SINGAPORE: A recent report by FICO has revealed a critical insight into the digital banking preferences of Singaporeans, highlighting a low tolerance for inefficient online experiences.

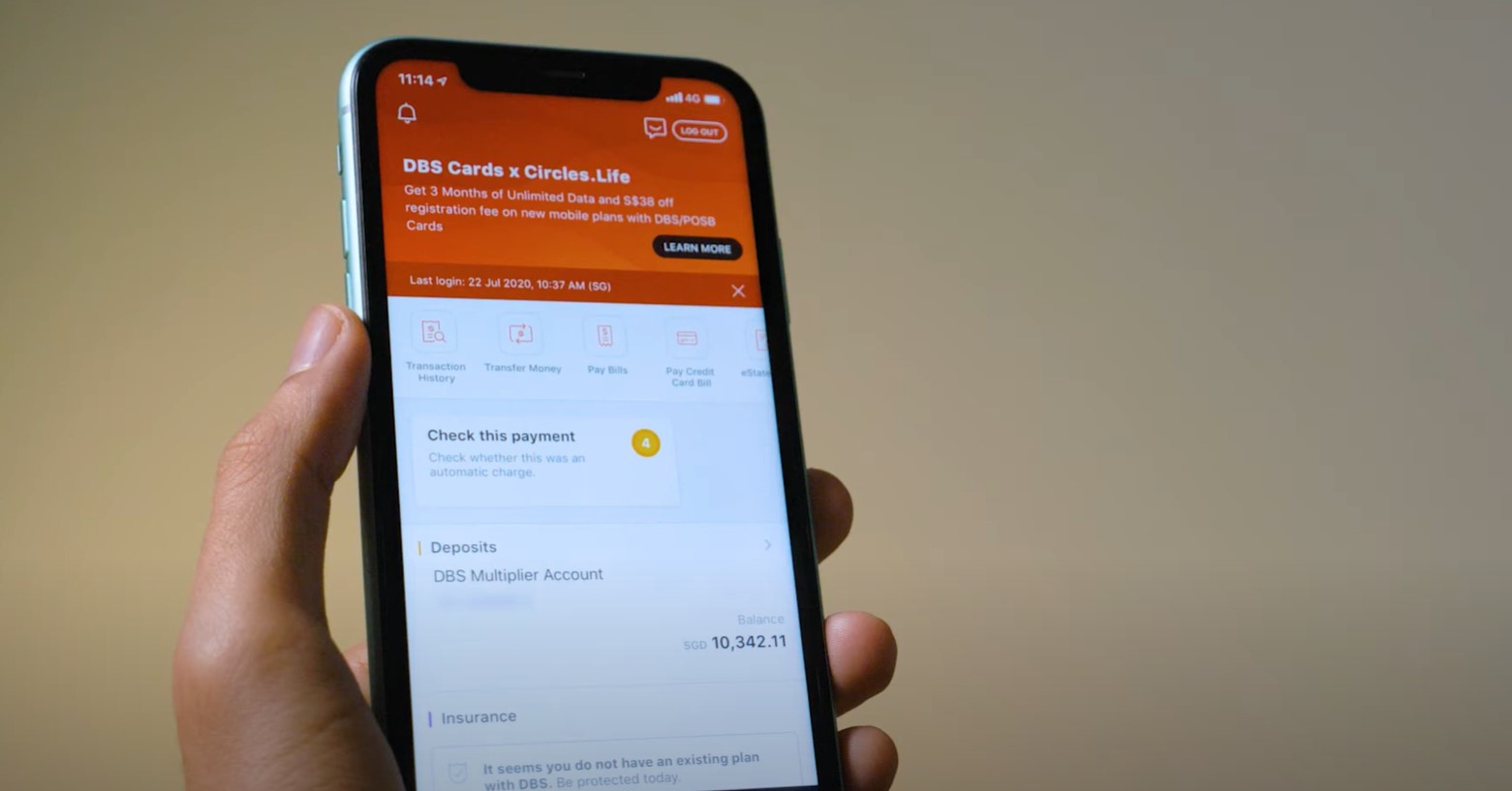

The findings indicate that 63% of Singaporeans expect to answer no more than ten questions when opening a personal bank account online. Should the process exceed this limit, these users are likely to abandon their applications.

FICO’s report further details that 29% of users will withdraw from the application process if asked more than five questions. Additionally, time efficiency is crucial, as one in three respondents will discontinue a bank account application if it takes longer than ten minutes, regardless of the number of questions.

The past year has seen a noticeable increase in identity checks, with 53% of respondents observing more frequent verifications when logging into bank accounts and 48% when making online purchases. This uptick in identity verification measures correlates with the rising concern over identity theft in Singapore.

The report highlights that 6% of online bank users have experienced fraudulent use of their identity to open accounts, and 25% suspect such misuse.

Despite the necessity of these security measures, they have proven to be a double-edged sword. The “cumbersome and time-consuming” identity verification processes have led one in five customers to either stop or reduce their use of existing personal bank accounts and credit cards.

Additionally, complex and lengthy identity checks have driven Singaporeans to abandon applications for personal bank accounts, insurance policies, and savings accounts, each at a rate of 25%. Credit card and mortgage loan applications have also been affected, with abandonment rates of 24% and 17%, respectively.

The report also highlights a significant discrepancy in comfort levels between different types of online applications. Only 17% of Singaporeans feel at ease opening a mortgage account online, while a larger portion, 34%, prefer to apply for personal loans in person at a bank branch.

Interestingly, despite these challenges, Singaporeans recognize the benefits of digital banking. The ability to open an account at any time is identified as the top advantage (64%), followed by the speed of the online process (60%).

These findings underscore the importance for banks to streamline their digital onboarding processes, balancing the need for robust security with user-friendly experiences to meet the expectations of their digitally savvy customers in Singapore.

TISG/