Margate Point, a 15-unit apartment development at Margate Road, is making their second attempt at a collective sale. JLL is the appointed sole marketing agent for the property.

Located off Meyer Road and Mountbatten Road, Margate Point has a land area of about 12,800 sq ft and is zoned Residential with an allowable gross plot ratio (GPR) of 2.1 under the 2014 Master Plan.

Margate Point may be redeveloped into a high-rise apartment project comprising a maximum of 24 units with an average size of 100 sqm per unit.

Subject to approval from the authorities, Margate Point may also be suitable as a serviced residences or as a co-living development. If approved for serviced apartments, the new development is estimated to be able to accommodate some 50 to 60 rooms which could be rented for a minimum seven-day stay.

Purchasers who wish to develop an entire building for co-living spaces or short-term accommodation should find Margate Point’s location, project size and price quantum attractive.

The Katong location has been a traditional favourite amongst both locals and expatriates due to its proximity to East Coast Park and the beach. Located only 15 to 20 minutes from the Central Business District and Changi Airport, Margate Point enjoys excellent, unobstructed views across the vast Meyer Road and Goodman Road landed estate, right up to the low-rise residential areas in Joo Chiat. The upcoming Katong Park MRT station which is expected to be completed in 2023, is approximately 400 metres away.

The owners of Margate Point are in the process of lowering their original reserve price of $38 million to $36.5 million.

https://www.icompareloan.com/resources/en-bloc-law-prevent-majoritarianism/

So far around 70 per cent of the owners have consented in writing to the reduced price. The Collective Sale Committee is optimistic that should an offer be received for the property, they stand good chance of securing unanimous owners’ consent to the sale.

Margate Point’s lowered reserve price of S$36.5 million translates to a land rate of approximately $1,362 per sq ft per plot ratio (psf ppr) for a redevelopment up to GPR 2.1, i.e. before any bonus gross floor area for balconies, a reasonable land rate vis-à-vis the transacted prices and asking prices of other land parcels in the vicinity.

The tender for Margate Point closes on Monday, 11 March 2019, at 2.30pm.

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

Whatever decisions owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Chief mortgage consultant of iCompareLoan, Paul Ho, pointed out that the rules for en bloc sale are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

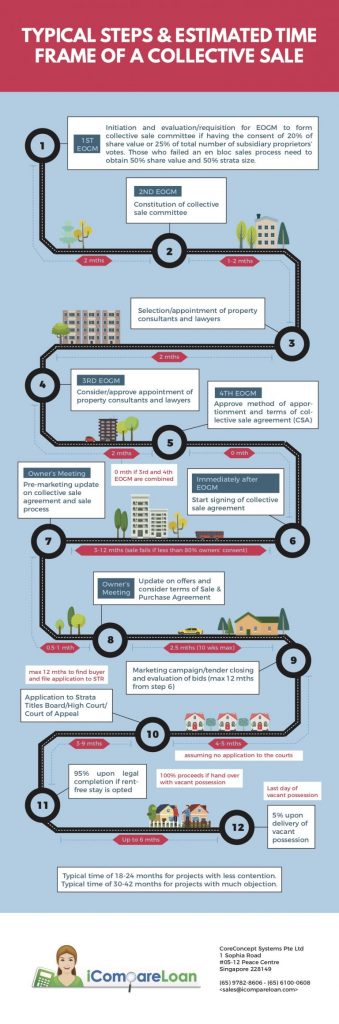

In order to understand how and whether to go into an En Bloc sales and sign on the Collective Sales Agreement (CSA), the owners will need to know how long it will take you to complete the En Bloc sales in case it is successful.The maximum and minimum duration of the en bloc sales process as indicated in the cumulative timeline in the table is roughly between 18.5 months to 38.5 months. The earliest any home owners can receive any en bloc sales proceeds could be around 13.5 months and the latest will be 32.5 months.

How to Secure a Home Loan Quickly

Are you planning to invest in properties like the collective sale relaunch site but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.