You have a startup idea. Now what?

You have a startup idea. Now what? This blog is going to take you through the key facets of a business model and the industry environment to help you build conviction that your startup idea makes sense before you start. It’s not just a list of things to test in coffee shops and with a live product to validate it.

If you internalise all the key factors, you’ll be able to rapidly evaluate each and every idea you have and hopefully help you mitigate wasting time on ideas that are doomed to fail for reasons you could have predicted.

When you have an idea, you will have a torrent of thoughts, especially if this is your first startup rodeo:

- Will VCs fund my idea? (No)

- Should I sell my house and just build this idea? (No)

- Should I validate my idea? (Yes!!!)

- Will it cost me a lot of cash to validate my idea (Not really)

- Can I validate this without talking to customers? (Yes)

- Should I talk to customers before building something? (Yes)

Clearly, you should start out doing the groundwork to really validate an idea. If you are not flush with cash, then you might be happy to know that spending money to validate your idea is actually the last step. There is a whole lot you can do if you understand business models to figure out if you are dead on arrival first, or if this idea is worth actually spending any time on at all.

Let me take you through the thought process of how to evaluate a business idea. First, let’s start by creating a baseline for your objectives to ensure the idea meets it.

Is this a side hustle or your big idea?

First, you need to set your personal expectations with any idea you will have. Are you doing a ‘side hustle’ and want to make some cash, or are you planning on going VC crazy and gunning for a monster exit? Both are equally fine. But there are large implications of both that heavily impact how you review the idea.

Side hustle

I bosh out some ‘startups’ which are basically passive income. If I make a few grand a month from them and I don’t have to do too much work, what the heck, right! But if you want to go big or go broke then the bar is really different, not just higher.

If you have a family, aren’t a big risk taker, but have an entrepreneurial itch, then why not launch something small? You never know, this could grow and become something big?

Ideally, it’s something close to what you do for a job or that is your hobby.

- If you have experience in M&A you could set up a course for budding analysts to get into M&A? Maybe you make models for PE investors?

- If you work in customer care, you might notice you built a handy little time-saving tool you built for yourself. Perhaps, other people would like that too? Why not polish it and sell it as a little SaaS business?

The main benefit of doing something ‘close to home’ is you really know what you are doing and are the customer yourself. You know already what people need and want, you might even know the market size and how much people will pay? That’s really handy, right! Might you even build something and get your company to be the first customer?

If this is your goal, you need to view your ‘idea’ through the lens of a side hustle. You might spend a few $k of your savings, but you don’t intend raising investment, so what you build has to be within these constraints. If it involves hiring 40 people and doing field sales, you should probably drop the idea and look for something easier to ship and manage.

Also read: Is Singapore’s early stage startup scene dead? What happened?

Gunning for a billion

If your goal with the startup idea is to make a tonne of cash which will involve raising a load of venture capital, you need to view your idea through an entirely different lens. The bar is 100x everything than for a hustle.

It needs to have a potentially huge market, there need to be scaleable acquisition channels, you need to be able to recruit an elite team, you need to think critically of your unit economics and you will want to have a special sauce that will imbue you with an enduring competitive advantage.

Figuring out an awesome VC fundable startup idea is not easy. When analysing your model you need to think far more critically than you would for a side hustle. Your idea might be fine for a side hustle, but you are going to drop most ideas as they just won’t meet the bar for investible. That’s fine, but be ok to kill your darlings. Don’t start something that doesn’t make sense, just because you want to do something.

How much do you want to sell for?

This is a question I ask all founders that I mentor and do consulting calls with. It’s is honestly incredible that 100% of people that I pose this to have no answer. They often say “hmm … I didn’t think about this.”

Whilst you care about your exit, it is all that investors think about. I’ve written about this in detail here: A meaningful founder exit is not the same thing for venture capital.

If you are setting up a side hustle you need to answer this question:

How much do I want to make each month to make this worthwhile?

This could be $5k a month. If you don’t think your idea can generate this much income, then you need to kill the idea.

If you are setting a VC fundable startup, you need to answer this question:

What do I want to sell this for and will someone buy it?

There are a lot of implications for how much you sell your startup for. If your goal is $20m it’s only likely at best fundable by one small angel round. That’s the only way the numbers work. If you are gunning for a $billion, then you are VC backable, but you’re going to have to build something really massive.

My recommendation is that you should aim to sell your startup for at least $200m. Sure, that’s still a large number, but VC’s business model needs you to have the ‘potential’ to be really large, assuming things go to plan.

For any VC fundable startup you are seeking an idea for, you need to write a $ number and figure out if your idea can get there. If not, then you need to drop it and keep looking. Don’t forget it’s ok to enlarge the market opportunity by redefining the market over time. Uber started with the market for black cars and then redefined it as the market for mobility. That’s a big claim, but hopefully, you get the implication.

It is worth bearing in mind though, that your pool of potential acquirors gets smaller and smaller as you become more and more valuable. There’s really only a handful of companies that can buy you for a billion. The number for $100m is vastly larger, as it is for sub a hundred. Consider the acquirers for different levels of success- are there many people who could buy me for $200m? Would anyone buy me for a billion, or do I need to IPO?

Additionally is what you are building a potential financial or strategic acquisition? You get better multiples for a strategic acquisition, but then why are you really strategic?

Ok, we are getting into the weeds too much now, but there are some of the ‘advanced level’ factors that you can retain in the back of your mind when evaluating an idea. I ask these questions to myself, but it happens in 20 seconds and not 5 hours. It’s a quick sense check.

