Singapore — Taking a jab at the withdrawal age of Central Provident Funds (CPF), netizens poked fun on social media that CPF accounts are indeed the safest place to store money.

Recent OCBC bank phishing scams saw at least 469 victims who lost a total of S$8.5 million. Subsequently, DBS Bank on Wednesday (Jan 19) warned its customers about a fake SMS being sent to users claiming to be from the bank.

The scam involves a message claiming that a user’s account has been temporarily suspended and inviting the user to visit a fake website designed to steal their log-in details and one-time passwords (OTPs).

Netizens then joked about the matter on social media, Thursday (Jan 20) on a post in a Facebook group Umbrage Singapore:

“2022 Putting your money in the bank is not safe. Where is the safest place to put your money. CPF, even yourself can’t withdraw”.

Over the years, the CPF withdrawal age has been a sore topic for Singaporeans, with many coming forward wanting to make early withdrawals because of their circumstances, but being unable to do so.

Read related: CPF responds, says father with insufficient cash for daughter’s education cannot make a withdrawal

At present, according to cpf.gov.sg, “You can withdraw at least 20% of your retirement savings, either from 55 or 65, depending on your birth year. This includes the first $5,000 withdrawable at any time after 55”.

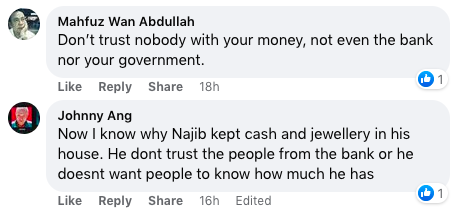

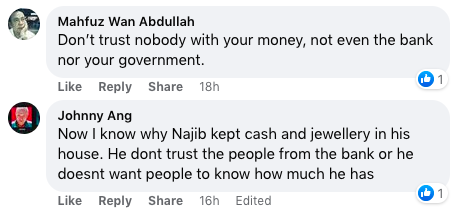

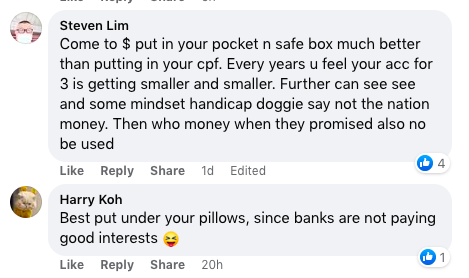

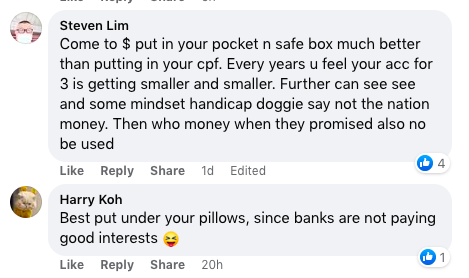

This is what netizens who commented on the post had to say:

/TISG