e27 chatted with Benoit Meneau, CEO and co-founder of Thailand-based digital accounting platform Plizz about the ease in dealing with accounting through their platform

Benoit Meneau, who spent the last 15 years living in Southeast Asia and worked as Chief Financial Officer for most of the period, could not help but notice the lack of fast, cost-efficient, and transparent accounting services, particularly in Thailand. “Cloud accounting services are already very popular in Europe and America, hence I decided to import the business model,” he confided with e27.

Your Do-It-Yourself accountant

The Do-It-Yourself approach is arguably one of ways a startup can survive, especially companies that offer a relatively niched service. Plizz both belongs to that category, having been founded just three years ago, and specifically targeting accounting departments for companies that have yet to have a solid team of accountants and can only afford to DIY their own accounting.

Providing technology-powered accounting services to SMEs, Plizz targets companies that don’t have the resources to hire a full time accountant, making the accounting matter something that can be done by anybody in a company with access to Plizz’s account. It’s either that, or making the lives of in-house or outsourced accountants easier.

Also Read: Ofo denies using GSE cryptocurrency for fundraising

“We aim to help them lessen time spent in all their accounting & tax obligations so they can focus on developing their business,” said Meneau.

Transparency matters

In a world that slowly but surely shifted to inclusivity, transparency becomes one of the main things Plizz offers to its customers. “Plizz’s all-inclusive packages give our users full online access to their accounting data on a user-friendly platform. Users can see what’s been dealt with, what is pending, and what is in review.”