Problem

By hook or crook you had an insight into a problem that people have and you think many people will share. This is always the first step. To be clear though, figuring out tech or a solution and then go looking for a problem is almost always a terrible idea.

I wrote about this in detail here: Your solution is not my problem.

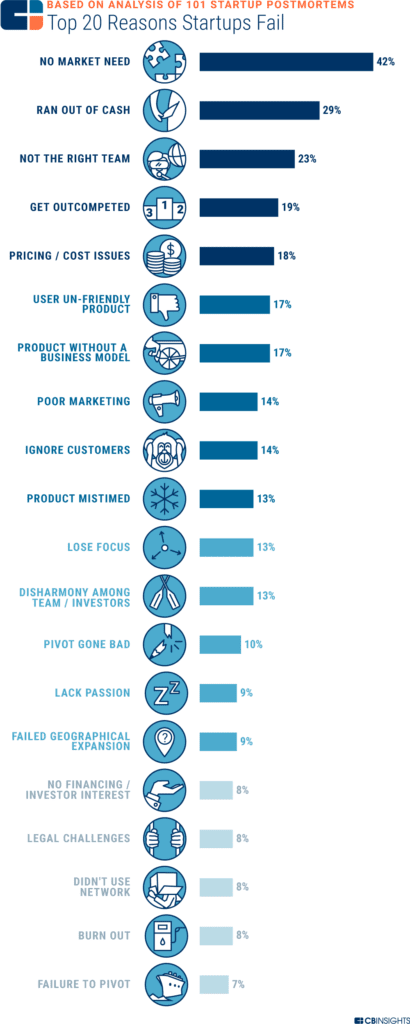

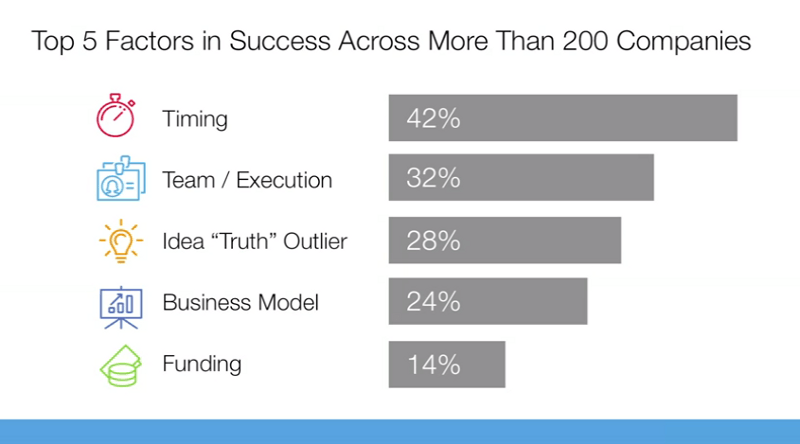

The solution may sound good, but not solving a real problem is a key reason for failure (42% of the time). See the main reasons for failure here:

Here is a presentation I wrote for a talk at Oxford about dumb ways startups die:

Give pain a name

You need to give pain a name, meaning get really specific. What is this problem? What exactly is the issue? How is it being solved now and what’s fundamentally flawed with that? It could be legacy architecture or archaic distribution strategy that would be too costly to change.

You then need to write that problem down and form a concise problem statement. This needs to be an incredibly crisp one sentence. If you say it to another person, they need to instantly ‘get it.’ So that means no jargon and $2 words! It might take some time to get this right, but by being really clear on the actual problem you are setting out to solve, you will not get confused about exactly what you are doing.

Here is a good and bad example:

- Bad: Help people make more money

- Good: SMEs in England don’t have an easy way to drive incremental revenue from their existing client base in an automated, SaaS manner

Your problem definition is a hypothesis that you seek to prove or disprove. When McKinsey seek to solve problems for clients they first define a hypothesis. This enables them to be focused on how they execute the engagement. It’s fine for that hypothesis to be wrong, but you need to have one at all times.

Also read: Venture debt is a viable alternative to VC funding, and it is getting hotter in Southeast Asia

How painful is it really?

How painful is the problem you have articulated? Is it a ‘broken thumb’ or a ‘fly flying around your head’. A broken thumb has the attention of potential customers. A fly is something you forget quickly.

The most common terms here to define problems are ‘Vitamin or painkiller.’ A vitamin is nice to have, a painkiller is a need to have.

The more painful a problem, the easier the sale is and the more successful you will likely be.

Following on from McKinsey learnings, you’re looking for a big ‘so what.’ You have a hypothesis but is there a big ‘so what’ with your idea that makes it meaningful? If there isn’t one, then it’s just not worth solving.

The other thing to think about is will people get addicted to your solution to the problem? If the problem is a one off your LTV needs to exceed your CAC by a multiple on one sale and not with repeat.

Casper and co who do mattresses may sell pillows etc., but people buy a mattress once every 7 years (I made that number up, I don’t know), so you need to be profitable on that one sale. Buffer is something you keep paying for if you want to make content posting easier.

If no one really cares about your problem, then kill the idea, unless it’s going to be a problem~2 years and you are positioning yourself for an industry change. Do think about the future market, not just the one you see now.

The key thing you are solving for here is “Is this really a problem worth solving?” If so, continue the analysis, if not, drop it!

Is this a priority problem?

Once you believe this is a real problem, it’s not enough for it to be a problem, it has to be a priority problem for your customers. This analysis is best done for B2B startups as it’s a little harder for consumers (B2C).

