A woman facing conflicts with her family asked other netizens if it was worth spending a significant portion of her salary to get away from them.

In an anonymous post to popular confessions page, the single woman in her late 20s wrote that she was looking to move out because of circumstances and conflicts with her parents.

She added that she also took more than an hour to travel to work while staying at her parents’ place, so by moving out and renting, she would be able to stay nearer to work.

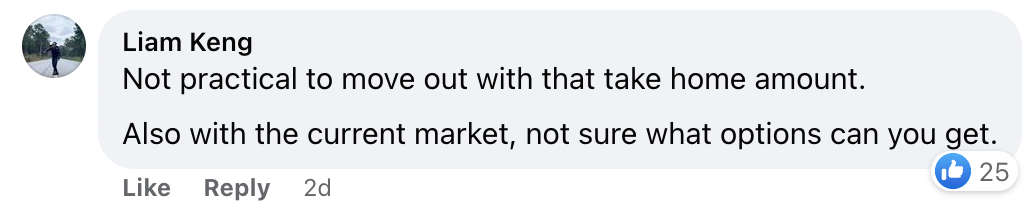

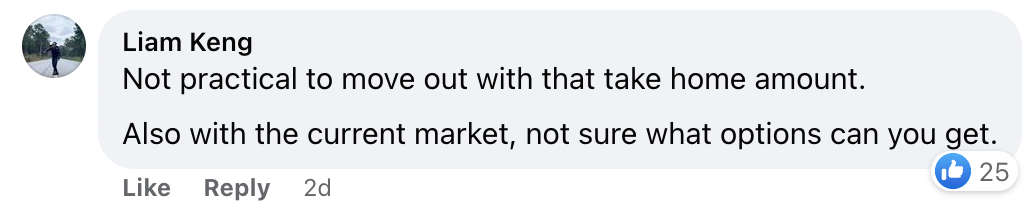

The woman asked other netizens: “Just wondering though would it be practical to spend $400-700 on rental when I earn a monthly take home salary of $2k”.

