SINGAPORE: A woman took to social media to ask whether an additional, though small, fee is allowed to be charged when a cashless payment is done.

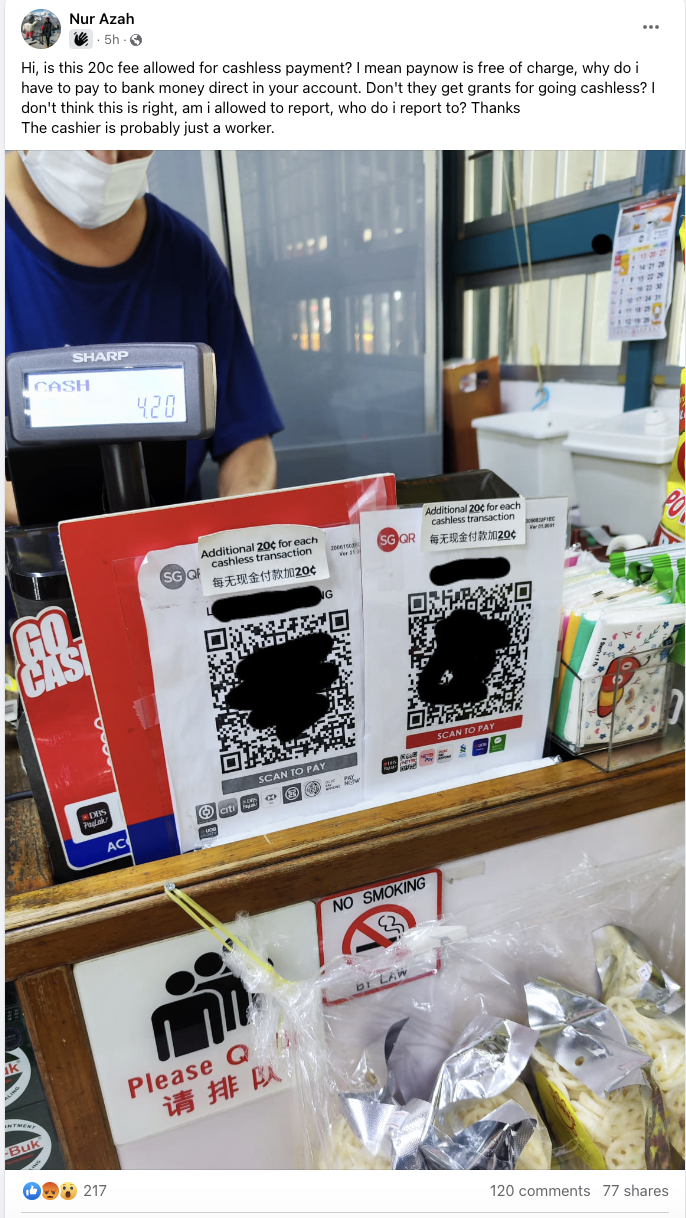

Ms Nur Azah posted on the COMPLAINT SINGAPORE Facebook page on Wednesday morning (Aug 9) a photo of a cash register at a shop, with the display showing a total of $4.20.

At the top of a display board showing the QR code for cashless transactions for the store, a small note has been tacked on that says, “Additional 20¢ for each cashless transaction.”

“Hi, is this 20c fee allowed for cashless payment? I mean paynow is free of charge, why do i have to pay to bank money direct in your account. Don’t they get grants for going cashless? I don’t think this is right, am i allowed to report, who do i report to? Thanks. The cashier is probably just a worker,” wrote Ms Nur.

The Independent Singapore has reached out to Ms Nur and The Association of Banks of Singapore for further comment.

Ms Nur’s question has been shared and commented on many times since it was posted.