Your customers are busy and always have some crap to deal with. There are never enough hours in the day, the budget and the resources to execute on everything. If your target customer has a top 10 list of problems you have to be in the top 3. Top 3 problems get attention and budget.

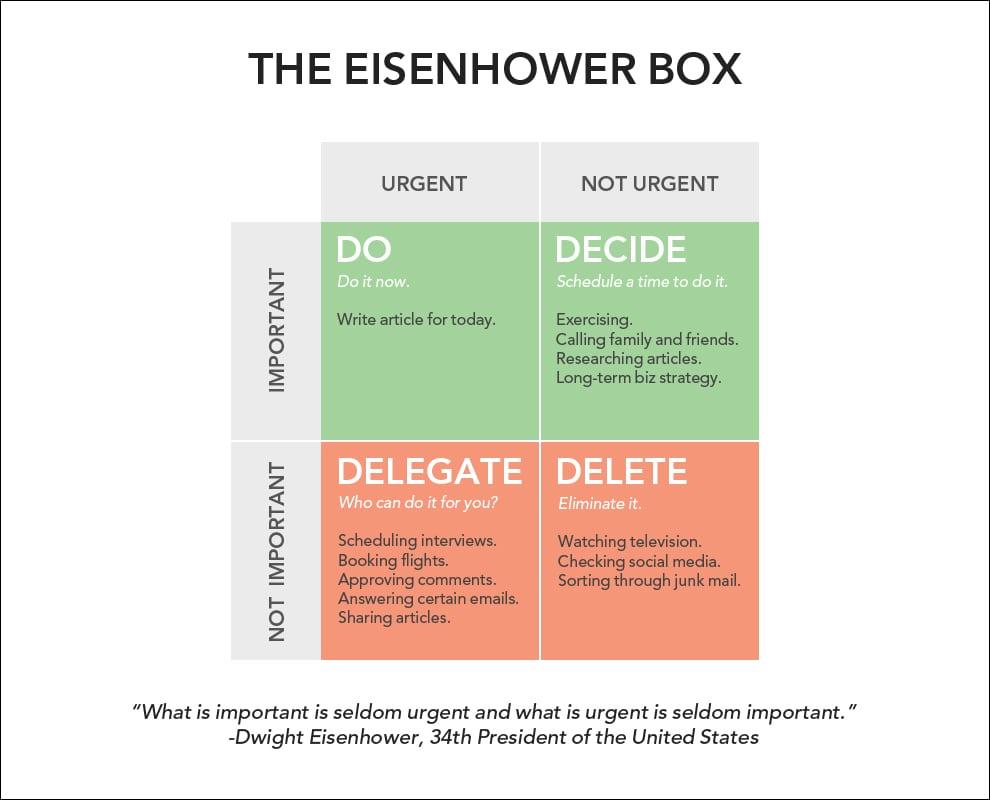

You can frame your problem in the Eisenhower matrix. Ideally, you want to be both important and urgent in the mind of your target customer.

Why is important and urgent so important? Startups are default dead. You need to close customers fast and get the next ones ASAP. If it isn’t important and urgent your sales cycle will be forever and you won’t make cash and you will die. Your sales team will not get meetings, won’t close and will get disgruntled.

I was working with an AI company and let me tell you, we got meetings with regional COO/CMO/CEOs of top-10 banks and insurers easily! What we were selling was important and urgent – it was of strategic importance. The people we were selling to could see that the solution would get them promoted! If you are selling to a problem where your corporate target believes they will get promoted, do you think they will pay attention and try get your offering bought and implemented? Darn tooting they will! The vice versa applied equally, though …

We need to get into the weeds of who your customers are, but you need to get clear about the solution you are building first.

Solution

Now you believe you have happened upon a great problem, you believe it is painful and it is urgent and important, you now need to figure out if can you solve the problem and in the smallest manner possible? You don’t want to blow $50k+ on the first iteration. You want to fail cheap and fast.

Can this be launched with limited resources?

The best ideas (given resource constraints) can be solved small. They can be launched fast. They don’t involve millions of dollars.

If you have to build crazy ass back-end architecture, massive logistics network involving a lot of CapEx etc, then you are going to fail expensively. Unless you have the cash, you can’t do that, but sure, some people can.

Can you solve the problem in a small fashion and still be compelling? With a broken thumb you want some awesome morphine. If I was a drug dealer and was like ‘hey dude, I have some vitamin C, want some?’ you’d be like f*** off loser. But if I said I have the legal, OTC morphine made in the garden by my Chinese, mystic grandmother that will take away all the pain without addiction, you’d be like f*** yeah! whoop whoop!

Ideally, you want to be able to code this up yourself or with a tech cofounder. You work hard to code something up in a few weeks and boom you are good to go. A lot of founders want to go straight to an angel round and expect investors to fund that idea. That ain’t going to happen, buddy. Get it out of your head. You need to test your idea without external funding.

So the key questions you are solving here, is can you launch this fast without a tonne of cash? Can you do this without any angel funding? If so, keep working on it, otherwise, keep saving money and work on it in future. Sorry.

Is there a niche you can sell to?

When addressing whether you can do this small, you are figuring out if you can launch with an efficacious painkiller, which whilst it isn’t as good as it could be (limited features) and as you would like, the core solution/feature is enough for a niche of your potential market to validate it is needed. But who is your niche?

Don’t go down the path of trying to do everything for everyone at the start. You can’t. You have to be super ghetto. You need to sell to someone. For Facebook this was Harvard students.