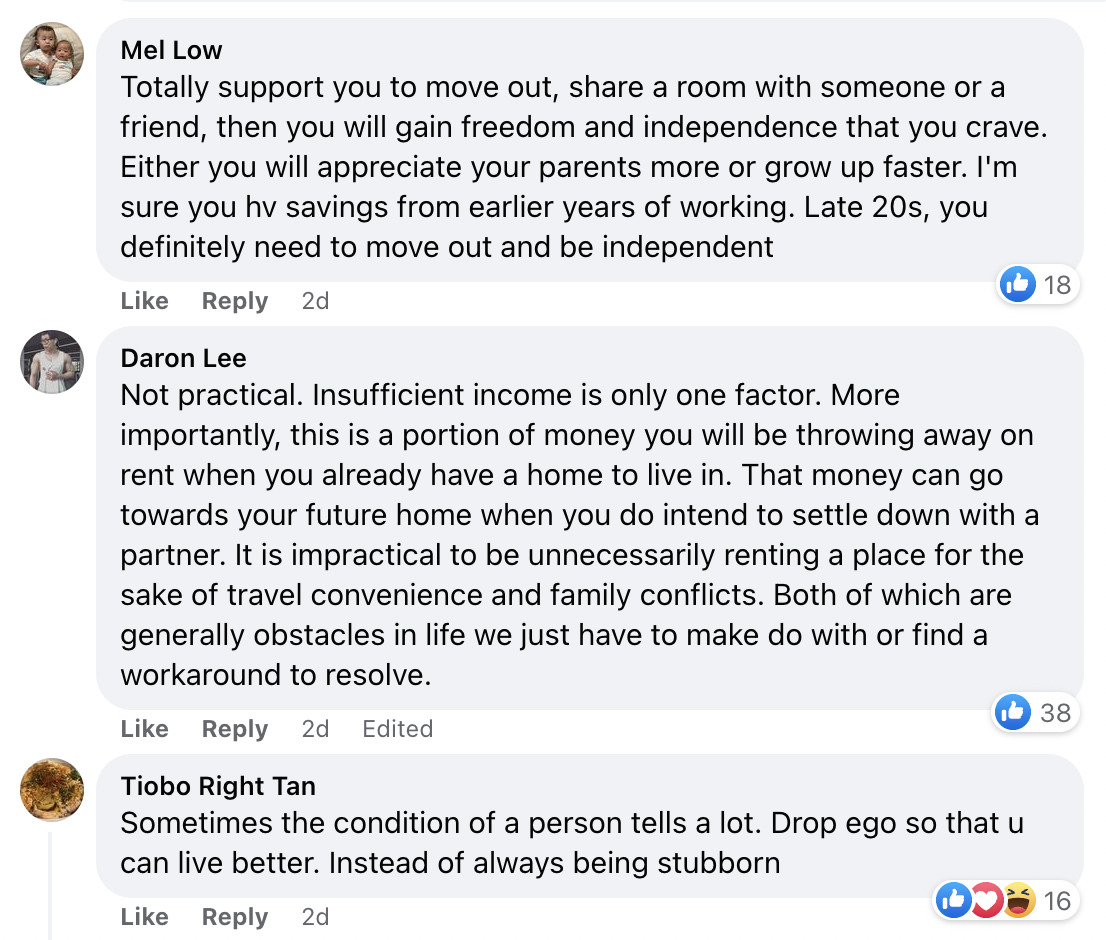

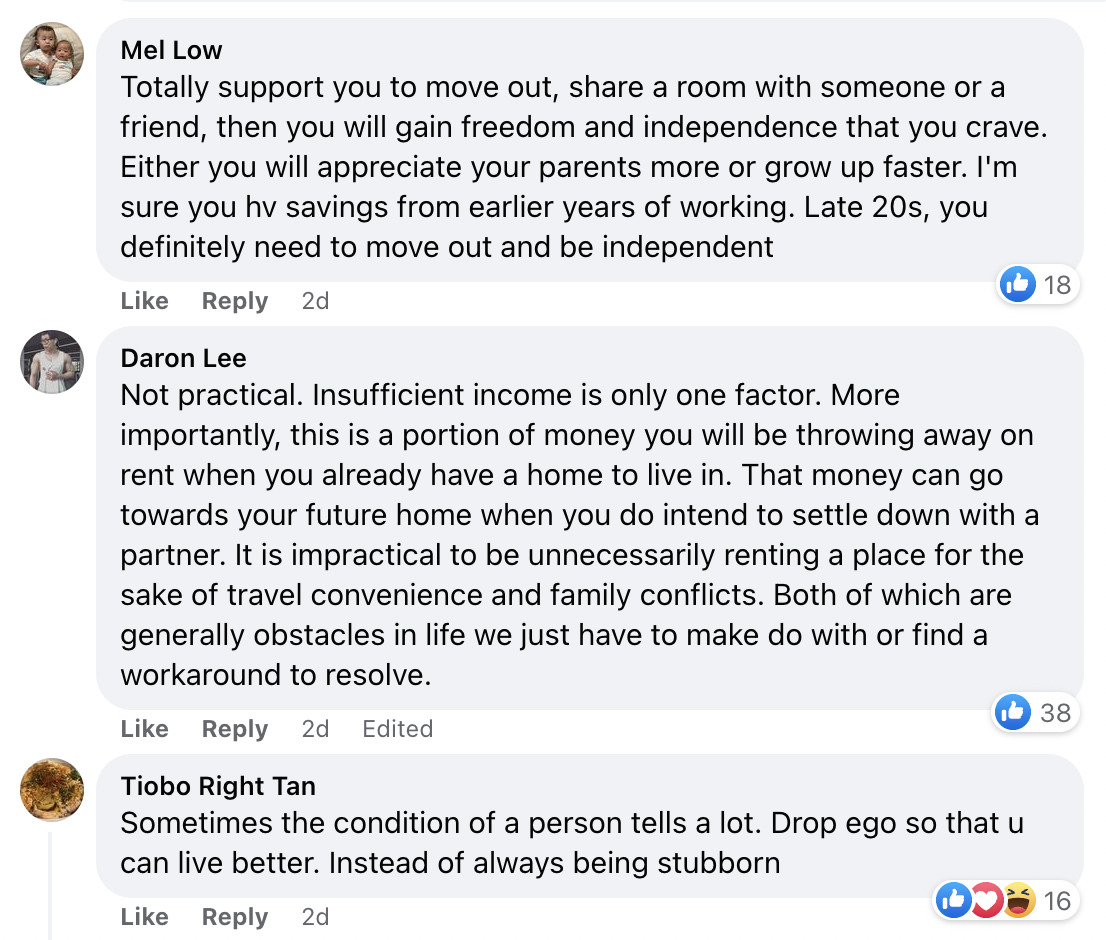

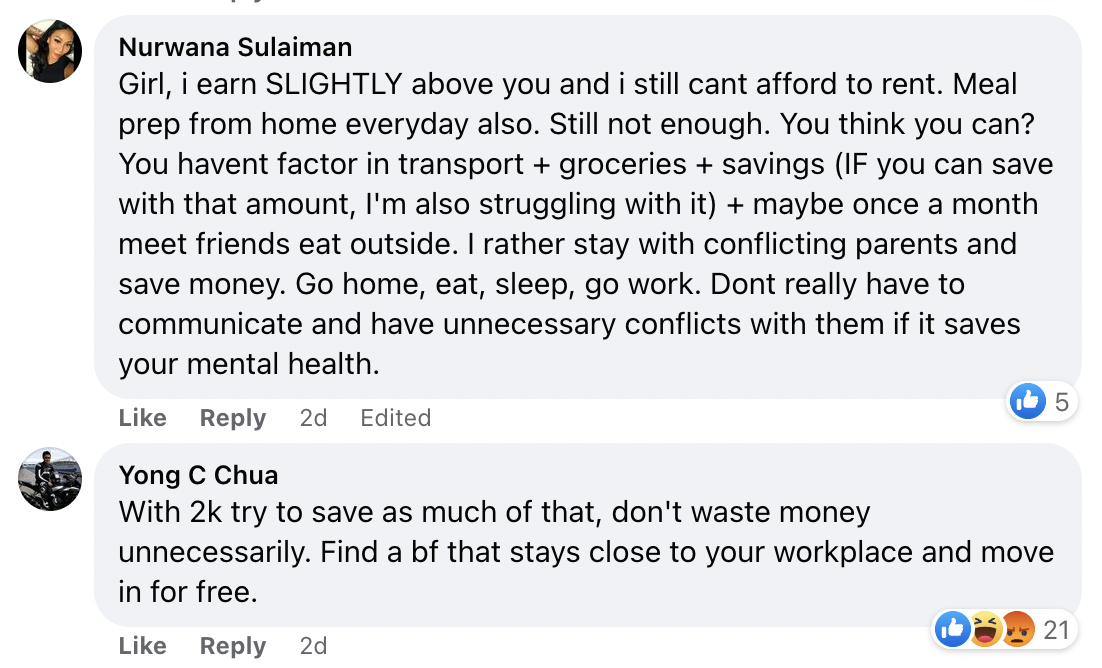

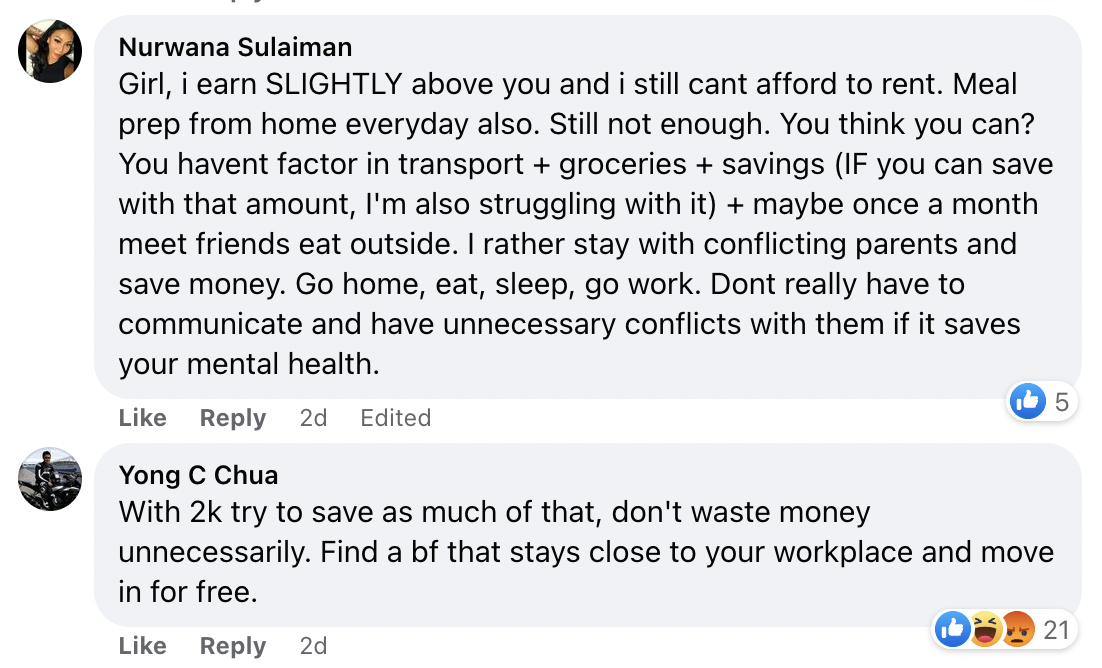

Netizens who commented on her post had mixed views, but a number of them advised her to lose her ego and try to manage at her parents’ place instead of moving out and having to fork out a large portion of her salary.

Here’s what they said:

Earlier this week, The Independent Singapore reached out to a couple of young individuals to get their opinions on their difficulties when buying an HDB flat.

One said that they needed to have a good job with a high-paying salary because the standard of living in the country was “getting higher and higher and higher”.

“So the standard is around S$3,000 and above. Plus, when you get a house, there are a lot of things to think about aside from the house payment, such as utilities and transportation,” she noted.

“If you want to own HDB, study very, very, very hard. You need that,” she added.

Another individual agreed that financial capacity was the main issue.

“Not a lot of us have a lot of cash, cause for guys, we just come out of the army, so we don’t have a lot of funds at the moment.”

“That’s one of the main challenges we have at the moment for my generation,” he noted.

He also admitted it was harder to get a bank loan due to the lack of high income, as they hadn’t worked for very long.

“We can’t get a good enough loan to get the house that we want because most of us are looking for BTO (build to order) in the new HDB (areas).”