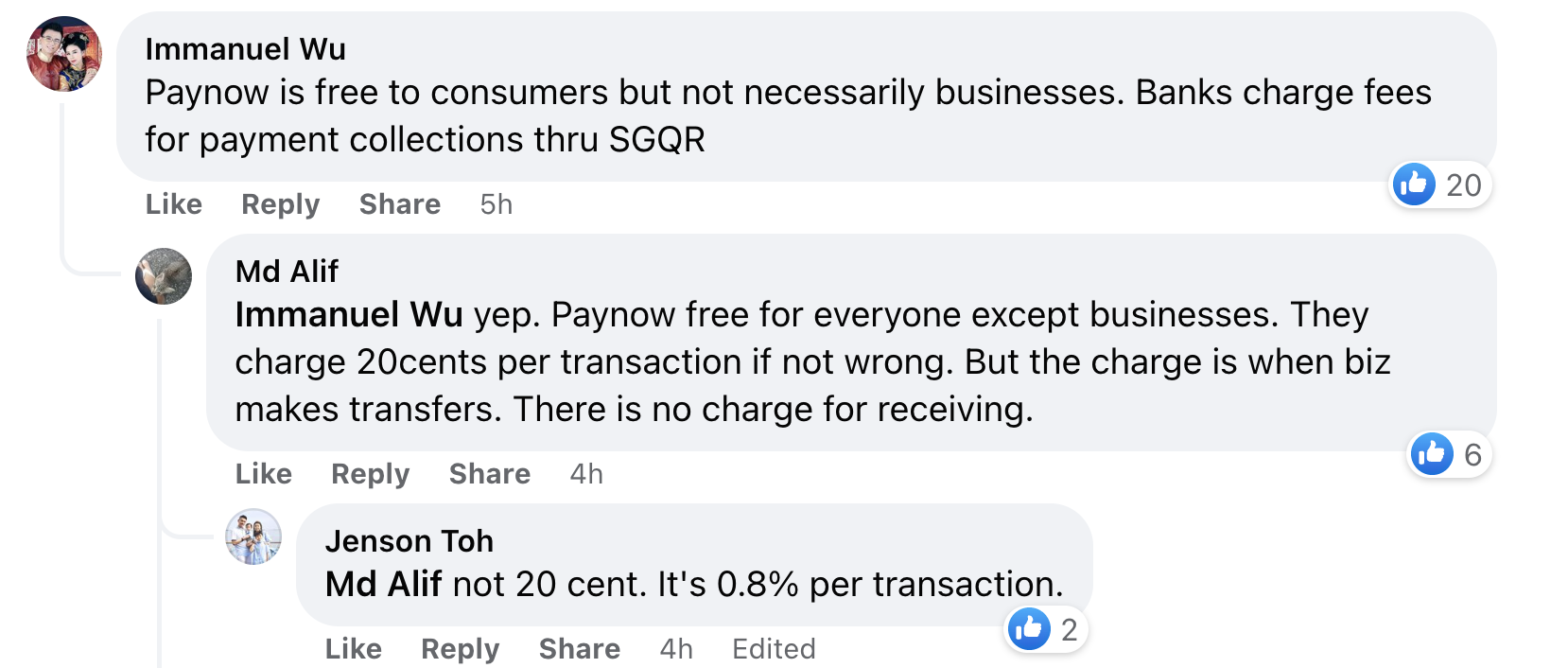

“Paynow is free to consumers but not necessarily businesses. Banks charge fees for payment collections thru SGQR,” wrote one netizen.

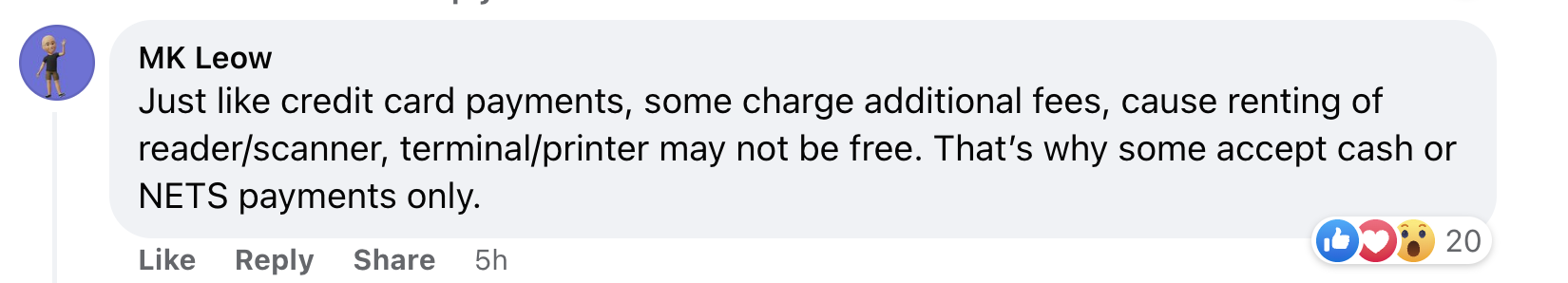

“Just like credit card payments, some charge additional fees, cause renting of reader/scanner, terminal/printer may not be free. That’s why some accept cash or NETS payments only,” chimed in another.

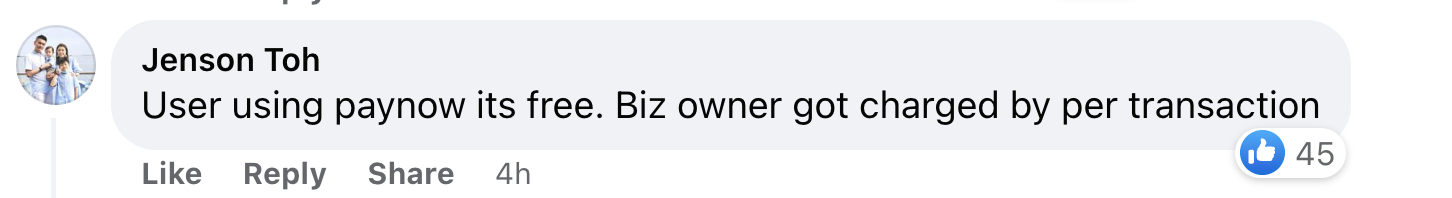

“User using paynow its free. Biz owner got charged by per transaction,” wrote one.

Another wrote, “government waived off paynow QR fee for merchants for a few years, now its chargeable.”

“Bank do charge Merchant for Paynow transactions. It’s not free,” noted a commenter.

One netizen clarified the issue even further.

/TISG

UPDATE: Aug 15, 2023

A spokesperson from The Association of Banks of Singapore (ABS) clarified the matter with the below statement:

“As with any payment scheme, there are clearing fees associated to offset the cost of running the infrastructure. PayNow participating institutions do not pass these costs to consumers, however, they may charge service fees to merchants for value-added PayNow services.

ABS and its members discourage merchants from passing such costs to their consumers. This is being formalised through PayNow scheme rules that will prohibit such surcharges and provide the PayNow institution a right to terminate services if any merchants do not comply.”