A woman who fell victim to an impersonation scam had S$1 million drained from her Central Provident Fund (CPF) savings, sparking concern among netizens that such an amount could be withdrawn from the account.

The victim, 75-year-old Madam Fong (not her real name), said on Friday (Apr 22) that she would receive calls up to three times a day for eight weeks by scammers claiming to be authorities in China.

The scammers told Mdm Fong that her name was involved in a money laundering case, warning her to refrain from getting her family involved as a way to protect them.

She also received a mobile phone which the scammers used to call her through video conferencing platform TeamLink.

It was reported that the scammers would call her when her husband wasn’t home, inquiring first of their whereabouts before continuing the conversation.

“I thought they just wanted to protect my family,” said Mdm Fong in a Straits Times report.

The first call happened in mid-December which came from an automated voice claiming to be from the Ministry of Health.

She was then transferred to an “agent,” to whom Mdm Fong later gave her personal information, such as her home address and NRIC number.

From there, she received letters purportedly from the police, Monetary Authority Singapore and the Attorney-General Chambers.

“My home Wi-Fi is not very good, so they said they will send me a phone to help me to talk and cooperate with them,” said Mdm Fong, referring to the mobile phone the scammers sent over.

Within two months, from Jan 28 to Feb 3, a total of S$1 million was transferred from her CPF account to her UOB account and other unknown accounts.

Mdm Fong does not recall authorizing the CPF withdrawal. She also did not remember ever enrolling her UOB account on internet banking services.

Mdm Fong has not recovered any of the S$1 million lost; her case is still under investigation.

It was also reported that the police visited her home on Feb 14 after being alerted by UOB, but Mdm Fong was convinced they were the police.

A total of 109 victims fell prey to an impersonation scam since January 2022, losing at least S$14.6 million collectively.

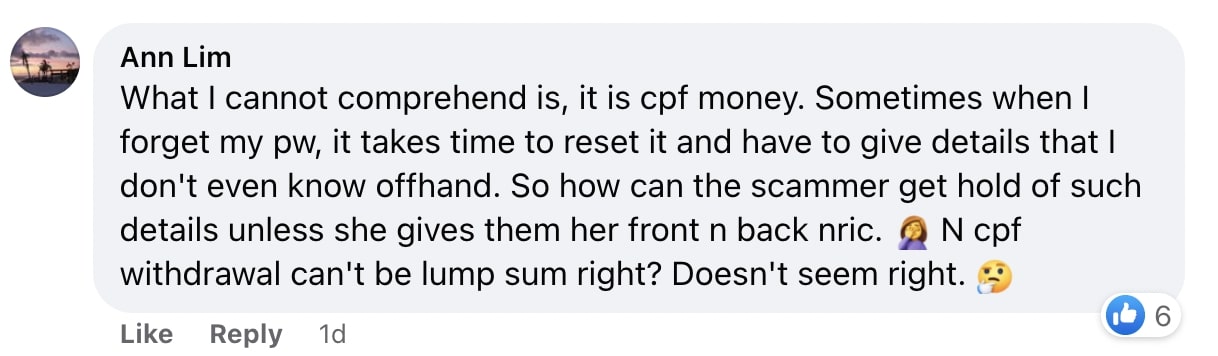

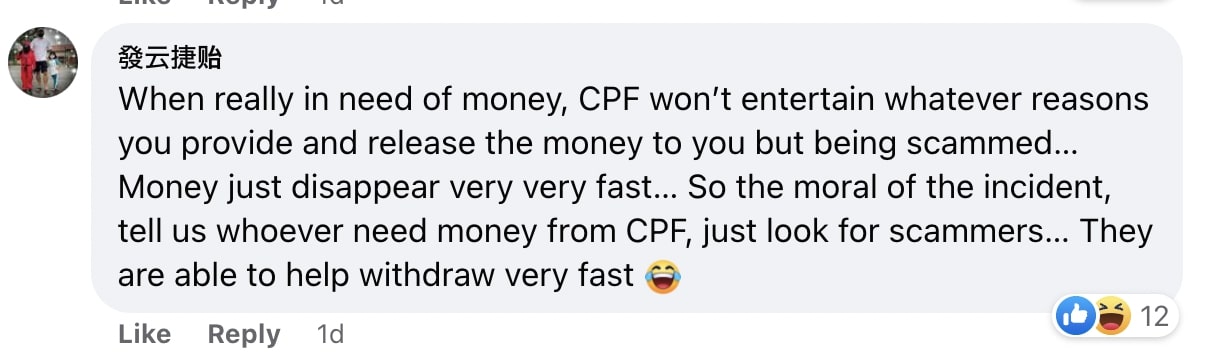

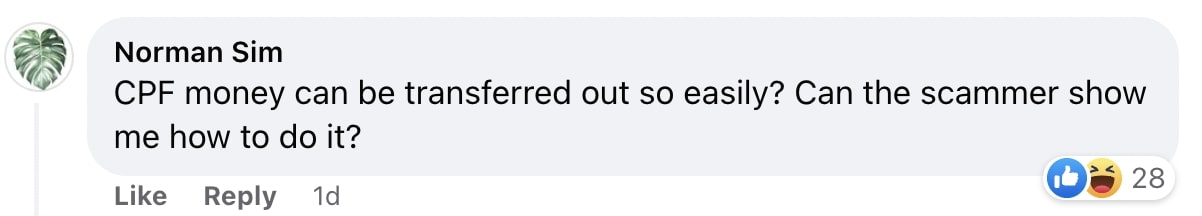

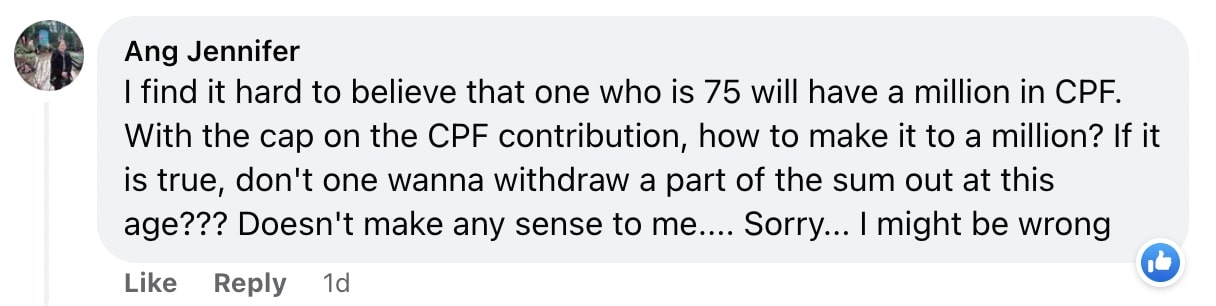

Members from the online community wondered how the money could have been withdrawn from the CPF account.

Others urged the public to practice extra caution given the multiple advisories from authorities concerning ongoing scams.

A UOB representative also confirmed that scammers would not gain access to their target’s account unless they have the banking details, passwords and one-time passwords./TISG