If you can’t articulate a niche market for your product, you are going to struggle with breaking through to anyone. 100 people who love you is waaaay better than 10,000 users that just don’t care.

Who is the tribe you are selling to and what features do they need?

What can you launch with?

Your goal is to be able to list in a very pointed fashion the exact feature set you will offer to your tribe. If you can’t elucidate exactly what you are doing, you don’t have a handle of the product.

Knowing what you won’t build and why not is also super useful as you know enough to know why not. You are demonstrating to yourself you know enough and are disciplined to prioritise.

If you can launch this cheap to a niche, what feature set do you need to provide to get going? Often you can start with a far smaller offering than you think. Common wisdom is ‘If you aren’t embarrassed by the product you launched with, you launched too late.’

Can this scale big?

Kicking off making the morphine in the garden is great, but you ideally need to be able to get to industrial scale production over time. You need to take that special sauce out of the garden and be able to put it in a factory. Can you actually do that?

You are fundamentally figuring out if you can actually scale this. There are a number of reasons why this may or may not be possible. SaaS companies are designed to be able to be scaled. But what if you rely on selling a really expensive product to affluent people in cities in NYC and London? Are there really enough affluent people for this idea to ever scale to the size you need?

This will be obvious or not, but quickly sense check if there is a reason this can never get big. If it is just going to be too hard, then you might need to drop it.

Competitive landscape

So once I know I have a cool problem to work on and I have an idea of what the solution could be now, and what it could look like in the future, the first thing I do is competitive desktop research. You have to do this. Competitive analysis is the main reason I would kill an idea.

To be honest, the moment I have an idea, I actually do a competitive analysis before even thinking about the solution (most of the time). It’s just such a better use of time understanding the market before getting emotionally attached to an idea.

Who is solving this today?

Spend 5+ hours (min) really digging into who the competition is. You want to understand not only what they do, but who they serve; you might just realise there is an untapped niche you didn’t think of and you could super target at the start.

Or, you could realise the comp is actually awesome and you just can’t compete. If you can’t realistically compete, that’s good to know early.

This really is one of the most key aspects of ‘startup idea’ validation.

What things do I do to figure this out?

- Google:

- Find a market landscape matrix

- Find a research report

- Read any announcements and find out who the key players are (note them in a list)

- See if there have been any acquisitions

- See who comes up first in SERPs

- (Turn off adblocker) See who is buying AdWords for keywords

- Are there any good TechCrunch articles on the industry

- Slideshare

- Anyone do an analysis so I don’t have to?

- Crunchbase: Once have a list of companies

- What year did they start

- How much did they raise

- What is the quality of the investors

- Did they raise subsequent smaller rounds or did they get larger

- Who are the similar companies to build out the competitor list

- How serious are the team

- AngelList: Not as useful as CB

- Read the description to understand what they do

- See if there is any useful info or not

- Company websites

- Study the main competitors

- Who do they focus on

- What does the product do

- Do they look serious

- Linkedin

- Check out the management/founders for capability

- How many people do they employ

- Glassdoor

- What do staff think about the company? You can learn a lot here!

- Spyfu: Get a feeling if competitors are serious, but this is advanced stuff I do later on

- Do they have a lot of backlinks

- How much are they spending on paid

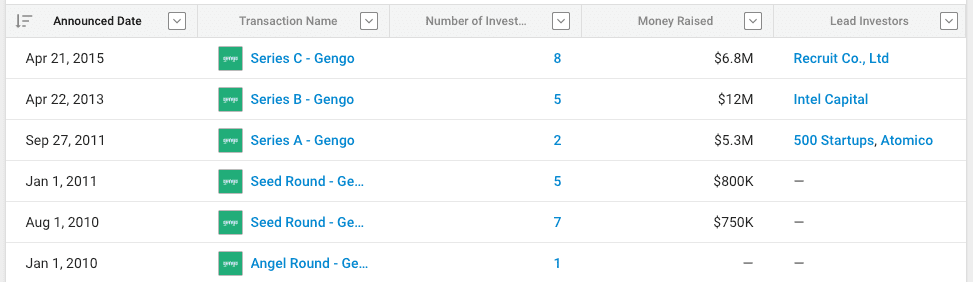

If you want the short version, I check google for loose keywords around the idea. I try to find an article on the industry which gives me a high-level overview and list of the competitors. Then I dig into the big players. I always go straight to Crunchbase and then Angellist and see how much they have been funded. If they haven’t raised much, you might still be ok, but I really wonder why they haven’t raised (Don’t think your competitors are incapable – that’s super ignorant!). If they have raised a tonne, you might be cautious and really wonder what the angle is. If they raised big and then did rounds which were smaller, there is a big issue! It’s either that the market is not there (bad news) or that they are crap at execution (good news).

