We extracted data from our database to bring you our first Southeast Asia ecosystem report, which will focus on 2018

2018 was a year of continued growth and new breakthroughs for Southeast Asia’s tech startup ecosystem. In the blink of an eye, a year has passed and we’ve reached the season of year-in-reviews and new year resolutions.

As e27 continues to be an active catalyst of this growth and movement, we want to help all stakeholders to get a solid grasp and make sense of the current state of the regional ecosystem and gear up for 2019’s Big Hairy Audacious Goals (BHAGs).

To that end, we are compiling an in-depth report on Southeast Asia’s tech startup ecosystem based on e27’s data. But first, here’s a teaser for you.

A 30,000 ft overview

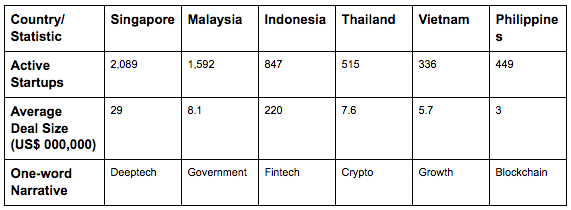

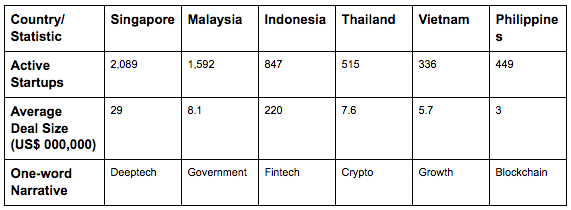

We tracked 5,828 startups currently active across the six ASEAN countries; these are companies who either created a new profile and/or updated their existing ones on e27’s media platform in 2018.

Although Singapore led in terms of total amount of startup funding recorded this year, Indonesia’s average deal sizes overtook that of Singapore. This is because though the country had far fewer deals, the huge investment deals raised by its two unicorns – GOJEK and Tokopedia – managed to skew the average deal size per startup to a whopping US$220 million.

Of course, the 327 deals recorded in Singapore were 3.5 times the number of Indonesia’s 93, which also affected the calculation of the above.

To add context to those figures, here’s a one-liner for each of the ASEAN-6 to sum up their narrative in 2018.

- Singapore: The government continues to ramp up deep tech innovations as part of its Smart Nation drive, giving rise to the new ABCDs in tech- Artificial Intelligence, blockchain, cybersecurity, data science.

- Malaysia: Major political changes and high profile movements within MDEC and MaGIC, two influential agencies driving Malaysia’s innovation movement.

- Indonesia: The country is finally embracing cashless payment, with competition among Go-Pay, Tcash, OVO, and Dana.

- Thailand: The government approved the use of seven key cryptocurrencies, including Bitcoin and Ether, for various commercial and retail applications.

- Vietnam: The only country with 2 equally vibrant startup hubs — Hanoi and Ho Chi Minh City — has moved beyond frontier Market status and is firmly a growth market.

- Philippines: The Philippines ecosystem has been quick to adopt blockchain technology; expect to see more blockchain innovations in the country.

Eyes on Tier 2 cities

While the bulk of the startup activity takes place mostly in capital cities, we are seeing a growth in new ventures opening up in secondary and fringe cities. For example, did you know that Siem Reap has given rise to notable startups including Kopernik and Apulus, and attracted global startup events like Techstars’ Startup Weekend to be hosted there?

Wait a minute, are you kidding me?

If you’ve read this far, you must have either been mind-blown (because you were too busy hustling to notice 2018’s growth in Southeast Asia), or noticed that there are still a lot of details and context missing to get a full and accurate picture.

Fret not, for this is just a teaser, and we’re reserving more figures and analyses for the actual publication titled e27 Startup Ecosystem Report 2018, which we expect to launch on the 15th of January.

But first, a caveat: the statistics in the full report will give you a clearer idea of the regional ecosystem but we do not claim the figures are completely accurate, as it is reliant on inbound participation, and we are fully aware there are startups who do not have any engagement with e27.

Nevertheless, the year 2018 saw the birth of this new initiative and we have great plans to be the Mary Meeker’s Internet Trends and roll it out annually.

This is not a one-off; this is a continuous effort to improve visibility and transparency in Southeast Asia’s tech startup ecosystem, and we are speaking to key stakeholders and various governments and in the region for strategic partnerships. But this is also a plea to the #e27community to continue engaging our platform proactively, as we continue serving our mission- to empower entrepreneurs to build and grow their business.

–

Get first access to the e27 Southeast Asia Startup Ecosystem Report 2018. Get report here.

The post A quick look at the state of Southeast Asia’s tech ecosystem in 2018 appeared first on e27.

Source: E27