As Singapore grapples with soaring inflation, worries about the cost of living here creep in. An expatriate moving into Singapore wondered if a S$6,000 monthly salary would be enough to sustain a family of three.

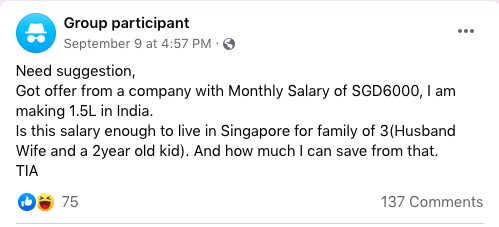

An anonymous post to public Facebook group Indians In Singapore saw a netizen asking if he should take up a job offer in Singapore. The netizen wrote that he was currently making 1.5 Lakhs in India (S$2,633.13).

The netizen wrote: “Got offer from a company with Monthly Salary of SGD6000, I am making 1.5L in India.

Is this salary enough to live in Singapore for family of 3(Husband Wife and a 2year old kid)”

They also asked how much they could save from that salary.

Since it was posted on Sep 9 (Friday), the post garnered 75 reactions and almost 140 comments.

Many others suggested that the family stay in India.

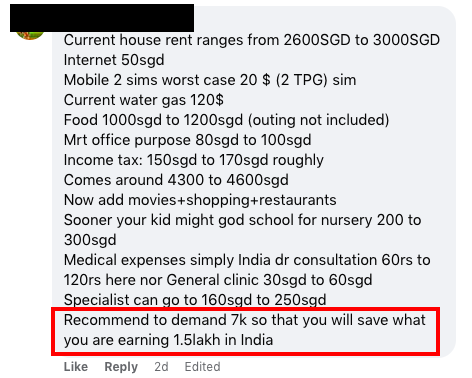

After doing the calculations, one netizen also wrote: “Recommend to demand 7k (salary) so that you will save what you are earning 1.5lakh in India”.

Others also said that it was not enough that just one person work here in Singapore, a dual-income household was necessary.

A report in the South China Morning Post cited that Singapore’s core inflation gauge, which excludes accommodation and private transport, climbed to the highest level in almost 14 years in July.

Last week, a 38-year-old woman took to social media asking for financial advice as she is “unable to save up anything” because of her monthly expenditure and credit card bills.

In an anonymous post to popular confessions page SGWhispers, the woman said that her 40-year-old husband was also earning money.

“I take home around $4500 , whilst my husband around $5800, both after cpf deductions. Staying in a 5 room hdb resale flat. We have 2 kids, one 3 years old and one 10 months old. My husband takes care of the childcare fees , enrichment classes, utilities bills and kids insurance”, she wrote.

She added that every month, she spent $2,400 of her salary on stocks and savings, money she gave her parents, insurance, and internet and phone bills.

However, she added: “My credit card bills racks (sic) up to between $1500-$2000 or over per month, making me unable to save up anything or even eat into my savings. The bills include transport fees, eating out, groceries, buying toys, clothes for the whole family”. /TISG