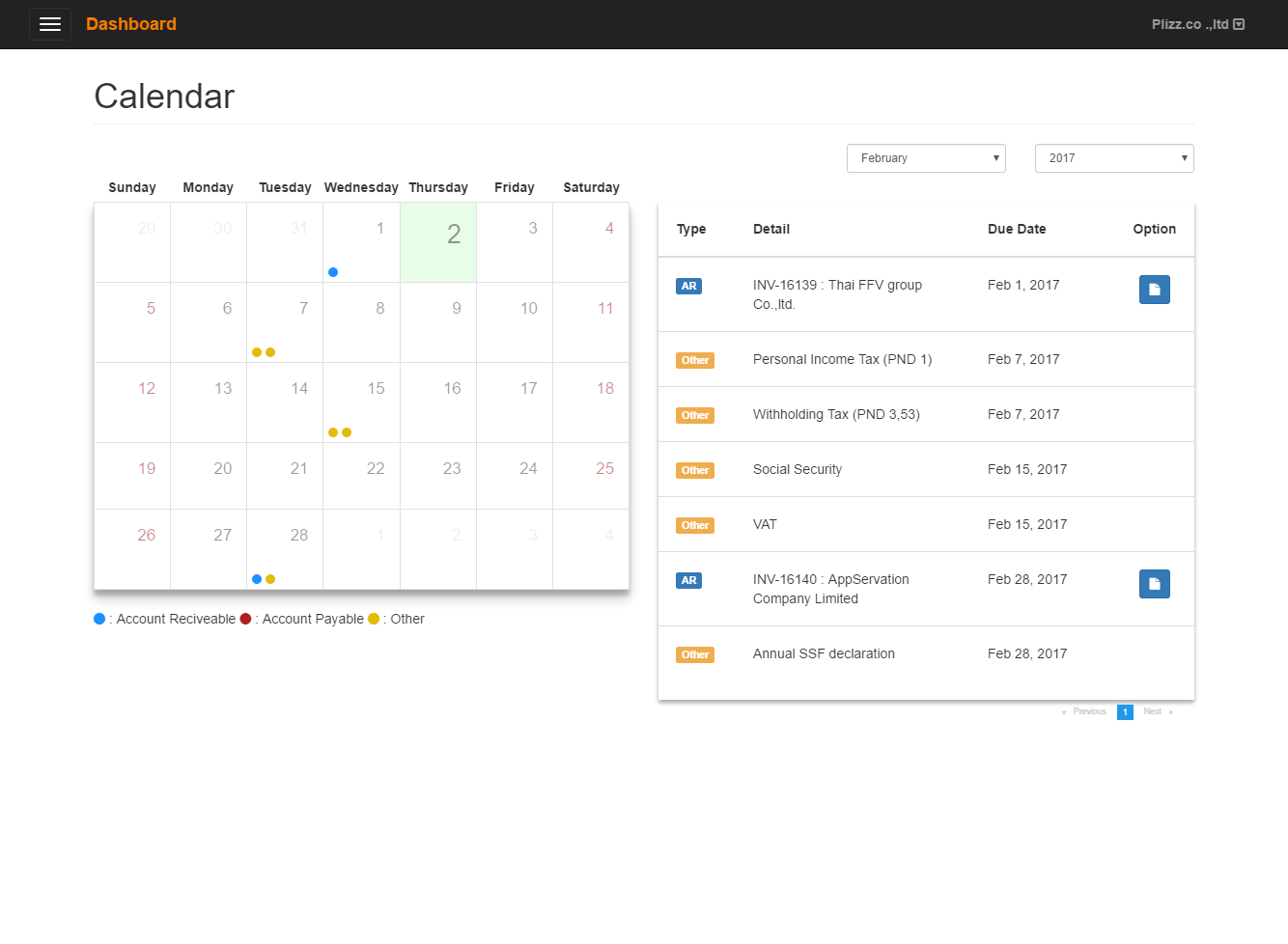

With these three promises, the software manages to bring forward services like Bookkeeping, Tax Filing & Submissions, Payroll & Social Security, Document Filing, Compliance & Finance Management Monthly Reporting, Annual Audits, and P/T Consulting. The special features in the app include financial statements, invoices tracking, and tax calendar.

“It’s all about simplifying the process of accounting. We feature a real experienced and certified accountants that work behind the software to make the platform a solution to any accounting need,” said Meneau.

Also Read: Cradle Fund invests in Malaysian international shipping startup Yellow Porter

The company lets users to have unlimited communication access to the team of bookkeepers and finance experts on hand to help with immediate needs. It is essentially an extension of the core team of the users’ businesses.

Setting the bar high

Plizz’s special feature lies in its completely-controlled-by-users nature. The software allows the users to have an insight into their state of finances, making accounting data significant in making strategic decision to improve business.

The company also makes sure that they operate on an encrypted and maximum security platform, to ensure users’ databases are not vulnerable to attacks — in fact, servers are located within the country, to ensure data sovereignty.

Since everything is automated, the bookkeeping service is also made paperless hence the lower costs and simpler process.

“Right now, what sets us apart is that our clients can have access to their accounts at all time, which no other provider is offering to the SME market specifically,” said Meneau. “Soon enough, we will launch new modules enabling clients to issue invoices and create bills from their platform,” he added.

Plizz has been selected among the APAC Top 100 Start-ups presenting at Echelon APAC Summit and has been part of the first Top 10 start-up graduating from DVA accelerator, the venture capital branch of the Siam Commercial Bank.

Here are the details on how to use Plizz’s software:

Clients are being onboarded online and this is the dashboard that welcomes the users

