Investing might be a thrilling endeavour — a sign of adulting — but for the uninitiated, it can be equally daunting. Not only is investing a common way to earn passive income, but it also helps us build a nest egg for our retirement. However, where does one begin navigating the choppy waters of today’s investing landscape?

And while we all know that making our money work for us is prudent, many people may not have the starting capital required to begin investing. Can we, therefore, still invest a modest sum of money?

Is There An Ideal Amount to Invest in?

The good news is that you don’t need much capital or a minimum amount to start investing. With fractional shares and zero-fee brokerages, you can even begin investing in the stock market with as little as S$1.

Many start with about S$1,000 to S$2,000 and work their way up there. But to determine your capital, consider these questions:

- Can you afford a single share of stock in the company you are looking to invest in?

- How do you intend to diversify your investment portfolio?

- Will trading fees eat into your profits?

The bottom line is how much you can invest depends on your financial situation and investment goals.

Suppose you have a sum of money sitting in your savings account or have a long time horizon (i.e. many years until you need to use the money). In that case, your investment capital will look different from that of someone with other financial goals, such as buying a house.

Related: A Basic Guide to Investing: Why it is important

How Can I Grow My Capital?

Before you start investing, here are a few things you need to do before taking the plunge with your money:

Pay Off Debt

Investing is a long-term activity, which means it will most likely be years before you see any significant growth in your investments as a result of compound interest, growth and dividends. Therefore, having high-interest debt (such as credit card debt) can cost you more money than you might make through investing. Therefore, paying off any high-interest debt (anything more than 7%) before you start investing is crucial.

Related: Debt Consolidation – How A Personal Loan Can Help Save Money Paying Off Credit Card Debt

Create an Emergency Fund

Life throws us curve balls sometimes—a medical emergency, car issues, being laid off—that can derail our plans and make a dent in our budget. So it’s best to ensure that you can pay for any unforeseen expenses by setting aside an emergency fund. A rule of thumb is to stash away three to six months’ worth of your average expenditure in a high-yield savings account for that inevitable rainy day.

Set Aside a Budget

To set aside sufficient money for investing, you must first ensure your basic expenses are covered. Set aside a monthly budget that includes all your basic expenses (rent/mortgage, regular loan repayments, utilities, groceries and transportation costs) and discretionary spending (dining out, entertainment, travel or shopping that isn’t necessary). This can help you determine how much you can invest each month.

Factor In Other Savings Goals

Everyone’s financial goals and circumstances are different. Some may be saving up for a vacation fund, some for a car or home, a home remodelling project, etc. Therefore, you need to look at your circumstances and goals to determine how much savings you need to dedicate to them, aside from your emergency fund. Setting aside this sum will save you from tapping into your investment funds.

Once you have established your financial goals and done your calculations, you should be able to settle on a monthly amount you can commit to investing. Whether you opt for lump-sum investment or dollar-cost averaging, whether you invest S$3,000 or S$100 a month, the key is to figure out a system that works specifically for you to invest regularly without compromising other aspects of your financial health.

Related: Should You Pay Off Your Monthly Mortgage Early Or Invest?

How to Begin Investing With An Online Brokerage

To invest in stocks, bonds, mutual or index funds, or any other types of investments, you will first need to open a brokerage account.

While most major financial institutions (i.e., banks) offer brokerage accounts that offer a few perks for investing directly with them, you may also wish to consider independent brokerage firms, online-only or app-based brokers.

Moomoo is an app-based broker with an intuitive interface and quality analytical tools and education services available in-app, making it especially helpful for beginners.

No Minimum Balance Fees

Sometimes, even though your initial investment amount may be above the broker’s threshold for a low-balance fee, the stock you invest in might drop, causing your balance to fall below that threshold.

Choosing a broker that does not charge minimum balance fees means that you, as an investor, are not at risk of paying unnecessary fees if your funds dip below the threshold.

No/Low Commissions or Transaction Fees

Unlimited commission-free trades might have been unheard of a decade ago. But these days, most brokerages charge either no fees or a very low fee (think less than S$1 per trade).

