If you are considering purchasing a home in Singapore, you have two options: HDB or private properties. For those buying a HDB flat, which represents about 80-90% of the market, deciding on whether to get a HDB concessionary loan or a HDB bank loan can be like being between a rock and a hard place. Both has unique merits and disadvantages, but here are some factors you’d need to consider before deciding on either of them.

Eligibility

As the name suggests, you can only take out a HDB concessionary loan if you are buying a HDB flat. Unfortunately, executive condominiums owners are only allowed to take up a bank loan. Besides buying a HDB flat, there are other eligibility conditions that you must be aware of. These include:

- At least one buyer needs to be a Singaporean

- Buyers cannot have taken two or more housing loans from HDB previously

- Buyer’s average gross monthly household income cannot exceed $12,000

- Buyers must not have owned or have disposed of any private residential property in the 30 months before the date of application for a HDB Loan Eligibility letter

If don’t qualify for these conditions, you cannot even apply for a HDB loan even if you are buying a HDB flat. If you qualify, there are still some other factors that are worth considering, which we discuss below.

Downpayment differs

The price of private condominiums and public housing has seen a closing gap in recent years, and it is no longer uncommon to hear of HDB flats hitting the S$1 million mark. But if private properties supposedly have a higher potential for price appreciation, why are Singaporeans still going for public housing without the facilities and perks of living in a condominium?

One of the main reason is that the difference in size of down payment that one has to fork out for a condominium and HDB. When you take up a bank loan, for example, the bank imposes a limit of maximum Loan to Value (LTV) ratio of 80 percent, which means you’d need to make a down payment that is 20% of the full price. For a HDB loan, on the other hand, you can get up to a maximum LTV of 90% so that you only have to pay 10% of a property’s price out of your own pocket.

Another difference is that for those who take up a HDB loan, you can even use your CPF money to pay down the 10% downpayment, which means you don’t really need much cash upfront. On the other hand, if you’re purchasing a private condominium or taking a bank loan for your HDB flat, at least 5% of your 20% downpayment needs to be paid for in cash.

Thus, for those Singaporeans who do not have a lot of cash available, taking up a HDB loan might help to relieve some of that cashflow problem that they face when making a sizable downpayment.

HDB Interest Rates Deemed To Be More Stable

A HDB loan’s rate is considered very stable because it hasn’t changed much in the last few decades. The concessionary interest rate is pegged at 0.10% above the prevailing CPF Ordinary Account (OA) interest rate, and may be adjusted in January, April, July, and October, in line with CPF interest rate revisions. Currently, this interest rate is at 2.60%.

If you compare this rate to average bank home loan rates of around 1-2%, you may find that its variability is much higher since bank home loans are usually pegged to rates like SIBOR and SOR that fluctuate on a daily basis. Because of this, there are still borrowers who would choose to take up the HDB loan because they will know exactly how much they need to pay every month despite the fact that bank home rates tend to be lower than HDB loan rates.

A way to get around this with a bank loan is that you can choose a fixed rate loan, or get a loan where you can lock in the rate for a few years before you refinance later.

Bank Loans Are Cheaper

You can find an assortment of home loans provided by banks, including fixed and variable rate loans, and those pegged to the SIBOR, SOR or even fixed deposit rate. According to our research, home loan rates provided by bank currently range between 1 to 2%, which means you are paying at least 0.6% less interest compared to a HDB concessionary loan.