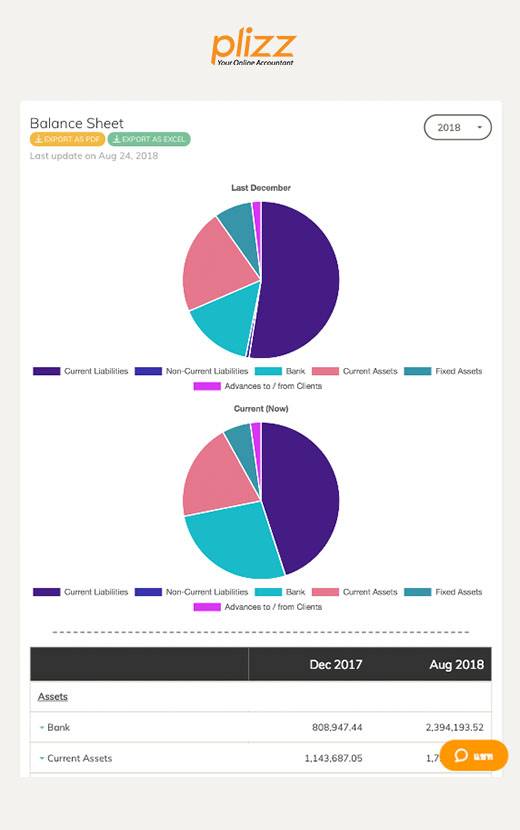

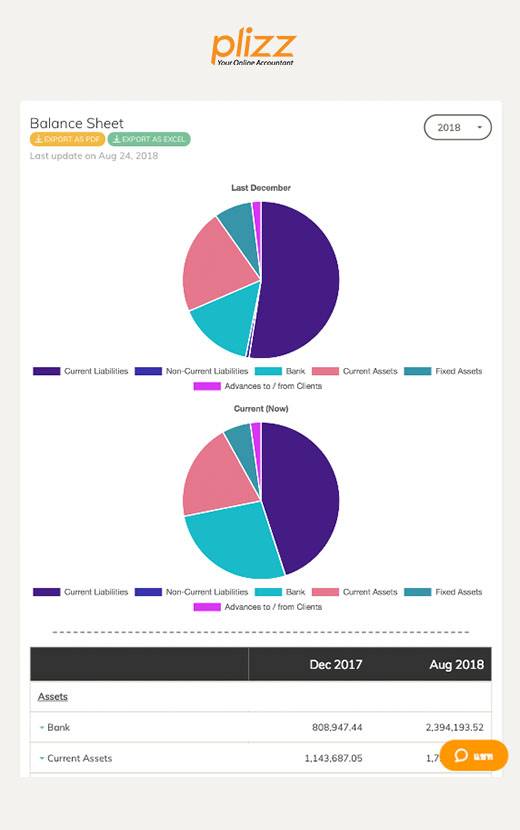

The balance sheet made digital

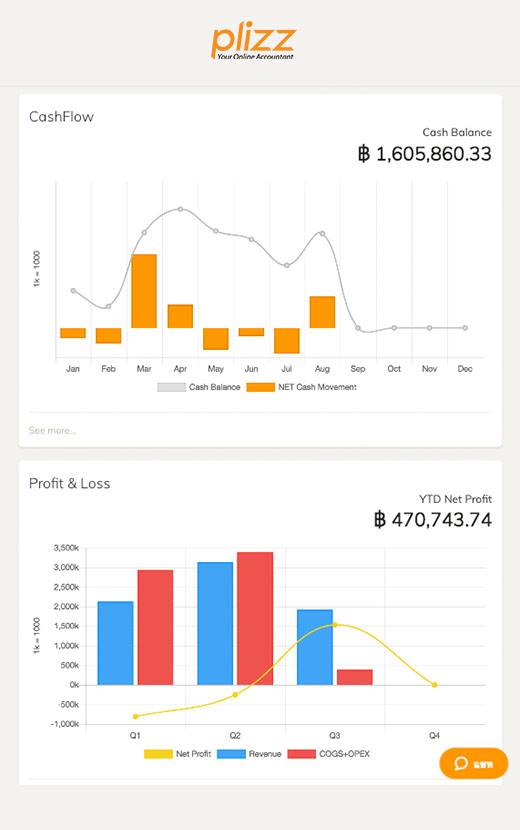

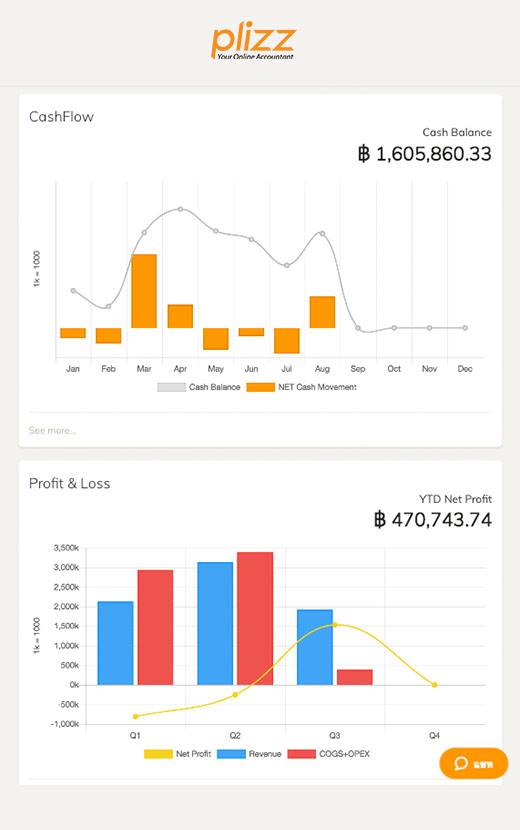

Insights on the cash flow and profit and loss

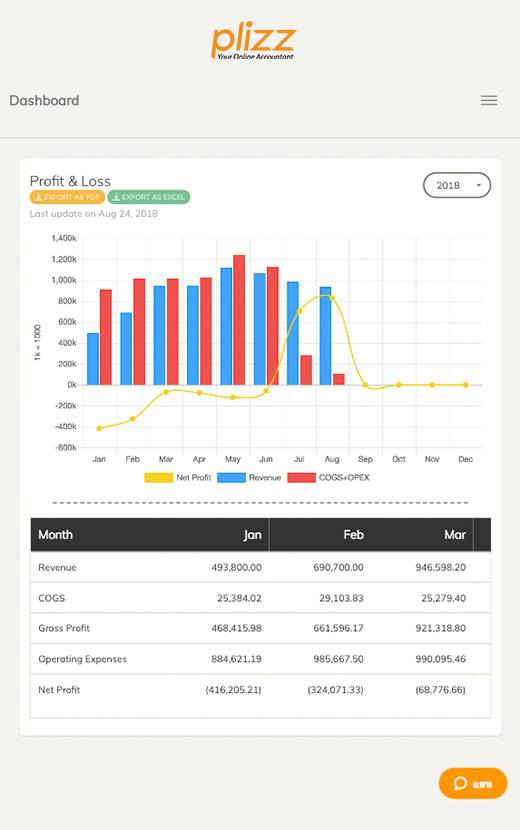

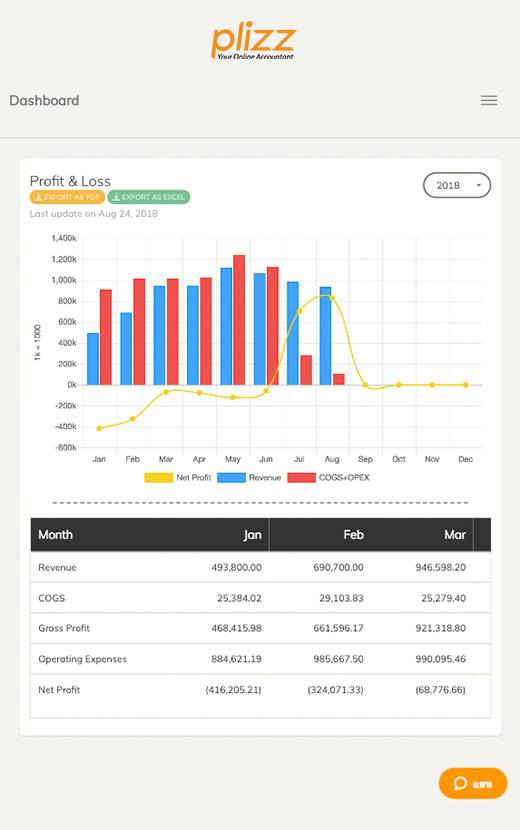

The breakdown for each month

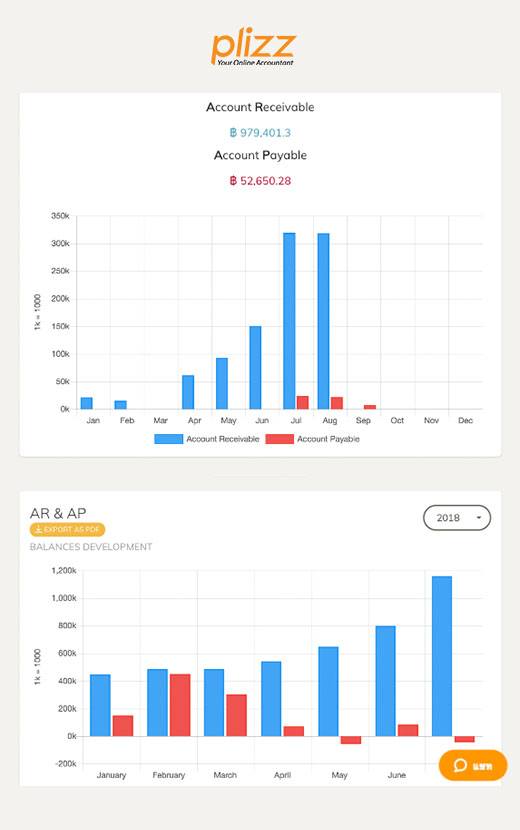

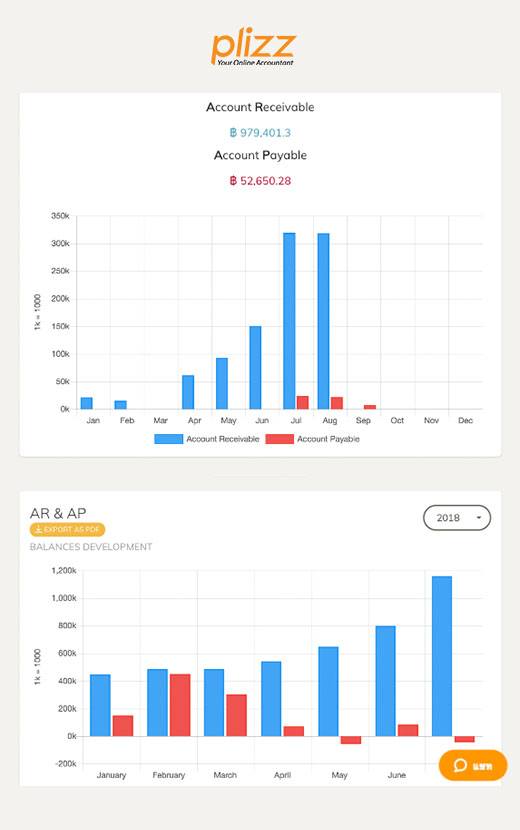

Here’s a look at the Accounts Receivable Management that takes care the customers’ billing, outstanding payments follow-up, and collection. Accounts Payable Management is the direct point of contact with your vendors, collecting and paying your bills.

Accounts Receivable Management and Accounts Payable Management

Tax calendar

Using the software, users will be able to view their financial data on the dashboard, access tax guidance and forms that’s needed for the preparation of tax documents, as well as generate automated tax reports. The company’s other previously mentioned features combine the software automation and extended team of accountants working on behalf of the clients, which as of now have close to 100 companies.

—-

Image Credit: Plizz.co

The post DIY accounting should be on every startup’s and SME’s digital arsenal for profitability appeared first on e27.

Source: E27