SINGAPORE: The Malaysian ringgit has been on an upward trend over the past six months, gaining strength against the Singapore dollar and the US dollar from the positive growth of the Malaysian economy and the recent US Federal Reserve interest rate cut.

“Clearly it is a matter of concern for both Malaysians and Singaporeans,” says 1M65 founder, technopreneur and investor Loo Cheng Chuan, adding that people are closely watching the ringgit’s direction.

According to Mr Loo, this rise is expected to continue into next year, potentially bringing the ringgit to 2.90 against the Singapore dollar.

The currency has strengthened due to two reasons. “The Federal Reserve has lowered the interest rate… so we now have a lot of hot money that generally flowed from Malaysia to the US now coming back to Malaysia, so the ringgit is appreciating,” Mr Loo explained.

In addition, Malaysia’s economy has been performing well under Prime Minister Anwar Ibrahim’s leadership, with new policies that have boosted investor confidence and supported the ringgit’s growth.

“They have cut a few subsidies, implemented very tough policies, picked up the economy, and so on. Foreign investor flow and further conversion of foreign currency deposits will help to support the ringgit.

So this is a very powerful show of strength of the Malaysian economy,” added Mr Loo.

This shift has raised questions for Malaysians and Singaporeans, as the currency’s movements impact businesses, consumers, and cross-border activities.

The ringgit rose from around 3.50 to 3.20 in just six months against the Singapore dollar, marking an 8% increase. According to Mr Loo, “That’s a significant rise, man, a super significant rise.”

This is the ringgit’s best quarter in 50 years, and it has also gained more than 12% against the US dollar, making it one of the top-performing emerging market currencies.

“A very firm congratulations to all Malaysians for the incredible rise of the ringgit,” he commended the people of Malaysia. This rise brings relief for Malaysian importers and consumers, as it makes imported goods cheaper.

“They were hit terribly when the ringgit was depreciating for the last two years,” Mr Loo noted, adding that companies with expenses in US dollars, such as AirAsia, are now benefiting from lower costs.

“Even my renovators have been saying that some of the prices they get for raw materials from overseas are improving,” he shared.

However, not everyone benefits from a stronger ringgit. Tourists from Singapore and other countries are now paying more when visiting Malaysia, and Malaysians working in Singapore are seeing their earnings lose value when converted back to ringgit.

“A lot of Malaysians who work in Singapore now receive their income in Singapore dollars. When they convert back to Malaysia, they will receive a lesser amount,” Mr Loo explained.

Export-oriented businesses face challenges, as a stronger ringgit reduces their profits when converting foreign income to local currency.

Will the ringgit keep rising?

The question now is whether the ringgit’s rise will last or collapse over time. Mr. Loo said, “Economists believe that the outlook of the ringgit remains bullish, given the news that the Federal Reserve will slowly cut interest rates by another 75 to 100 basis points by the end of the year.”

Although he mentioned that the ringgit could keep gaining value against the US dollar, there are differing opinions on its future trajectory. Some analysts believe the current rise may be “overstretched,” signalling a potential consolidation in the near term.

According to Mr Loo, some analysts also predict that the US dollar to ringgit will average at 4.15 in 2025, which is likely as it is currently at 4.13.

He also said the exchange rate to the Singapore dollar could reach 3.18 or 3.19 but expects significant fluctuations due to potential interest rate cuts by the US Federal Reserve.

