The second quarter of this year may be considered a robust one for the property market, with big condominium launches fetching high prices and good sales volumes, one report noted. However, Singapore property news may be about to become less bullish. There are signs that a price slowdown is coming, PropertyGuru’s latest property market report noted.

The report took a look at property sale and rental prices, supply, and demand as well as data from the Urban Redevelopment Authority (URA) and the Housing and Development Board (HDB).

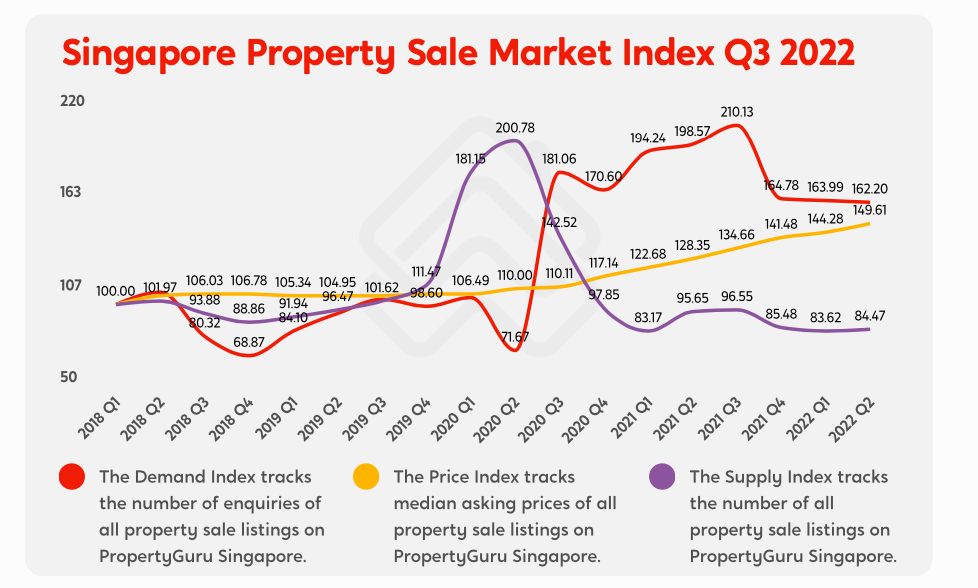

The data shows that in spite of rising mortgage rates, the second quarter has been a robust one. There has been a 3.69 per cent quarter-on-quarter growth in the Singapore Property Sale Price Index, which is significantly higher than the 1.98 per cent growth from the previous quarter.

Furthermore, developer sales went from 1,825 to 2,397 in the second quarter of this year, while resale non-landed private property sales also climbed from 3,377 to 4,236. Singapore property news in the second quarter, therefore, was distinctly bullish.

“The increased costs of borrowing seems to have had only a limited impact on the buying sentiment,” PropertyGuru noted.

Moreover, rental prices have steadily increased and are now at a 16-quarter high. The Rental Price Index saw a nearly 5 per cent increase this quarter.

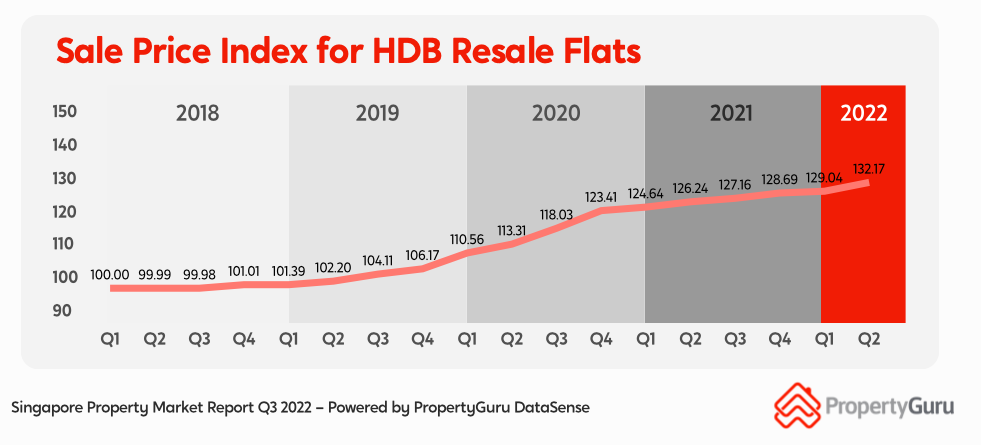

One thing to note from the report is that while asking prices for HDB resale flats have reached a new high, a price slowdown is expected. So Singapore property news is about to take a bearish turn, but it won’t happen overnight.

For the third quarter of the year, prices are still expected to go up, but in small increments, “despite the spreading sentiment that the average buyer is becoming more resistant towards and unwilling to match high asking prices,” said PropertyGuru.

Noteworthy as well is the number of million-dollar HDB flat transactions, which by the end of the second quarter was already higher than in 2021.

The report says 2022 may be a record-breaking year with over 300 million-dollar flats bought and sold.

Hougang/Punggol/Sengkang, Bukit Batok/Bukit Panjang and Sembawang/Yishun are the highest performing estates when it comes to HDB resale flats.

PropertyGuru noted, however, “Although HDB resale flat prices have reached a new peak, there are signs of an oncoming slowdown. Transaction volumes are steadily declining, and recorded gains are more modest than the previous year’s.”

The report noted that mortgage rates have continued to rise, but this has not had a significant impact on the buying sentiment for private properties.

As for HDB rental properties, both price and demand have gone down for the first time in three years.

The quarter-on-quarter decrease is less than one per cent, but could still mean that a slowdown is coming for the HDB rental market.

For now, singles and unmarried couples, as well as foreigners, are still keeping the HDB rental market afloat. But with more BTO flats being built, demand and prices for the rental market are expected to go down. /TISG

Bukit Batok & Marine Parade join million-dollar club as HDB resale flats fetch record prices in July