Ensure you go for a broker that charges low to no transaction fees or commissions.

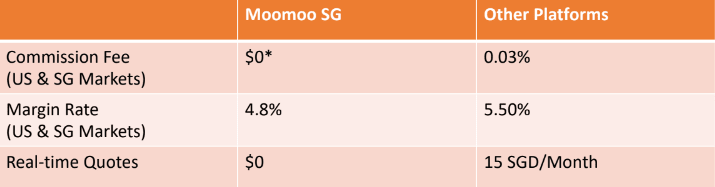

Moomoo stands out by having one of the lowest commission fees in the market. Investors need only pay a commission fee of 0.03% when trading Hong Kong stocks on the Moomoo app. This is significantly lower than the 0.22% industry average. For US stocks and ETFs, the commission is S$0. And with National Day around the corner, Moomoo has a unique “Rediscover Singapore (Market)” National Day campaign. This means that you get to enjoy S$0 commission for a whole year for Singapore stocks, ETFs and REITS.

As such, if you have a small investment capital, you can make multiple small trades instead of investing large funds.

Fractional Share Purchases

As the name suggests, fractional shares are a fraction of a share (half, quarter, or less of a single stock). Some brokers allow fractional shares only in special events such as reinvestment of dividends or a stock split. Since a single share of many stocks can cost hundreds or thousands of dollars, fractional shares can be a way to make investing in stocks more accessible to the average person who doesn’t have tens or hundreds of thousands of dollars lying around.

(Psst! Fractional U.S. shares will be available soon on the moomoo app, so that’s one more reason to trade with moomoo.)

Start Investing in Singapore Stocks Now With Your Beginner Budget

Singapore stocks offer relatively stable earnings, good dividend yields, and attractive valuations, making them a promising investment option amid rising interest rates and fears of a global recession.

This National Day, celebrate Singapore’s 58th anniversary by investing in Singapore stocks, REITs and ETFs with moomoo. The app also provides real-time quotes and 24/7 news about the Singapore market so you can pick the best SG stocks to invest in and sniff out new opportunities.

Moomoo’s National Day Promotion

This July to August, “Rediscover Singapore” (market) with Moomoo SG, which offers the lowest SG trading fees for Singapore stocks.

