In answering a parliamentary question, Senior Minister and Minister in charge of MAS Tharman Shanmugaratnam said: “Borrowers who have difficulty servicing their mortgages should approach their lenders early to explore possible loan refinancing and repayment solutions.”

The Senior Minister was responding to a Parliamentary question asking, “Given the recent increase in interest rates, what is MAS’ assessment of the risk of borrowers defaulting on loans financed through floating rate loan packages offered by local banks.”

Mr Tharman in replying to the question said,

“The household debt situation in Singapore, by and large, remains healthy, and should remain so in the rising interest rate environment… (but) there will be a small segment of households who are more highly leveraged and will be more seriously affected by interest rate rises (and) borrowers who have difficulty servicing their mortgages should approach their lenders early to explore possible loan refinancing and repayment solutions.”

“The household debt situation in Singapore by and large remains healthy, and should remain so in the rising interest rate environment that we face.

“The median Total Debt Servicing Ratio (TDSR), which measures the proportion of income spent on debt repayment, is 43% for new mortgages issued over the past year, well within the regulatory threshold of 55%. The proportion of non-performing mortgages in overall outstanding mortgages has also remained low and stable at less than 1%.

“The average loan-to-value ratio for outstanding mortgages extended by financial institutions is less than 50% as at Q1 2022, suggesting that households generally have significant net positive equity in their residential properties. Households’ cash deposits have also grown faster than their liabilities, which improves their ability to meet immediate debt repayment obligations.

“The overall financial resilience of households to service their mortgages reflects the measures that MAS has put in place over the years.

“(a) The interest rate used to calculate loan repayments under the TDSR is the higher of 3.5% or the prevailing market rate. This rate has built in a buffer against interest rate rises for borrowers who have taken out a mortgage in the past.

“(b) Loan-to-value limits and restrictions on loan tenure have also encouraged greater financial prudence among mortgage borrowers.

“Looking ahead, stress tests by MAS suggest that most households, including borrowers on floating rate packages, should be able to service their debt even under conservative scenarios of significant income losses and a full pass-through of sharp global interest rate hikes.

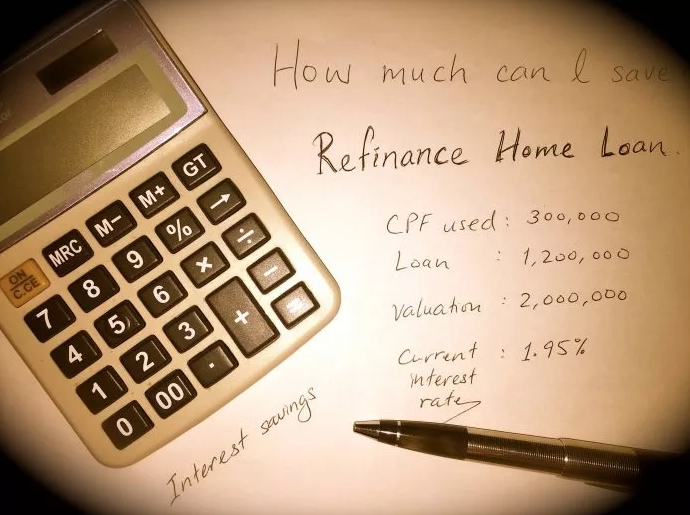

“That said, there will be a small segment of households who are more highly leveraged and will be more seriously affected by interest rate rises. Borrowers who have difficulty servicing their mortgages should approach their lenders early to explore possible loan refinancing and repayment solutions. For financially distressed HDB homeowners, MAS has worked with MND, HDB, MOM and financial institutions to establish standardised interventions when late repayments occur.

“These include potential loan restructuring solutions, early referrals to appropriate social service agencies and in certain limited cases, helping homeowners obtain alternative HDB accommodation where foreclosures are unavoidable.

“MAS urges everyone to exercise caution in any new borrowings. Households should assume that there will be further interest rate increases over the next year at least, and be sure of their ability to service their loans before making additional commitments.”

— Mr Tharman Shanmugaratnam, Senior Minister and Minister in charge of MAS

Considering the increasing global interest rates, the rising borrowing costs for home loans are inevitable.

SORA will rise in tandem with the internationally rising borrowing costs

Our domestic benchmark interest rate – the Singapore Overnight Rate Average (SORA) – is set to hike up in tandem with US rates. But for now, mortgage interest rates are still competitively hovering around 1.65 – 2.35 per cent, but they will continue to go on the up and up throughout 2022.

How the FED interest rate hike works are by making loans more expensive and, technically, should lead to reduced spending. The move will put pressure on Singapore’s financial institutions to raise interest rates as well, which is why homeowners should explore possible loan refinancing.

As most home loan rates are now pegged to SORA, you will not see interest rates prematurely rising too out of step with the US Fed Funds Rate. This is because although SORA is a “backward”-“-looking interest rate mechanism that reacts to interest rate movements in Singapore, changes to the US Fed Funds Rate have global repercussions, so SORA is expected to react accordingly.

The biggest interest rate hike in the US will definitely dent some of the enthusiasm in the buoyant property market and could pose a big problem for homeowners who are still servicing their mortgage loans. This is because banks and financial institutions calculate lending rates by adding a margin (which covers their costs and their profit) to a published financial index, like SORA.

The post “Explore possible loan refinancing”, Tharman tells highly leveraged households appeared first on The Independent News.

Read also:

Singapore goes to the polls: Tharman, Ng Kok Song, Tan Kin Lian qualify as presidential candidates

Calvin Cheng predicts a two-horse Presidential race — Tharman and Tan Kin Lian – Singapore News

“Singapore’s presidency a consolation prize for Tharman” — Prominent historian