SINGAPORE: On Tuesday (Feb 11), the Singapore Police Force warned the public to stay alert and vigilant against investment scams. The force explained that at least 470 such cases have been reported since the beginning of the year, and the losses from these cases have reached at least $32.6 million.

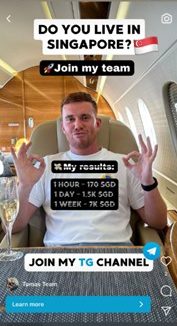

The perpetrators of this particular scam approach people online through diverse social media, communication, and even dating apps such as Facebook, Instagram, Telegram, WhatsApp, and Coffee Meets Bagel. They then proceed to befriend their would-be victims and, after gaining their trust, introduce “investment opportunities,” including investing in cryptocurrencies.

They are persuaded to open accounts in crypto exchanges and transfer funds into these accounts to purchase cryptocurrencies. Then, the scammers have their victims transfer their cryptocurrencies to fraudulent cryptocurrency trading platforms or into the scammer’s wallets.

To encourage them, some victims are initially given small profits by scammers, making them feel they should keep investing. In other cases, the victims are shown fake “investment” websites or applications where there are alleged growing “profits” made by the victims, which may then cause the victims to invest even larger sums.

Some victims encountered scams through advertisements on social media sites wherein they saw politicians or celebrities supposedly “endorsing” the “investment.” Upon clicking links on these advertisements, the victims sometimes use other apps, such as WhatsApp or Telegram, to contact the scammers.

In other cases, they are redirected to fraudulent trading platforms and instructed to provide their details to register for an account. Scammers posing as staff from investment companies or brokers then call the victims.

Scammers are also known to add victims to chat groups or Telegram channels supposedly associated with famous individuals or reputable companies or use “other members” to talk about their profits from the investments.

This would lead the victims to contact scammers and fall for fraudulent investment plans, where they provide their personal information after being shown “investment” websites or applications that display “profits.”

When victims are unable to withdraw their “profits” after investing, at times, large amounts of money, they realize that they were scammed. At that point, in many instances, the scammers can no longer be contacted.

The Police are also encouraging members of the public to adopt the following crime prevention measures:

- Add the ScamShield App to block and filter SMSes, and set up security features for payment accounts.

- Check for scam signs with official sources such as the ScamShield Helpline (1799), the ScamShield app, a trusted person, or through www.scamshield.gov.sg. Individuals should also ask as many questions as they need to before agreeing to an investment, check on the company behind the investment, and confirm its credentials using available resources, including the Financial Institutions Directory, Register of Representatives, and Investor Alert List on the MAS’ website (www.mas.gov.sg).

- Tell family, friends, and the authorities about the scams you encounter.

“If you are in doubt, call the 24/7 ScamShield Helpline at 1799 to check. For more information on scams, members of the public can visit www.scamshield.gov.sg. Fighting scams is a community effort. Together, we can ACT Against Scams to safeguard our community!” the Police added. /TISG

Read also: Retired Johor engineer loses S$2.87 million in crypto scam