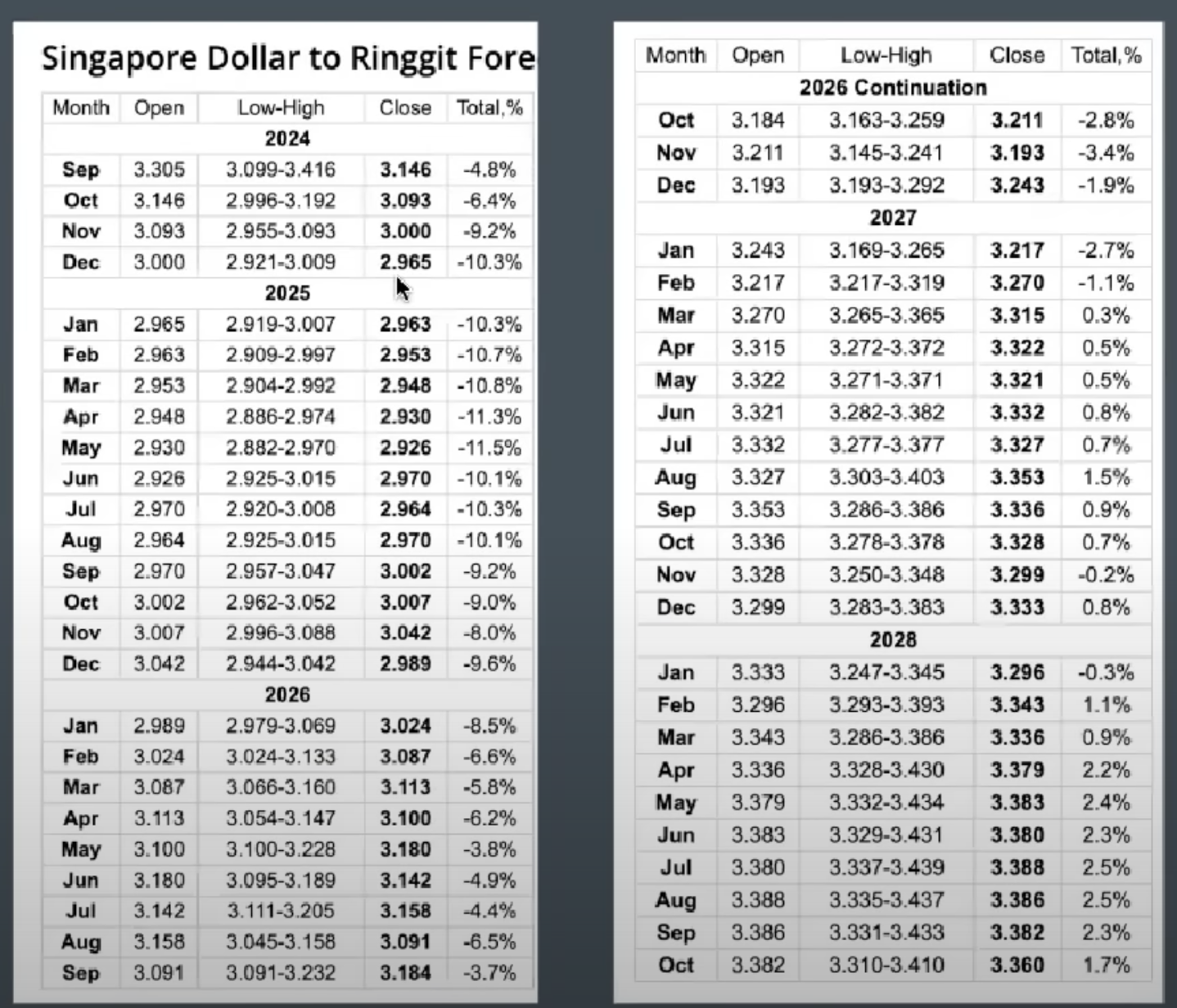

The Economy Forecast Agency (EFA), known for providing long-term financial market forecasts, has projected that the ringgit could reach 2.90 by the end of the year.

He explained that EFA predicts the upward trend will continue through 2025 and in 2026 before the reverse happens again. Then, the whole thing will start all over again from that period to 2028.

However, Wallet Investor stated that the ringgit has a “very gloomy outlook,” with the Singapore dollar potentially rising to 3.70 against it.

“So who is right, who is wrong? It’s very difficult to predict… But if you’re an exporter, importer, or tourist, know there’s a lot of uncertainty and volatility,” Mr Loo said.

He added, “It’s hard to say, but the current trend favours all Malaysians. Generally speaking, as consumers, my fellow Singaporeans, I’d like to say you already had a good run.”

Mr Loo noted, “I would say that touching 3.00 seems to be a reasonable prediction for next year. Whether it hits 2.90 is hard to say, but I think 3.00 is possible for next year… It’s not unthinkable that it will hit 3.00 or even 2.90.”

He also pointed out that some money changers in Malaysia are already predicting the exchange rate could fall to 3.00 or even 2.90.

“The question is not a question of if it will or will not happen, but a question of when. Beyond that, it’s hard to say. Let’s watch and see,” he stated. /TISG

Read also: Malaysian ringgit hits 16-month high amid strong economic performance

Featured image by Depositphotos (for illustration purposes only)