The end of the year is generally a good time to take stock of things because, new year, new start, right? Doing regular reviews of your financial portfolio can help you stay on track with your financial goals, be aware of your spending patterns, and even alert you to any unpaid debt or tax responsibilities. You get to take a critical look at your goals and milestones and pinpoint potential growth opportunities.

This year, many investors were affected by mounting inflation and austere macroeconomic conditions. Particularly in times like this, a year-end review of your portfolio is a good opportunity for you to assess your progress and set effective investment strategies for the coming year.

So how should you go about it? Here’s a step-by-step guide to help you through your portfolio assessment.

1. Review Your Overall Progress

First, look at the basics. Take stock of what you have accomplished in the year. Have you been saving consistently and paying your bills and debt on time? Are your investments performing within expectations? How stable are your current income sources?

Market fluctuations and uncertain economic conditions caused by volatility or high-interest rates may have sent your investments veering off course, so the review is a basic wellness check that lets you reevaluate the risk these investments may pose in the future.

You can then assess if your current portfolio balance and expected contributions over your time horizon will still put you on track to achieving your financial goals.

Of course, everyone’s financial goals are different. Be it repaying debt, accumulating wealth, or buying that dream home, everyone’s goals call for a different strategy. But whatever your goals are, it’s essential to benchmark your progress against your financial goals.

