Davies, and Davies’ wife, Kelly Chen, citing that creditors are owed around $3.3 billion.

Among the assets affected by this freeze are another mansion on Yarwood Avenue, purchased for S$48.8 million, and a smaller property on Balmoral Road.

The Dalvey bungalow has been bought by Chrispianto Karim, a Singapore citizen and member of the prominent Indonesian Karim family, which controls the Musim Mas Group, a major player in the palm oil industry.

While Teneo has not responded to requests for comment, the sale marks a significant event amid the ongoing fallout from one of the crypto industry’s most high-profile failures.