Here is an example where I realised there might be an opportunity. My housemate was talking about professional translation… ‘Look at Gengo’ I said immediately, then I did a check. You can see on CB that their round sizes got smaller (see the B vs C round). Hm…

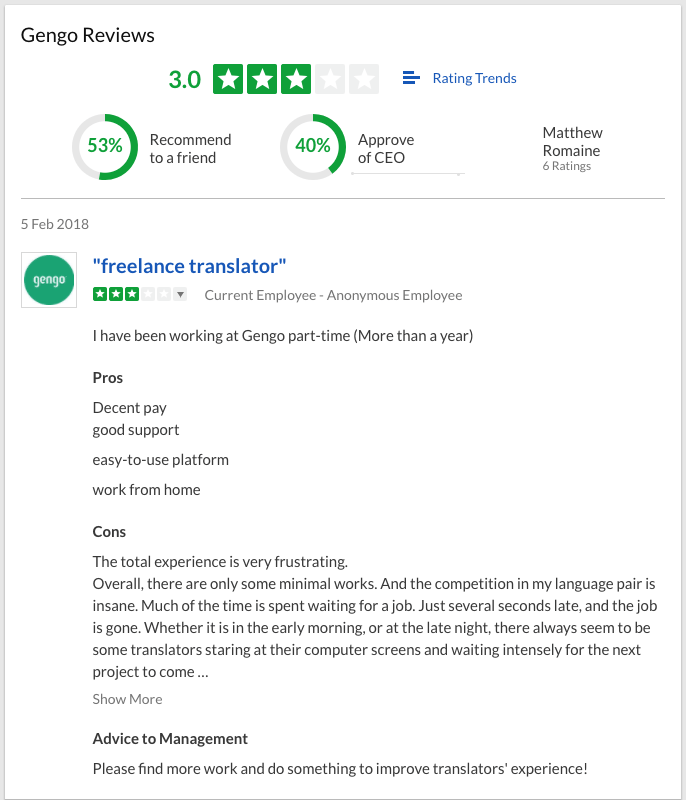

Then I read glass door reviews and realised there is an issue at the company.

I’m not super passionate about translation, but there could be an opportunity right now to do it better from a quick analysis.

Short version, there is a LOT to learn from competitive analysis if you know what to look for.

Also read: You do not need to choose a methodology to innovate

Who tried solving this before?

It’s good to be a student of startup history. There is a veritable graveyard of startups who have tried solving your problem before. They won’t always be easy to find out about, but if you can there is a tonne you can learn.

You can either try find old blogs (ideally a post-mortem! autopsy.io has a list of modern failures) or better yet, try reach out to the founders and learn from them why their startup didn’t work. Sure, they’re not 100% likely to even talk to you, let alone share, but you can have a go. Frankly, you’re more likely to get people to share when you are already live and operating.

“We’re trying to solve what UberSnap tried and here is the URL” will go down better than “We’re thinking about an idea in this space”, right?

This is so important. So from the analysis you want to figure out if this is a market that you can compete in and win? Is there a niche angle for you to start in and where? If so, then you can start getting a bit pregnant, if not, then maybe drop it and lament on the idea for a while to revisit.

Special sauce

To really win big, you need to do something special.

There are fundamentally two types of a market to solve for:

- Existing: If you are doing the same thing, it needs to be 10x better for anyone to care and move to you, away from your competitors. Zenefits is a great example of this. Free software monetised as a broker. It was so ‘unfair’ that they got banned in Utah

- New: You may think new markets are the best, but you are stuck with market education now. Your value proposition is going to have to be understood simply and fast and you may need innovative marketing strategies. And let’s face it, you are going to have to be able to pitch it simple, which most founders are terrible at!

Ultimately, whatever kind of market you are addressing, you need to be doing a good job and you need to be different and better. Only in a new market, the bar for the product may not have to be as high (it depends of course) as users may be so happy there is a solution they don’t mind how buggy it is (for early adopters).

The best business models are when you not only do something better and different but something unfair; you have a structurally designed mechanism that destines you for glory. There are 4 real enduring competitive advantages:

- The more obvious one is a network effect– see Facebook and Linkedin (These are always hard to start!)

- A data exponent is another. Think Google and search. Bing will never compete due to this

- Government regulation or protection is fantastic. MyEG in Malaysia is the sole provider to the Government services for work permits and the like. There is no competition.

- The last real one is brand. Think Coke. But that’s expensive as balls to build, right?

You could argue patents are, but:

- Patents have a shelf life of about 20 years

- You need the budget to defend them. The minimum you need to budget for a court case is $2m. And if you go against Apple you’re going to lose anyway

For normal companies, what you can do is:

- Flywheel: You do something which funds you getting bigger. As you get bigger you have more funds to get bigger and it perpetuates. It’s a little like a network effect, but it’s different and more applicable

- Unfair cost structure: There are ways to be really cheap. I was working with a client the other week and they have a way to be 16x cheaper than their industry. Sure, the comp could do the same thing, but it involves such a radical departure from their business model, they just won’t. But when a core aspect of your cost structure is 16x lower, that’s really hard to beat

- Timing and new technical architecture: These are lesser ones depending on your model, but they could be important. Think SalesForce going to the cloud. If first to market really is important (often fast follower is better) than timing can matter

So sure, you could just launch without an evil plan … but I prefer to play dice games with a loaded die. What about you? People who get rich have a model that just makes sense. It’s smart. What about you?

Market size

The market always wins. If you are doing a passive income hustle, fine, a nice uncompetitive niche is gold to make maybe 6 figure salary. That’s awesome, but for grand plans, the market needs to be a billion minimum.

Why does market size matter so much? 100% of a million $ market is a million. Your market size sets a ceiling for your business idea.

I’ve written about the market size being critical here: How big can this get? This market sizing question has killed many startup fundraises.

You need to know the market, but do it quickly. Someone might have done an analysis for an existing market already. Try find research reports; what does Euromonitor peg it at? Then do bottom-up analysis and think ‘there’s probably 200k people that might buy this. At $59 a month that’s $11.8m MRR at 100% penetration (not going to happen)’. Is that good or bad if you get there?