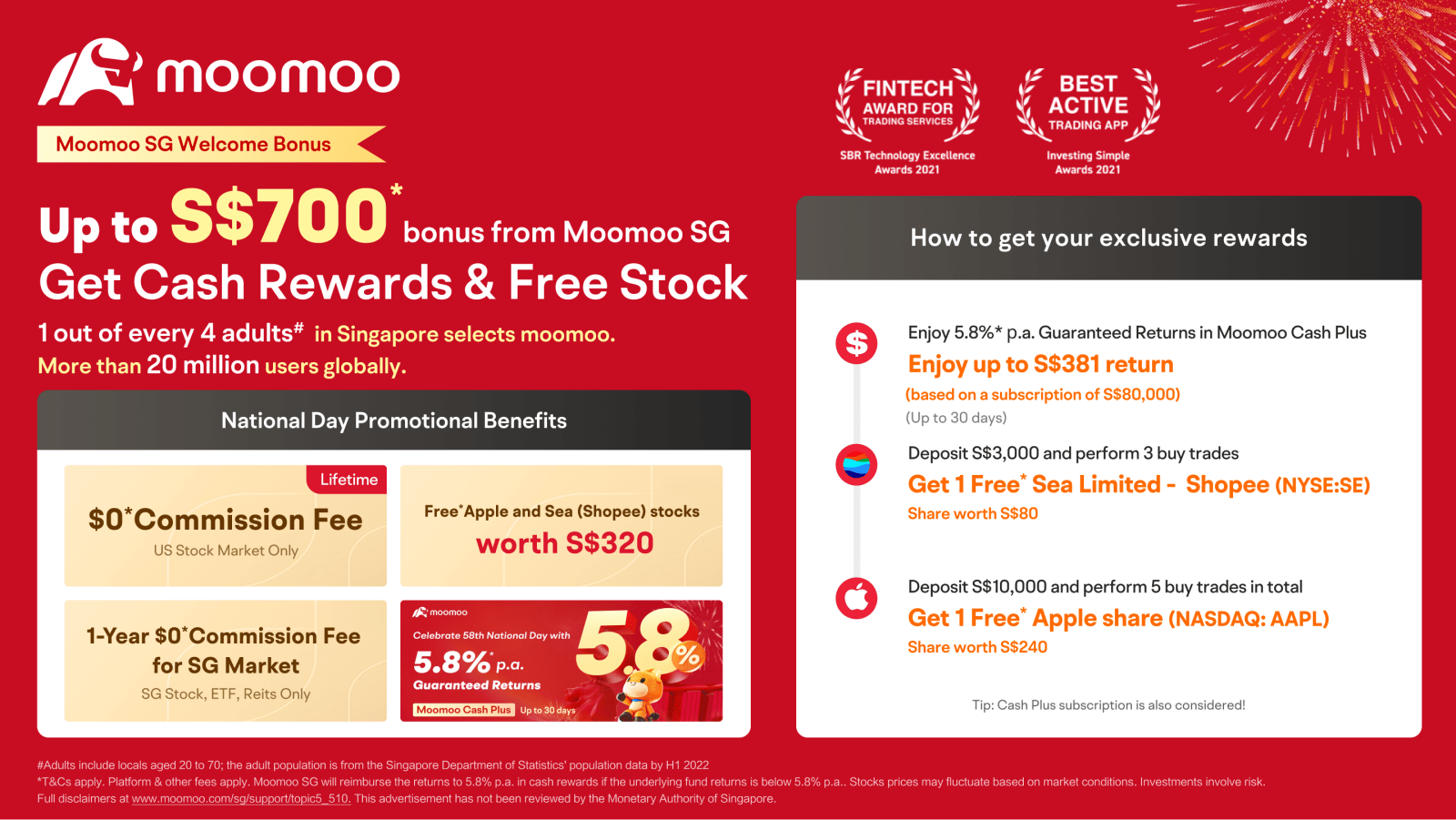

Sign up for an account, and not only will you receive up to S$700* in Welcome Rewards, you’ll also enjoy zero commissions for a year for SG stocks, MoomooCash Plus’ 5.8%* p.a. guaranteed returns for up to 30 days, and free Apple and Sea Ltd (Shopee) stocks worth S$320*. (Refer to the image below for more details.)

Conclusion

Investing early helps you build the discipline you need to set aside money every month to invest and keep up to date on the stock market. Starting with small monthly investments will help you cultivate the necessary habits required of any investor in the long run.

To learn more about investing, moomoo offers a plethora of information, educational resources, and the latest news on the stock market. Download the app and start investing.

If you’re new to investing and unsure where to begin, check out our investing guide for beginners and a roundup of the best online brokerages.

*T&Cs and other fees apply. MoomooSG will reimburse the returns to 5.8% p.a. in cash rewards if the underlying fund returns are below 5.8% p.a. Investments involve risk. Full disclaimers at www.moomoo.com/sg/support/topic5_510. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Read More:

- What You Can Invest In Singapore With S$5,000

- Ways to Start Investing For Your Children to Give Them a Financial Head-Start

- Hedge Funds vs Mutual Funds vs ETFs – Which Should I Invest In?

- The Most Popular Types of Investment in Singapore (And How to Get the Most Out of Them)

- Everything You Need to Know About Investing in REITs Safely & Efficiently

Cover Image Source: Unsplash

The article originally appeared on ValueChampion.

•

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

•

More From ValueChampion:

•

What You Can Invest In Singapore With S$5,000

Ways to Start Investing For Your Children to Give Them a Financial Head-Start

Hedge Funds vs Mutual Funds vs ETFs – Which Should I Invest In?

Read also:

How to Start Planning For Retirement in Your 20s and 30s

How to Get the Best Credit Score to Apply for Loans in Singapore

Secure Your Child’s Financial Future in Singapore: A Comprehensive Guide on Investment and Savings