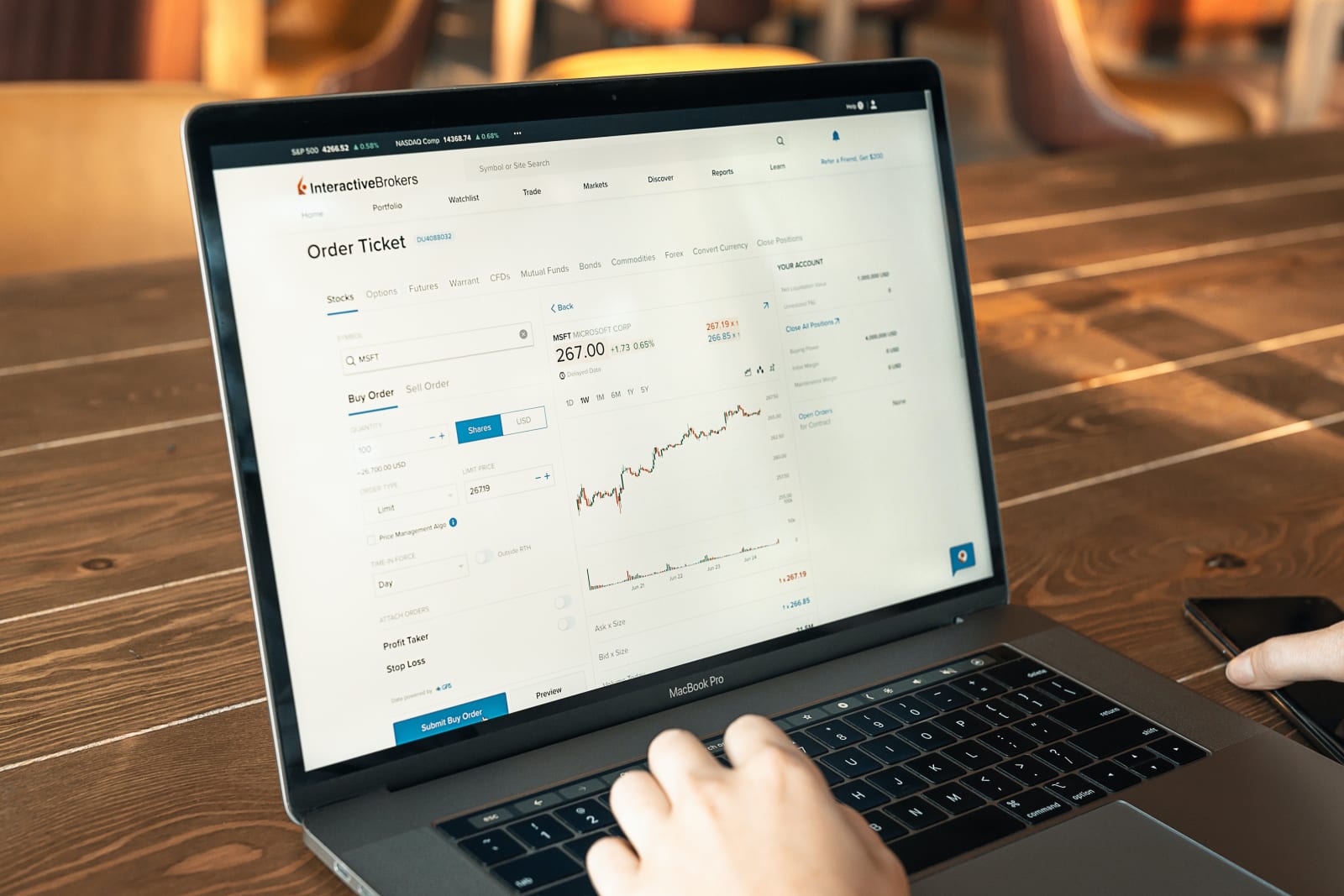

Related: Best Online Brokerages and Trading Platforms in Singapore 2022

2. Review Your Asset Allocation

The way you allocate your assets determines how well your portfolio performs. Your asset allocation should take into account your risk tolerance, time horizon, and financial situation at the point of assessment — which means you should factor in whatever life changes you may be experiencing when you adjust your investment strategy and asset mix.

Diversifying your assets is the best way to mitigate your portfolio’s volatility and potential risk as the losses from poor-performing assets can be offset by the other better-performing assets. If you feel that your current asset mix is not serving you, you might want to revise it while taking into consideration your financial circumstances and the market dynamics.

A well-diversified portfolio will be able to weather market volatility. To ensure that, begin with an overall portfolio review, then zero in on the industry/country/sector and individual holdings to pinpoint any problem areas. For instance, given the current economic climate, one way to reduce your portfolio’s risk is by reducing equity allocation and upping high-quality bonds.

Related: Best Online Brokerages for ETF & Unit Trust Trading 2022

3. Factor in Major Life Events

Your financial goals won’t naturally remain the same at every stage of your life. Along the way, you may have to readjust your portfolio to make space for the milestones in your life, such as a job change, marriage, buying a new house, having a child, etc.

With the current market volatility, you may need to put some of these plans on hold or adjust your financial goals. So when you review your portfolio, you’ll need to check if your financial objectives and investment horizon still make sense in light of your financial circumstances, and if they don’t, how you can make concessions, be it in terms of your goals or your milestones.

Related: Best Personal Loans in Singapore

4. Rebalance Your Portfolio

Reviewing and rebalancing are two different things. While reallocating your investment portfolio involves diversifying and switching allocation between asset classes, rebalancing involves actively removing or reducing fund allocation to specific holdings to manage risk and remove underperforming assets that may be weighing down your portfolio.

In short, portfolio rebalancing means correcting your original allocation wherever necessary. It is also an opportunity to value-invest by purchasing undervalued assets that have growth potential. This can help to boost your portfolio performance while reducing the risk that comes with an over-concentration of any particular asset class.

Conclusion

It is essential to review your portfolio regularly, if not biannually, then at least annually. No matter how conservative your portfolio is, it is never truly safe from market conditions. Even if you choose your investments carefully now, there’s no guarantee that they will always perform well since every investment comes with risk and exposure to market volatility and can affect your portfolio’s performance.

Reviewing your portfolio is crucial in helping you achieve your financial goals. Life events, personal circumstances and growing older may alter your ability to tolerate risk. Therefore, you will need to adjust your strategy over time regardless of market conditions. Be sure to always do your due diligence in studying and analysing the assets you choose to invest in before investing.

Ready to invest? Check out our round-up of the best investment tools in the market — from Robo-advisors to online brokerages — as well as asset classes like stocks to ETFs.

Like what you just read? Follow us on Telegram, Instagram, Facebook, and LinkedIn to get up to date on fresh content!

Read More:

The article originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Is It Enough to Retire with S$6,000 In Monthly Expenses Given The Current Inflation Rate?

A Basic Guide to Investing: Why it is important

An Introduction to Funds in Singapore: What Are Unit Trusts and ETFs?