If you are doing the VC thing, don’t just think 1% of the market. As Sequoia dudes say, um, why not take 30%? But could you? Maybe? It’s ok to think expansively when evaluating your idea, you just need to have a thesis as to why you think you can own the market.

On this topic, one strategy is to actually dominate a market by doing something that actually shrinks it, but be so competitive you end up owning it. You can learn about this strategy here: Shrinking a market and owning it.

Things are harder if your idea is for a new market. You can’t do a top-down analysis as no one has done the work for you. You need to make some reasonable bottom up assumptions. I would just think ‘is this a problem a lot of people have?’ If so, that’s enough.

I’m not going to harp on, but the market size is soooo important depending on your aspirations. Really figure out if there is real money to be made and how you can target them and how much it would cost?

It’s kool and the gang if the market is small now. It could grow…but you need to have a thesis as to what the drivers are that will grow the market? Are you tapping into an industry trend?

When I am doing an analysis to validate an idea, I don’t spend too much time here. Market sizing to me is a bit like porn, ‘I know it when I see it.’ If the market just feels too small, I drop the idea. If it feels right, then plough on. I would do a more detailed analysis before I pulled the trigger though.

Industry trends

What’s happening in the industry? What is changing? What will the market look like in 3 years? If the market is going to grow, then awesome. A tiny market no one cares about now that is poised to be huge is gold! You’re at the perfect time to start. The corporates will view the market as a toy and ignore it. But it could be enough for you to stake your claim and position yourself for when the crazy times happen.

So many companies have come undone because the market didn’t look like it was worth playing in. Desktop install companies were undone by the move to the cloud (i.e. Salesforce).

But for new industries with no existing competitors, think about Coinbase. No one could give an ass about it a few years back… but who’s laughing now?

But… think about NFC! I’ve had calls with a bunch of older dudes who tried NFC with cool tech but the market just never took off. So they’re dead.

The reality is you never know, but having a sense the market might take off helps you validate your idea for the long term and give you the confidence you are working on something that looks like a toy car now but might be a Ferrari in the future.

Really big companies have been built because they rode the right wave. Being at the right time at the right place can be more important than just doing the right things. The wave pushes you forward despite your incompetence! People who did ICOs made money…

Timing

Bill Gross at Idealab did some analysis on why startups succeeded or not. Watch this TED talk.

Also read: Is innovation all about breakthrough ideas only?

Timing matters. Timing is a little different to industry trends though, as it’s the Y position on the slope. You want the right trends to yield you an awesome slope, but where you are on the curve matters. If you are too early the market may be too small to sustain you. If you are too late you might not be able to compete. I don’t know how to get the timing right, but you should have a think, given what you know, why now is the time to start.

As someone who has founded or been part of monster companies and spent dick loads of money on marketing like Groupon, Lazada and Delivery Hero, market education SUCKS BALLS. It costs soooo much money.

In Asia, before Lazada, no one shopped online. Lazada was one of the biggest charities for founders, educating millions of Asians about shopping online. Millions. Now the competition just competes for the people we brought online.

If you have to do market education you need to get fancy with marketing. Think about Birch Box who popularised the concept of a box a month (and unboxing as a strategy). No one was searching for ‘beauty boxes’ so how do you do SEO? You don’t.

I have a monster blog to teach you about business models and strategy here. One of the case studies is Birchbox. It’s a long blog, but worth reading.

You need to have a think about how the hell you market your idea whether you are in a new or established market.

If you are doing B2B what is the install like? Do you need to do lengthy onboarding? Infusionsoft charge customers $2000 (sometimes have discount offers of $300) to onboard customers! Can your unit economics afford field or phones sales? Can you do customer success or even customer care? If not you need to design your marketing and product accordingly.

Think about your primary marketing strategies and question how easy it will be to find customers. If this is a ‘latent problem’ you need to educate customers. Be cognizant of this fact.

Customer definition

Never sell to ‘everyone!’ You need to segment customers and segment again. You need avatars for customers. Who exactly are you selling to and why do they use you?

Be super niche at the start. Think about Facebook, duh. Harvard, then some other unis then…. Senate hearing committees.

Don’t build a CRM for everyone. Build a CRM for Doctors specialised in infant mortality in the greater Atlanta region starting out. I know that sounds lame, but ‘do things that don’t scale.’ I know that’s not the perfect mapping to my point, but start small is the start to scale. The benefit of focus is you can really target.

Now think about how you do marketing. When you are testing your idea you can do FB ads targeted at ‘Doctors specialised in infant mortality in the greater Atlanta region’… do you think that targeting will have higher or lower conversion than targeting ‘everyone?’

So use Canva, etc., and make really specific ads, use FB and a/b test your custom audiences to those ads and see how they convert.

If you can’t identify a nice avatar and a niche market you are targeting, this isn’t the end of the world, it’s the basics of Customer Development Methodology. You’re just going to have a bit of a painful time figuring out who your actual customer is. Fine. This is not a reason to drop your idea, just list it as something you need to prove for.

Unit economics

When you have no data, there is not a huge amount of analysis you can do. And if you suck at Excel it might take you too long to learn to be able to bosh out quick and dirty models. But you can do analysis to varying degrees.

Before I commit to launching something I do analysis on the basics of my theorised CAC and LTV and associated operational costs. I’m good at Excel so I can just bosh them out. I use very few assumptions, but I want to get an idea of what the operating model looks like numerically. You don’t want to launch something where the fundamentals don’t work. Doing the math helps.