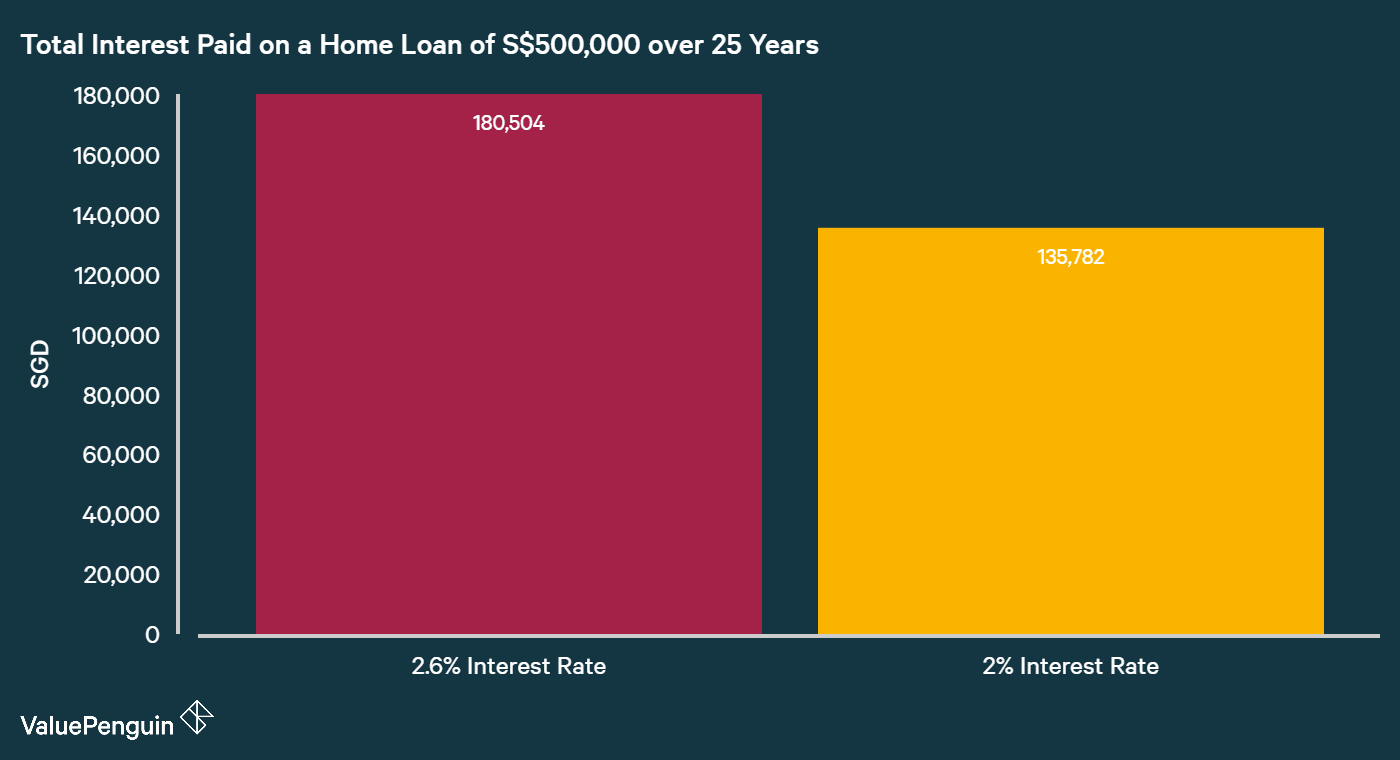

If you apply this 0.6% to a loan of S$500,000 paid over 25 years, your interest difference can be more than S$40,000! So do think carefully about taking up a HDB loan just so you are paying the same amount each month since the cost for stability is pretty high in this case.

No Prepayment Penalties For HDB Loan

In order to reduce the total amount of interest paid, some borrowers may want to make a lump-sum payment during their mortgage tenure. Sadly, this is often penalised by banks with a prepayment penalty as they would have factored in the entire cost of borrowing from the start. These penalties can cost about 1.5% to 1.75% of the loan amount, which may negate whatever interest savings you get.

For a HDB loan, however, there is no such penalty if you want to make lump sum prepayments. So if you are likely to refinance your home loan or prepay a considerable amount of your home loan in the next few years, then you may want to opt for a HDB loan.

To conclude, a HDB loan could be the ideal solution for someone who is more risk-averse and prefers to pay less down payment. But for a more savvy borrower who focuses more on reducing the cost of borrowing, getting a bank loan could help to save on substantial interest payments in the long term.

The article HDB Loan vs Bank Loan – What Should You Consider? originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

- Best Home Loans 2017

- Best Personal Loans in Singapore 2017

- Average Cost of Moving a Home in Singapore

Source: ValuePen