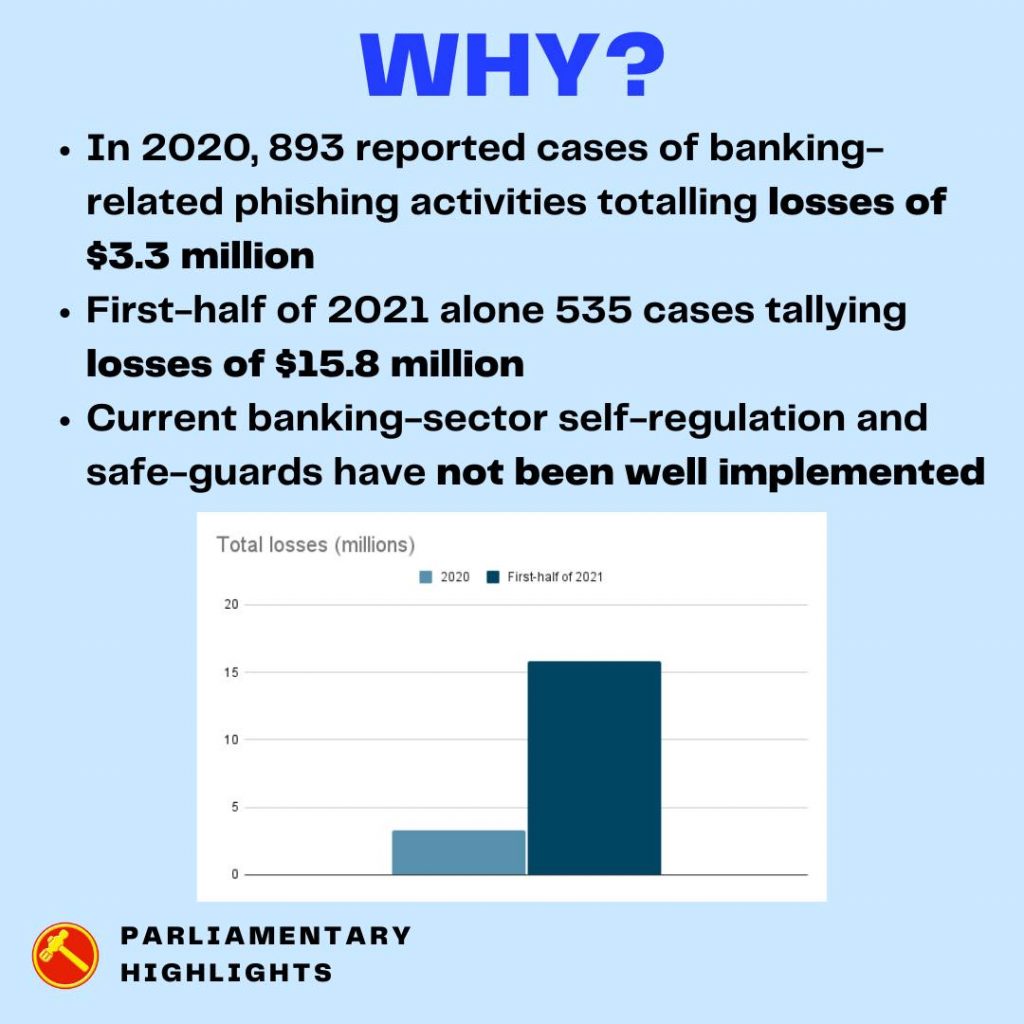

The recent spate of scams where people were scammed, and their money stolen from their bank accounts, has led the Workers’ Party to call for better financial protection for Singaporeans.

In Parliament earlier this month, WP MP Jamus Lim argued for a more comprehensive approach to protecting the interests of consumers. He said that constituents approached him after the OCBC phishing scam last December, which affected 790 victims, with total losses reaching S$13.7 million.

In a speech on the Financial Services and Markets Bill on Apr 4, Assoc Prof Lim (Sengkang GRC) urged for a more comprehensive approach to protecting the interests of the consumer. This would include an independent financial protection arm within the Monetary Authority of Singapore (MAS), as well as supplementing existing regulations with new legislation.

“The time for more consumer financial protection is now,” he wrote in a Facebook post on Thursday (Apr 14) as he explained further how victims of frauds such as the OCBC scam could be better protected.

“Victims aren’t usually spendthrift or greedy, merely trusting. The OCBC case at the end of last year is a reminder that many innocent victims could lose their life’s savings in the blink of an eye, just by (mis)trusting seemingly innocuous messages sent from an apparently trusted source.”

And while many might believe they’re immune from these scams, it only takes a “careless” or “distracted” moment, “to let something slip through, and the mistake would have monumental effects on our life as we know it.”

The Sengkang GRC MP added that even if banks would “have a vested interest in keeping their customers happy… unless there is some coordinated force to compel them to be more proactive, it’s easy to fall back on passing the buck to the consumer.”

These consumer protection actions come at a price, after all, and he added that more regulation is necessary.

The problem, however, is that the MAS is “overcommitted,” being “simultaneously the lender of last resort, banker to govt, inflation guardian, exchange rate intervener, financial stability promoter, financial developer, and financial regulator.”

One solution that would provide better financial protection from scams would be to have a dedicated and independent consumer financial protection arm that MAS would oversee.

This entity would “receive complaints from the public, and be empowered to advocate on behalf of the consumer.”

And while such a division is already existent in MAS, “its role appears to be more focused on the oversight of market professionals and sophisticated investors, rather than the common (wo)man.”

Assoc Prof Lim went on to write that when he lived in the US, “it had been easy for him to challenge unrecognized transactions on his credit card bill, and get them written off. This type of consumer protection causes merchants to become more careful about accepting fraudulent transactions because it affects their ability to use a payments system.

“Ultimately, whether we choose to enact greater consumer financial protection depends on us…

Many advanced nations have explicit consumer financial protection laws, which help ensure that financial institutions don’t just ask their consumers to ‘practice cyber hygiene’ but also take proactive steps to safeguard their customers.

We can choose the same. We can do more to avoid scams like what plagued OCBC customers late last year. We can share financial risks more equally.”

/TISG

Jamus Lim: Resident shares concerns over migrant professionals crowding out locals – Singapore News

Resident talks to Jamus Lim about challenges singles face in Singapore