I helped a client build his financial model. We realised his business model would simply not work with his approach to CAPEX. With that numerically clear, he reached out to the head of France for X big company and got his tech on a licensing deal which suddenly made his startup viable. Booooom!

Yeah, it takes time, but if you ran the numbers, you wouldn’t need to write a line of code before you knew your idea literally doesn’t pass the numbers test (You can listen to my podcast on the two key test you need to pass to be fundable here).

If you suck at Excel, here is a free pragmatic course to teach you.

Here is a live video example of me building a model for one of my startup’s Perfect Pitch Deck. I take you through how I build it step by step.

I highly recommend getting an idea for what your CAC and LTV will be. All startup is just a function of these two numbers. Your forecasts will be wrong, but you need to fathom what you can play with on the CAC side to get a sense for what channels you can afford, or not. If your LTV is about $50, you can’t afford paid channels with $200 CAC (CPC x conversion rate).

If you want to get into some more detail, I wrote a blog about why you should build a startup and why passion is overrated. This is incredibly linked to what we are discussing in this blog. Another recommended reading: Passion is over-rated. Build a better mousetrap instead.

Acquisition strategy

I talked about market education, which sort of addresses this, but get really clear on how, where and for how much you will acquire your customers from.

You really need one channel that works. Do you know what this is going to be? How scaleable will these marketing channels be?

If it is paid, it’s easy. You just get ideas for search volume, CPCs and then make assumptions on a conversion rate to get the CAC. I would inflate this number as it doesn’t get cheaper over time as you scale (assuming you plan on scaling).

I wouldn’t rely on something like channel sales at the start. That’s just not going to happen. Platforms are not interested in giving you their customers, they are interested in taking your customers. For enterprise, S&I is the same. Don’t go there till you have already scaled a bit.

If you are doing SEO, can you actually compete? What is the search volume and how competitive are the keywords?

You want to have a quick think about these, but if you aren’t sure, that’s ok. You can launch and figure it out…. but it is something you can develop a go or no go thesis for.

Founder-market fit

You should really question if you want to do this idea and if you are actually the best person for it. Founder market fit matters.

You will only really kill it if:

- You know everything about the industry and are an insider

- You have the network for deals etc

- You have a pool of talent to hire

- You understand the ‘why’ behind the what and when

Sure, plucky kids can do cool stuff, but would you not prefer to back an insider as an investor? If you are building a VC funded startup then understand that the team is 70% of an investor’s investment decision.

If you want to learn more about what an investible founding team is, then I wrote a presentation on this topic: Investible Founding Startup Teams.

Ask yourself if you are the best person to do this… if you are doing the VC thing anyway. But learn if it is a side hustle.

Execution complexity

There are reasons why people in Asia copy startups in America. You don’t get it if you are in America. There is a contiguous land mass and sure there are state laws, but everything is basically the same. There is a tonne of service provers, yada yada.

Try doing ecommerce when your logistics providers suck and you need to teach them how to do their job. I’m not fricking joking. At Lazada, we had more data about logistics company operations than they did and we had to teach them. Everything is hard in new markets. Make no assumptions.

Now let’s pick on enterprise. Sales cycles suuuuuuuuuuuck. 12 months plus is a nightmare and real. I know. I sold to insurance companies and banks. One mate at the investment bank with the largest tech budget on the street said it would realistically take 13 months to be in production (and getting those licence fees).

I can go on, but the point is this. How hard is it for you to execute on your startup? If you are in emerging markets, don’t make assumptions …

Also read: From startup idea to success story: 7 things all entrepreneurs should know

Investment thesis

As a final point, before you start, write an investment thesis. Explain why this makes sense and what you need to prove for this to work in the short term. Be explicit. Then set out to test it.

Write it down so it is real. I don’t have any examples to share right now. I’ve been meaning to write a blog on how to do it.

Testing

Ok, we went through the fundamentals of a startup idea. That is real validation, not just a cheaper alternative to test your idea with AdWords.

Once you really believe you are on the right track, it’s time to actually do some startup planning. How do you execute this?

If we are talking tech product, you need to figure out your starting value proposition. I talk in terms of minimum desirable product, not MVP.

Here is the The real reason to launch faster (not talked about) and I highly recommend reading if you intend raising money.

But… you don’t start with the tech. You want to do some testing, so do this:

- Talk to potential customers. Do they like it and will they pay? Actually, pretend you have product and ask them to pay for it. That’s the difference between talk and walk. Most people will say they like it and will pay it to be nice, but they won’t cough up the dough when you ask for it

- Starbucks ambush. If your market is consumers, ask your avatar in Starbucks in return for a coffee. Tell them it’s your brother’s idea, not yours as they will be more likely to be honest. People are generally nice and don’t care enough to be honest if there is even the inkling of it getting weird for them

- Do a survey. Post if on FB, Hackernews, Reddit, message people etc. Get feedback on the concept, pricing etc. You can chuck in a prize of an Amazon voucher.

- Ask your smartest contacts for feedback. Pitch them the idea. You will learn. Yes, your idea sucks and yes you should share. You can only learn. No one is going to copy you

- Pitch an investor if you have the network. Again pretend it is real and get feedback (negative too)

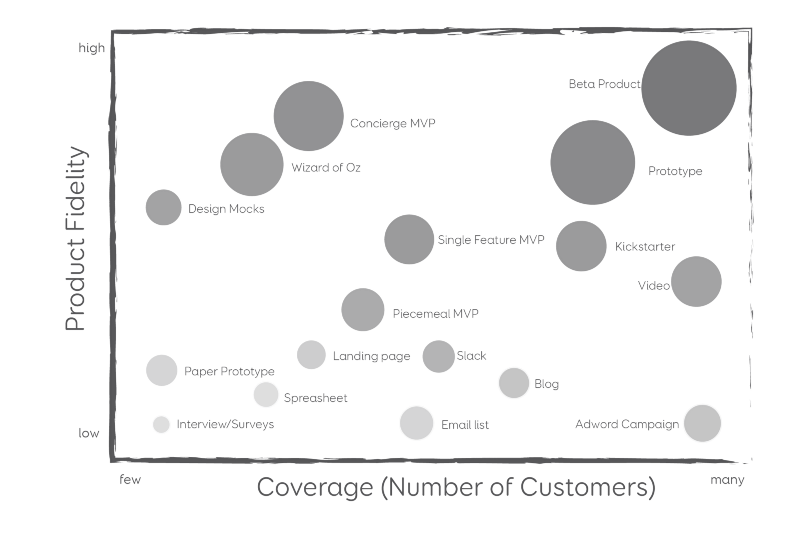

This blog is more about fundamentals than the customer testing part, but this graphic is pretty interesting and informative, to get an idea of how much work you need to do vs the amount of customer validation. You can see an actual beta product is in the top right and interviews are in the bottom left.

Refine your pitch and product. Figure out if this actually makes sense.

Live test

Don’t build a product first. ‘Ship’ vaporware.

- Name the company

- Buy domain

- Set up a landing page

- Ensure your hero has a ‘to the point’ statement and CTA

- Populate a pretty site which sells benefits

- Set up GA and GTM to track

- Buy some targeted FB ads- key is you want ideas around CAC

- Post to Quora, Reddit, HackerNews, Medium, Startup FB groups…

- Track metrics

- Goal is sign ups

Does it convert or not?

If so, congrats, you have a lead list. If not, you failed fast.

Example

Here is a real example of a consulting like startup I started this year, Perfect Pitch Deck. It helps founders unsuck their pitch decks and help them look fundable.

What was my thesis?

- Pitch decks suck. I know because I get them every day

- There is a large market as there are hundreds of thousands of startups looking for investment and there are competitors in the market already

- Founders don’t know how to write them and would pay for a service with guaranteed pricing

- A lot of issues can be removed by simply redesigning them and rewriting the content

- I’m the best person for this as I am already an expert at pitch decks

- The unit economics will work under certain time constraints and being able to leverage lower cost base of certain countries to execute some of the work

- The cost to launch the service will be low and I can do it fast

- I can acquire customers through Facebook ads profitably

- This isn’t a massive business, but the RoI is enough to warrant me testing it

So I launched it.

What were the exact steps I did to launch this?

- Saw someone do AdWords for pitch decks. Wtf?

- Saw they had 8 people on their hiring page

- See they raised $500k or so on angellist

- Google who else is doing this. Eh, whatever, I’m not going to raise, who cares about competition but understand pricing.

- I’m an expert on pitch decks (founder market fit) so I don’t care as nothing to learn to start

- Do excel model to understand unit economics (Watch it)

- Only costs me a site and some time to launch, f*** it, launch it

- Copy site. Copy … everything. Ghetto on WordPress, Buy theme for $59 and host. (Step by step guide). Just get it done

- Pay chick on Fivrr to make logo for $20

- Set up Stripe

- Get my girl in Phillippines to set up GA and GTM for me

- Pay a dude to build a pricing form on Upwork which sucks. Pay a chick on fiver to build on Jotform (works better) but takes time. FML. Down maybe $150

- Steal my own blogs from alexanderjarvis.com on pitch decks and post on ‘blog’ to fake content

- Steal my ‘featured in’ type logos to add social proof to the site

- Learn how FB ads work

- Brainstorm problem statements to market this

- Use Canva to make some ads

- Set up FB myself and do retargeting on my blog (focused on startup founders also). Scream f*** FB ads is such a crap platform…

- Get a customer for €380 the first day I start ads. Holy crap that was fast. Screw it, let’s put in more work

- Make site nicer (ish)

- Set up some basic marketing automation and lead magnets for an email automation course (Step by step guide)

- Get €22k worth of clients in 2 weeks

- Make site better. French designer says site is terrible, so learn about design. Redesign.

- People start saying site looks awesome.

- Add a new lead magnet to do ‘free pitch deck audits’ and start getting a load of leads which 70% convert (most are too poor). Make template deck which is backed by AI analysis which people think is cool

- Clients start returning for other kinds of help. bla bla bla…

That’s literally what I did to launch and test a startup idea.

Conclusion

Most of the work to validate a startup idea is on the back end and business nerd orientated. I’m certain most founders are not aware quite how much that can be done to derisk their startup idea. The reasons for failure are so common. Of course, your assumptions may all be wrong, but I’d prefer to go into a market with my eyes wide open about what I am seeking to solve for, then just winging it.

Once you have done the groundwork, then it’s time to apply what you have read or learnt about CDM (customer development methodology) and get customer feedback. Yeah, that matters, but there’s a lot of work to build a compelling thesis first.

I hope this guide is useful to help you think about how to review startup ideas. If you need some help figuring out if your business model makes sense or not, you can book a one on one call with me and I can help you with the thinking. Book a time here.

—-

This article was originally published on alexanderjarvis.com.

e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Photo by Markus Spiske on Unsplash

The post The definitive guide to validating your startup idea appeared first on e27.

Source: E27